Certificates of Origin

A Certificate of Origin (CO) is an international trade document, certifying that goods in a particular export shipment are wholly obtained, produced, manufactured or processed in a particular country. It is often requested by overseas buyers for customs clearance, payment management and import tariff concessions. Each Certificate of Origin is governed by Rules of Origin.

The Rules of Origin are the criteria needed to determine the national source of a product. There is a wide variation in the practice of governments with regard to the rules of origin. The rules are negotiated as part of a Free Trade Agreement (FTA) and are different under each FTA. The FTAs generally make the trade cheaper and easier to facilitate for all parties.

Types of Certificates of Origin

here are two main types of COs based on the different rules of origin:

- Non-Preferential COs – the country of origin does not qualify for any preferential tariff treatment. These are the main type of COs, also known as “ordinary COs.”

- Preferential COs – the goods are subject to reduced tariffs, under FTA, or exemptions when they are exported to countries extending these privileges. (e.g. European Union)

What is the purpose of Certificates of Origin?

For many products exported to foreign markets, using the correct CO, enables the buyer in the foreign country to import your product at a lower tariff, compared with other international suppliers. The CO effectively makes your product more cost-efficient to your buyers and easier to sell.

How do Certificates of Origin work?

How do you obtain a certificate of origin? To obtain a certificate of origin, you will need to do three things:

- provide a tariff harmonisation code for your product

- ensure your product complies with the rules of origin

- arrange shipment of your goods to your buyer

The tariff harmonisation code is a standardised system of names and numbers used to classify traded products. The codes are used by customs authorities and other government agencies to monitor, control and tax products as they move across borders. To find out how the appropriate harmonisation code for your goods, you can use the Trade Tariff Tool of the HM Revenue & Customs.

The Rules of Origin set out whether a product can be considered as originating under the FTA. They are usually used to apply trade remedies or to grant preferences. They typically distinguish between:

- Products wholly obtained in a territory (e.g. minerals);

- Products ‘substantially transformed’ in a territory

For example, many products in a particular country have imported components that may or may not be eligible for tariff reduction. So things like the value of inputs, labour, the origin of parts, and whether the product has undergone a significant transformation are taken into consideration when issuing CO. There are several different rules defining the origination of a good under FTA. Some of the important once are:

Wholly obtained rule – applies when a product is grown and produced in a country. Agriculture and mineral products are typical examples.

Changing in tariff classification rule – a product that is made from both home and foreign inputs may still be considered home produced. The change in tariff classification rule requires that any foreign inputs incorporated into the final product undergo a specific change in the tariff harmonisation code.

Regional value content rule – The regional value content rule requires a product to undergo a specific amount of value adds in the home country or FTA partner country in order to qualify for an available tariff reduction. Some FTAs also require a combination of the change in tariff classification and regional value content rules to qualify. The shipment of your products must be pre-arranged as the Certificate of Origin requests shipping details.

Who Issues Certificates of Origin?

The first Certificate of Origin (CO) was issued back in April 1898. Since then this document plays a key role in the functioning of global trade. The governments around the world rely on the network of the chambers of commerce for the issuance of CO. In fact, following the signing of the 1923 Geneva Convention, governments began delegating the issuance of CO to the chambers. They were regarded as an accountable, reliable and impartial third-party in the international trade process. The ICC’s International Certificate of Origin Council was established to promote the position of chambers as the dominant agents in the issuance of trade harmonisation documents.

COs need to comply with Letters of Credit, foreign Customs requirements or a buyer’s request. The Chambers are the key issuers of these international trade documents. In limited jurisdictions and for a particular type of goods other bodies such as the customs authorities and the ministries are responsible for the issuance of a certificate of origin.

Working with Your Local Chamber of Commerce

Your local chamber can help you sign and stamp your CO. Individual chamber processes vary, but there is a general procedure of obtaining a CO.

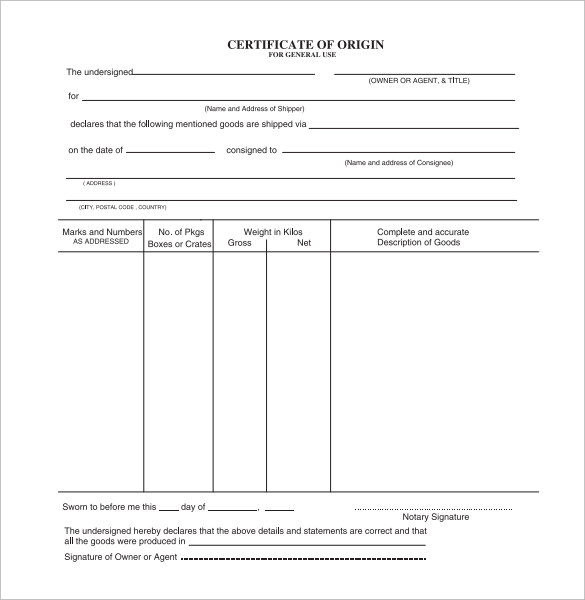

Obtaining a Paper Certificate of Origin

- Fill an appropriate affidavit and have it notarized.

- Provide a manufacture invoice or commercial invoice.

- Complete the certificate of origin document.

- Take your notarized affidavit, certificate of origin document, and corresponding invoices to your chamber of commerce.

Chambers usually charge a fee for stamping certificates of origin—however, if you’re a member, that fee may be reduced

Obtaining an Electronic Certificate of Origin

Because the process of creating a paper Certificate of Origin can be time consuming and expensive, more and more exporters are creating electronic certificates of origin (eCO). With an eCO, you can submit the required documentation online and get an electronic certificate stamped by a chamber of commerce in less than a day. Chambers of Commerce issue millions of CO each year. To keep pace with the rapid shift to e-Business and improve efficiency, eCO systems are a top priority for the chambers.

Certificate of Origin Examples & Case Studies

Letters of Credit insights

Customs Hub

1 | Introduction to Customs

2 | HSN Codes

3 | HS Codes

4 | HTS Codes

5 | Import Controls

6 | Export Controls

7 | Phytosanitary Certificates

8 | Certificates of Origin

9 | Customs Brokers

10 | Single Window Systems

11 | Customs Clearance Process

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom