Treasury Management Systems and Software

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContent

Treasury Management

Treasury management is evolving at an unprecedented rate, and treasurers now have to contend with an increasingly complex business landscape to keep track of their liquidity and cash. They have to overcome the challenges of FX volatility, constantly shifting market restrictions, and regulation changes – a task which is no small feat to manage.

Top 10 Treasury Management Systems (TMS)

- Kyriba – Best for treasury management, offering a leading SaaS platform with robust features, AI-driven capabilities, and global reach, despite potential implementation complexity.

- Reval (ION) – Best for treasury and risk management, providing a scalable SaaS solution with comprehensive features, including innovative enhancements like AI and machine learning.

- GTreasury – Best for comprehensive treasury and risk management, with an as-a-service ecosystem emphasising connectivity and productivity.

- SAP Treasury and Risk Management – Best for integration with core processes, advanced analytics, and cloud deployment options.

- FIS Quantum – Best for treasury professionals, emerging as a sophisticated solution with powerful automation, global connectivity, and a private cloud architecture to address their challenges.

- Calypso Treasury & Liquidity – Best for a comprehensive, integrated cross-asset post-trade processing platform, standing out with real-time visibility.

- Fusion Treasury (Finastra) – Best for delivering strategic planning, control, and execution, offering an integrated solution with quick implementation and proven software.

- Treasury Intelligence Solutions (TIS) – Best for global payments, cashflow, and liquidity management, providing a robust cloud-based solution with versatility, global expertise, and a client-centric approach.

- Oracle Cash & Treasury Management – Best for comprehensive treasury operations, distinguishing itself with comprehensive functionality, seamless integration, and a secure framework as part of the E-Business Suite.

- Trovata – Best for revolutionising financial and treasury management, empowering users with automated data collection and efficient intelligence for informed decision-making.

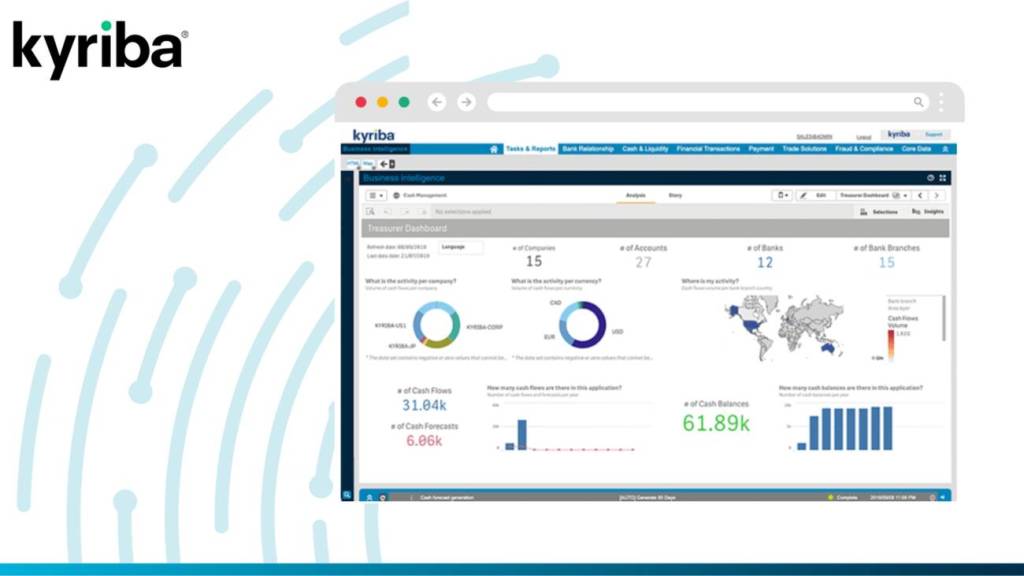

Kyriba

Kyriba is a comprehensive SaaS platform designed to transform liquidity into a dynamic, real-time driver for growth and value creation. Catering to CFOs, Treasurers, and IT professionals, Kyriba leverages artificial intelligence, automates payment workflows, and serves multinational corporations and banks worldwide.

Why Kyriba Stands Out:

Kyriba stands out for its robust features, leveraging AI, APIs, and data analytics to offer extensive treasury management capabilities. The platform addresses the challenges posed by rising interest rates, market volatility, and recession fears, empowering treasury teams to protect balance sheets and streamline operations.

Kyriba Standout Features & Integrations:

- Cash and Liquidity Management: Efficiently manages global cash structures and optimises liquidity across the enterprise.

- Financial Fraud Prevention: Provides tools to mitigate the risk of financial fraud.

- Treasury Management Payments: Streamlines payment processes for increased efficiency.

- Bank Account Management: Offers solutions for effective bank account management.

- Treasury Risk Management: Addresses the complexities of risk management in treasury operations.

- Treasury Reporting: Provides analytical tools and reporting capabilities for treasury functions.

- Liquidity Forecasting: Empowers treasurers to predict cash flow against various risk scenarios.

- Market Data: Utilises AI, APIs, and data analytics to enhance treasury management capabilities.

Pros

- Global Reach: Kyriba serves more than 2,500 clients globally, including 25% of Fortune 500 and Euro Stoxx 50 companies.

- Automation and Efficiency: Drives automation and streamlining of treasury processes, resulting in >50% productivity improvements

Cons

- It can be hard to implement, especially for customised solutions

Kyriba emerges as a leading solution in the treasury management landscape, offering a secure, scalable platform with innovative features and global reach. Its focus on addressing contemporary challenges, such as rising interest rates, sets it apart, providing treasurers with tools to enhance decision-making, protect balance sheets, and optimise liquidity on a global scale.

Reval

Reval, a treasury and risk management platform acquired by ION in 2016, empowers companies to navigate dynamic environments with changing regulatory requirements, multiple banks, currencies, and risk factors. As a highly scalable SaaS solution, Reval enables treasuries to effectively manage cash, liquidity, financial risk, and hedge accounting.

Why Reval Stands Out:

Reval stands out for its comprehensive and integrated capabilities, offering a seamless user experience. The platform simplifies compliance with complex regulations and provides innovative tools to enhance treasury management.

Reval Standout Features & Integrations:

- Cash, Liquidity, and Financial Risk Management: Comprehensive tools to manage FX, investments, debt, credit facilities, intercompany loans, and deals.

- Hedge Accounting: Market-leading tools for executing hedge accounting strategies.

- Daily Cash Management: Streamlining daily cash management processes for increased efficiency.

- Internal Banking Automation: Automation of internal banking services, including POBO, COBO, FX requests, and working capital.

- Risk Mitigation: Addressing credit, market, and liquidity risks to enhance financial stability.

- Scalable SaaS Delivery Model: A highly scalable Software as a Service (SaaS) delivery model for seamless growth.

Enhancements with Optional Value-Added Solutions:

- Bank Account Management: Web-based management with bank fee analysis for maintaining a centralised, accurate inventory of all bank accounts and documentation.

- Mobile Access: Access information from the ION treasury management system using any mobile device, tablet, laptop, or PC.

- Money Market Funds Automation: Full automation of the trade lifecycle, real-time consolidated investment and cash reporting, and access to a rich set of money market fund data and analytics.

- AI and Machine Learning: Enhanced capabilities powered by artificial intelligence and machine learning for fast, accurate algorithms that optimise data potential.

Pros

- Comprehensive Solution: Reval offers a comprehensive suite of tools for treasury and risk management.

- Innovative Enhancements: Continuous innovations, including AI, machine learning, and mobile access, contribute to a cutting-edge treasury solution.

Cons

- The user interface is not modern or fresh

Reval, as part of ION Treasury, stands as a dynamic treasury and risk management platform, providing companies with an innovative, scalable solution. Its comprehensive features, seamless integrations, and continuous innovations position it as a valuable asset for treasuries navigating the complexities of evolving markets, regulations, and risk factors.

GTreasury

GTreasury, a comprehensive Treasury and Risk Management Solutions (TRMS) provider, offers an ecosystem designed to empower treasury and finance teams globally. With a focus on connecting, consolidating information, and unleashing financial potential, GTreasury provides a unified platform that simplifies finances, drives productivity, and ensures future success. With over 30 years of corporate treasury experience, GTreasury stands as an expertly crafted, integrated platform that streamlines workflows and delivers powerful insights.

Why GTreasury Stands Out:

GTreasury stands out for its as-a-service ecosystem, providing cloud access to integrated treasury and risk management solutions. It is built for practitioners, by practitioners, offering an unmatched level of expertise and support.

GTreasury Standout Features & Integrations:

- Optimise Liquidity: Full visibility into the entire cash landscape to inform strategic business decisions.

- Manage Risks: Real-time tracking of all positions with actionable insights.

- Maximise Productivity: Unified, automated workflows to replace manual spreadsheets and disjointed solutions.

- Drive Business Growth: Elevate treasury and finance teams to strategic change agents.

Pros

- Comprehensive Solution: GTreasury provides a functionally rich treasury management system that manages liquidity risk, market risk, counterparty and credit risk in one integrated SaaS solution.

- Integrated Platform: Single database, connectivity, and workflow for a seamless experience.

- Ecosystem of Support: An expansive network of implementation and payment services, bank connectivity, and third-party software solutions.

Cons

- Reporting module needs to be more user friendly and allow users to extract larger data sets

GTreasury’s as-a-service ecosystem, developed by experts with over 30 years of corporate treasury experience, offers a seamlessly integrated platform for treasury and risk management. With a focus on connectivity, productivity, and future success, GTreasury stands as a valuable solution for treasury teams worldwide, providing comprehensive support and an ecosystem that adapts to evolving needs.

SAP Treasury and Risk Management

SAP Treasury and Risk Management, built on the in-memory SAP S/4HANA Finance software, offers a comprehensive solution for optimising the treasury function in enterprises. This solution integrates processes for managing cash and liquidity, payments, bank communications, investments, debt, and forecasting. With options for on-premise, cloud, or hybrid deployment, SAP Treasury and Risk Management provides enhanced cash and liquidity planning, real-time analytics, and advanced risk management features.

Why SAP Treasury and Risk Management Stands Out:

SAP’s solution stands out for its integration with core data processes, advanced real-time analytics, and the ability to link treasury and risk management workflows with core business processes in SAP S/4HANA Cloud.

SAP Treasury and Risk Management Standout Features & Integrations:

- Comprehensive Treasury Workflows: Support for managing cash, liquidity, payments, bank communications, investments, debt, and forecasting.

- Integration with Core Processes: Link treasury and risk management workflows with core business processes in SAP S/4HANA Cloud.

- Advanced Real-time Analytics: Full transparency and on-the-fly analysis across all dimensions of financial data.

- Cloud-based Infrastructure: Access the latest innovations in treasury management tools quickly and securely with a cloud-based deployment.

Pros

- Integrated Solution: Comprehensive integration with core processes, enhancing operational efficiency.

- Real-time Analysis: Advanced analytics for accurate and real-time financial insights.

- Cloud Deployment: Quick and secure access to the latest innovations without costly on-premise upgrades.

Cons

- Some users can find it a steep learning curve to utilise all the functionality as it is not so intuitive to navigate through the platform

SAP Treasury and Risk Management, leveraging SAP S/4HANA Finance software, emerges as a robust solution for enterprises seeking comprehensive treasury management. With features such as advanced analytics, integration with core processes, and cloud-based deployment options, SAP’s solution stands as a powerful tool for optimising cash and liquidity planning, risk management, and overall treasury functions.

FIS Quantum

FIS Quantum, a sophisticated and user-friendly treasury management solution, addresses the challenges faced by treasury professionals, offering comprehensive capabilities in cash management, risk management, and debt and investment management. By consolidating disparate systems and data, providing integrated cash and risk management, and facilitating automation, FIS Quantum stands as a powerful tool for optimising global risk and cash positions.

Why FIS Quantum Stands Out:

FIS Quantum stands out for its powerful front-, middle-, and back-office treasury, risk, and cash management system. It consolidates diverse data sources into a single, customisable desktop, providing a real-time snapshot of global risk and cash positions. With support for multiple languages and connectivity within complex treasury departments, FIS Quantum excels in simplifying processes and enhancing performance.

FIS Quantum Standout Features & Integrations:

- Comprehensive Treasury Workflows: Covers cash management, investment/debt management, currency management, counterparty risk management, and more.

- Integrated Accounting: Fully integrated accounting capabilities with seamless straight-through processing.

- Private Cloud and Managed Services: “Built for Enterprise” private cloud architecture, “Secure by Design” infrastructure, and easy-to-consume Managed Services Catalogue.

Pros

- Powerful Automation: Automation and workflow support for sophisticated analysis and modelling, including funding scenarios, derivatives transactions, and more.

- Global Connectivity: Connects global users from anywhere, offering real-time snapshots of risk and cash positions.

- Managed Bank Connectivity: Efficiently manages bank onboarding, maintenance, and updates to connectivity.

Cons

- Limited training on their platform

FIS Quantum emerges as a robust solution for treasury professionals, offering a comprehensive suite of features for cash, risk, and debt management. With its sophisticated analysis, modelling capabilities, and support for multiple languages, FIS Quantum enables treasury departments to navigate complex global environments effectively. The solution’s private cloud deployment and managed services contribute to its effectiveness in optimising treasury and risk management operations.

Calypso Treasury & Liquidity

Calypso emerges as a comprehensive, integrated cross-asset post-trade processing platform designed to support front, middle, and back-office activities for both exchange-traded and OTC instruments. With a broad application across financial asset classes, including Capital Markets, Investment Management, Central Banking, Risk Management, Clearing, Collateral, Treasury, and Liquidity, Calypso caters to the needs of over 35,000 users in 60+ countries. The Infosys partnership with Calypso strengthens its implementation capabilities, supported by a dedicated training ecosystem.

Why Calypso Stands Out:

Calypso stands out for its integrated treasury solution that centralises balance sheet, funding, investment, and cash management activities on a modern platform. Offering real-time visibility, stress-testing, and behavioural scenario analysis, Calypso facilitates funding and hedging execution. With support for Dodd-Frank and EMIR derivatives workflow, along with robust investment management capabilities, Calypso provides treasurers with the tools to navigate diverse challenges and enhance liquidity management.

Calypso Standout Features & Integrations:

- Integrated Treasury Solution: Centralises balance sheet, funding, investment, and cash management activities.

- Real-time Visibility: Provides a real-time enterprise-wide view of liquidity.

- Stress-testing and Scenario Analysis: Performs stress-testing and behavioural scenario analysis on assets and liabilities.

- Regulatory Compliance: Offers full support for Dodd-Frank and EMIR derivatives workflow.

- Investment Management: Allows treasurers to invest, monitor, and manage investment portfolios.

Pros

- Comprehensive Platform: Covers front, middle, and back-office activities, supporting various asset classes.

- Global User Base: Widely adopted with over 35,000 users across 60+ countries.

- Infosys Partnership: Strategic partnership with Infosys enhances implementation capabilities and provides a dedicated training ecosystem.

Cons

- Recommended to undertake an eLearning module to fully utilise and fully understand the nature of Calypso Treasury and Liquidity

Calypso stands as a versatile and widely adopted platform, offering a comprehensive solution for treasury management and post-trade processing. Its integrated treasury solution, real-time visibility, and robust regulatory compliance features position it as a valuable tool for treasurers navigating the complexities of liquidity management. The partnership with Infosys adds to its strengths, enhancing implementation capabilities and ensuring a well-trained user base.

Fusion Treasury

Finastra presents Fusion Treasury, a powerful treasury management system and suite of applications designed to simplify the operational complexities of global corporate treasury management. Fusion Treasury aims to deliver enhanced strategic planning, control, and execution through a single, integrated solution. The platform focuses on providing treasurers with better tools, insights, and the agility needed in a dynamic market environment.

Why Fusion Treasury Stands Out:

Fusion Treasury stands out for its commitment to delivering greater strategic planning, control, and execution through an integrated solution. Key features that set it apart include comprehensive scenario analysis, real-time insights into liquidity, risk, and profitability, and a focus on automating treasury operations efficiently.

Fusion Treasury Standout Features & Integrations:

- Integrated Treasury Solution: Centralises balance sheet, funding, investment, and cash management activities.

- Comprehensive Scenario Analysis: Provides tools for viewing liquidity, risk, and profitability on a single screen.

- Fast Time to Market: Ensures quick and efficient implementation within 90 days, faster than a standard RFP.

- Standard Operating Model: Offers essential functionality supporting treasury business with a transparent Target Operating Model.

- Premium Software: Built on Finastra’s tried and tested core products, leveraging over 30 years of experience and serving close to 1,000 treasury clients.

- Defined Cost & Low Resource Implementation Impact: Straightforward implementation with a fixed cost, low resource impact, and a standard annual subscription fee.

Pros

- Fast Implementation: Fusion Treasury Essential is designed for a rapid 90-day implementation.

- Transparent Target Operating Model: A clear and standard operating model streamlines manual systems, increases transparency, and reduces operational errors.

- Proven Software: Built on Finastra’s well-established core products with a track record of serving a significant number of treasury clients.

- Fixed Cost Implementation: Offers a fixed implementation cost and a low resource impact, making it cost-effective.

Cons

- The system could improve efficiency around recalculating prices when variables are changed

Fusion Treasury by Finastra emerges as a robust treasury management solution offering a single, integrated platform for comprehensive scenario analysis, real-time insights, and efficient automation. With its commitment to quick implementation, a transparent operating model, and proven software, Fusion Treasury stands out as a competitive and cost-effective choice for treasurers seeking strategic planning, control, and execution in their operations.

Treasury Intelligence Solutions (TIS)

Treasury Intelligence Solutions (TIS) stands as a global leader in cloud-based payments, cashflow, and liquidity management. TIS offers a cloud-based platform that simplifies and streamlines global payments and cash management operations for organisations of all sizes. The platform, active in over 140 countries, supports key functions such as cross-border and domestic payments, bank connectivity, cash forecasting, fraud prevention, and payment compliance.

Why Choose TIS:

TIS provides a comprehensive suite of solutions under CashOptix, PayOptix, and RiskOptix. These suites cover cash reporting, forecasting, liquidity, bank account management, bank connectivity, payments, and compliance. The TIS platform, actively used by over 30,000 users, has earned industry recognition through awards for its transformative technology projects in payments automation, cashflow visibility, and global security and compliance control.

Key Features and Benefits:

- Cloud-Based Solutions: TIS offers award-winning cloud solutions designed for CFOs, treasury, and finance teams, facilitating global payments, cash forecasting, liquidity, security, and compliance.

- Global Reach: With a presence in over 140 countries, TIS connects with 2.5k+ client ERPs and TMSs, managing $80 billion in daily cash positions and handling $2.5 trillion in annual payment volume.

- Client-Centric Approach: TIS prioritises client success, providing a best-in-class approach to onboarding, training, and support to ensure smooth operations without interruption.

- Versatile Solutions: TIS’s product suites cater to various treasury and finance needs, including cashflow management, payments automation, and compliance control.

Pros

- Global Expertise: TIS boasts over 11,000 banking options, $80 billion in daily cash managed, and $2.5 trillion in annual transaction volume, reflecting its global expertise.

- Versatility: TIS covers a wide range of functionalities, including cash reporting, forecasting, liquidity management, bank connectivity, payments, and compliance.

- Cloud-Native Hosting: TIS operates on a cloud-native infrastructure, offering flexibility and scalability for clients.

- Industry Recognition: The platform has received awards for its transformative technology projects in payments automation and compliance control.

Cons

- An implementation guide specific for each country, used bank, payment type and format would be time efficient for users at the beginning of implementation

TIS emerges as a robust cloud-based solution for global payments, cashflow, and liquidity management. With its comprehensive suite of solutions, global reach, client-centric approach, and industry recognition, TIS provides a compelling option for organisations seeking to optimise their treasury and finance functions. The platform’s versatility and commitment to client success position it as a trusted partner for enterprises of all sizes and industries.

Oracle Cash & Treasury Management

Oracle Cash and Treasury Management, an integral component of the Oracle E-Business Suite, distinguishes itself as a comprehensive solution for corporate treasury operations. Engineered to enhance efficiency, profitability, and control in core treasury functions, the solution offers robust features across front, middle, and back-office processes. Its 100% Internet-enabled nature allows for flexible deployment options, either locally or through Oracle OnDemand on a subscription or managed basis.

Why Oracle Stands Out:

Oracle Cash and Treasury Management stands out due to its:

- Seamless integration with applications like Receivables, Payables, and Payroll for real-time cash position and forecast visibility.

- Streamlined automation of deal administration processes, including revaluation, accruals, accounting, and straight-through processing.

- Robust security framework supporting centralised or decentralised treasury operations with a single source of data and explicit segregation of duties.

Pros

- Comprehensive Functionality: Oracle Cash and Treasury Management covers a broad spectrum of treasury processes, from cash management to deal administration and accounting.

- Integration Capabilities: Strong integration with other enterprise applications, delivering real-time cash position and forecast insights.

- Secure Operations: The solution ensures security through centralised/decentralised operations, segregation of duties, and effective limit controls.

Cons

- Some users note a learning curve, suggesting that the tool may require familiarity to maximise its potential initially

Oracle Cash and Treasury Management emerges as a standout solution for core treasury functions, emphasising integration, automation, and security. Its inclusion in the Oracle E-Business Suite, positive sentiments from users regarding functionality and return on investment, positions it as a recommended choice for companies seeking to enhance their treasury management capabilities.

Trovata

Trovata revolutionises financial and treasury management by automating the collection and normalisation of diverse financial data. Targeting finance and treasury teams, Trovata empowers users to access, build, manage, and control their financial data from various sources, including banks, business and accounting systems, and external markets. Leveraging machine learning, Trovata excels in cash forecasting, analysing historical data trends, and enhancing forecast accuracy.

Why Trovata Stands Out:

- Automated Financial Data Management: Trovata simplifies the process of gathering and normalising financial data, allowing teams to focus on strategic analysis rather than manual data compilation.

- Machine Learning-driven Forecasting: The platform employs machine learning to establish a forecast baseline, analyse historical trends, and improve forecast accuracy, enabling informed decision-making.

- Efficiency-Driving Intelligence: Trovata answers complex financial questions, such as real-time cash position and cash flow destinations, driving efficiency through transparent visualisation, workflow automation, and machine learning.

Pros

- Comprehensive Cash Visibility: Trovata provides 100% daily visibility of cash across all banks and accounts, facilitating efficient liquidity, yield, and risk management through powerful aggregation, search, tag, and reporting capabilities.

- Automated Cash Reconciliation: The platform automates the month-end close process by aggregating, normalising, and storing bank balances and transactions with a user-friendly spreadsheet-like interface.

- Smarter Business Decisions: Trovata enables smarter business decisions by offering a single platform for accessing multi-bank data, customisable reports, and easy communication with stakeholders.

Cons

- Users may experience a learning curve due to the platform’s extensive features and capabilities

Trovata emerges as an intelligent financial tool that transforms the way businesses manage their financial data and make strategic decisions. With automated data collection, machine learning-driven forecasting, and a user-friendly interface, Trovata empowers finance and treasury teams to analyse, report, forecast, and transact with ease. Its global leadership in bank integrations further solidifies its position as a trusted cash management solution for businesses of all sizes.

Fortunately, as the business landscape has evolved, so too has treasury technology. Treasury management systems (TMS) provide a solution to meet the market need for complex treasury management, and, over the last decade, have become a near necessity for all kinds of businesses.

But what are treasury management systems? Why do we need them? And what, if any, are the alternatives?

TFG has prepared this guide to answer these questions for you and provide you with all there is to know about TMS solutions.

What are Treasury Management Systems (TMS)?

Treasury management systems, also known as treasury management software (TMS), is a specialised software solution implemented by businesses and financial institutions to effectively manage their treasury and financial operations in real time. These software systems are carefully designed to optimise and automate various treasury functions, playing a crucial role in managing cash, investments, and financial risks.

Treasury management software is particularly advantageous for sizeable corporations, financial institutions, and entities grappling with intricate financial undertakings. It equips them to efficiently administer their financial assets, curtail manual workflows, augment security, and foster judicious financial decision-making.

The specific features and capabilities of Treasury Management Software (TMS) vary among different providers, so organisations need to consider which software best meets their unique treasury management needs

What can Treasury Management Systems Do?

The treasury technology used in TMS allows you to carry out many complex activities.

Some basic functions include:

- View cash balances in real-time

- Cash forecasting

- Payment reconciliation

- Debt managementTrade finance

What are the advantages of TMS?

There are many advantages to utilising treasury technology in your business. Here are three key benefits:

It can help to save time:

TMS automates and digitises processes which would have historically needed to be completed manually. In the past, it would have been necessary to manually input transaction and revenue data, taking up time which could have been devoted to other important business tasks. These processes can now be completed automatically and quickly via a TMS. Treasury management systems can also dramatically reduce the time spent on variance analysis and advanced cash flow forecasting.

It can reduce human error:

Automating treasury management eliminates the need for spreadsheets and manual processes. This, in turn, eliminates the risk that staff will incorrectly input data which could cause inaccuracies and documentation errors.

It can help with compliance:

From a compliance perspective, manual processes are inherently risky. The aforementioned risk of human error could cause compliance infringements. There’s also the risk that data could be deliberately entered incorrectly with fraudulent intent. Moving away from manual input to straight-through processing solutions can eliminate this risk.

What is the difference between local and cloud-hosted TMS?

There are two types of basic TMS solutions: local systems and cloud-hosted systems.

Local systems are those which are installed on your business’ own local servers. This enables you to have the maximum amount of control over the features and security protocols as the system will be exclusively used by your company. The flip side of this is that you’ll also be responsible for managing the system in-house, which means you’ll need to have a skilled IT team or pay for top-end third-party support.

The alternative to this is to use a cloud-hosted system. These are cheaper and quicker to set up but afford you less control than local systems.