India’s financial parliamentary panel has called for the ratings agencies to regulate MSMEs seeking receivables loans and factoring credit.

With amendments to the country’s Factoring Regulation Act 2011 being proposed by the government, the volume of business from factoring credit is expected to increase significantly, according to the Standing Committee on Finance.

They have now suggested that the Reserve Bank of India (RBI) develop regulatory resources to make sure that factoring activity is effectively supervised.

In a report led by former minister of state for finance, Jayant Sinha, the panel has called for “significant regulatory resources” to supervise factoring activities “and address the lingering issues involving factoring industry, particularly the chronic delays in payment and liquidity crunch faced by enterprises”.

“This may be accomplished by encouraging the existing credit rating agencies to provide ratings for the MSMEs that are actively seeking to factor in their receivables,” it added.

The Factoring Regulation Amendment Bill 2020 was introduced in Lok Sabha, India’s lower house, in September, and has been recently referred to the finance panel.

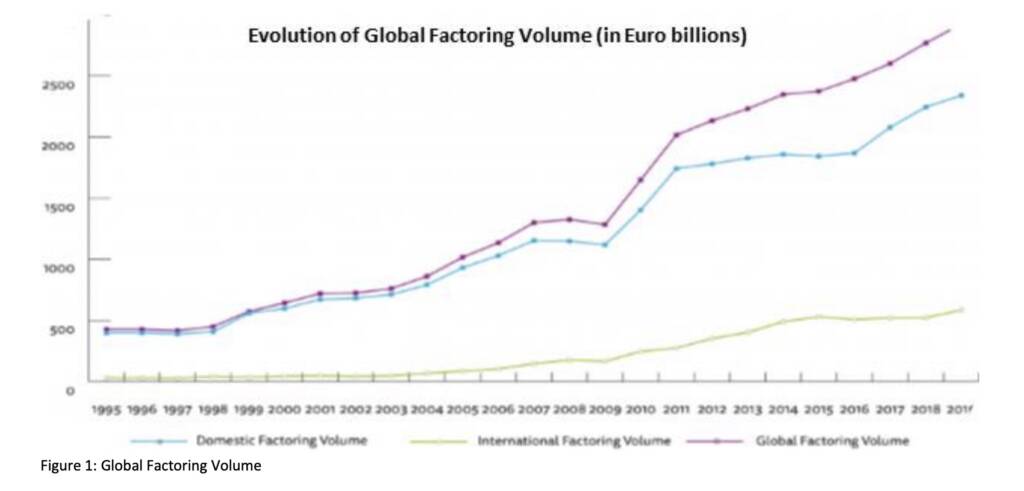

Factoring occurs when a financier purchases or takes security over unpaid invoices or receivables from a business. This allows the company to benefit from additional working capital which would otherwise be locked up in unpaid invoices. It constitutes only 2.6% of MSME credit lines in India. This means there has historically been a delay in small businesses getting payments against their bills, leaving restraints on working capital when compared with larger firms and multinationals.

The panel added that as one of the principle means of trade finance, that bill discounting and factoring remained underutilised in India.

Peter Mulroy, Secretary-General at FCI, said:

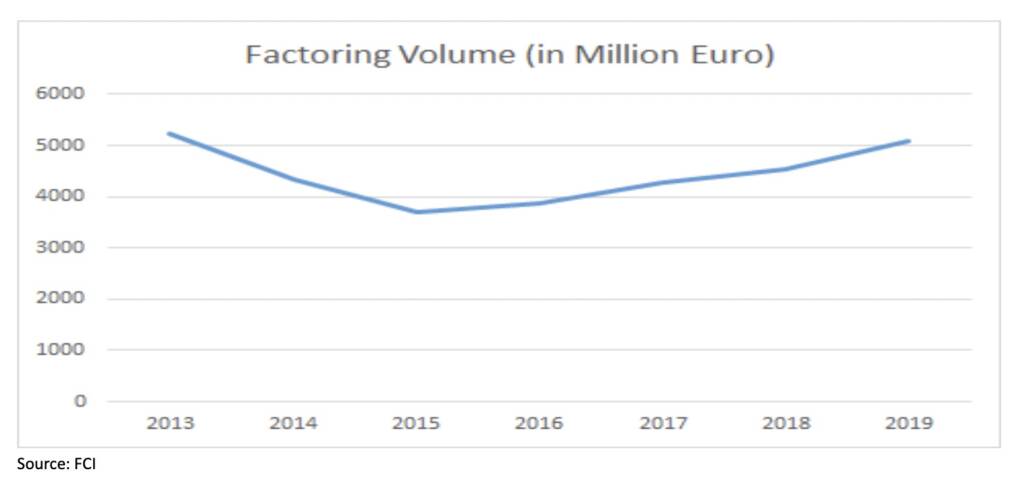

““This is a significant development in India. Ever since the Factoring Regulation Act was passed in 2011 and the RBI instituted its policy on factoring in 2015, we have witnessed a surge of growth in factoring volume there. So further strengthening of the Act, by introducing the requirement to support MSMEs will enhance their capability to obtain liquidity by using factoring services. MSMEs are the engines of growth in both trade and employment in any developing economy, and the importance factoring plays in supporting MSMEs around the world is well known.”

The act will also extend the scope of the term “receivables” to bring it in line with international definitions, as well as permitting all types of non-banking financial companies (NBFCs) to engage in factoring.