Risk Management in Treasury

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContent

What is Liquidity and Risk Management in Treasury?

Liquidity risk management is a sub-function of treasury management. It’s concerned with managing risks to liquidity and works hand-in-hand with the cash and liquidity management function to ensure that the business always has enough cash to meet its financial obligation.

Whilst the cash and liquidity management function helps to achieve this is by monitoring and managing working capital, the risk management function is concerned with assessing and managing risks to liquidity. Together, these two roles help to protect the business from shortfalls and the costs of borrowing.

In today’s global marketplace, risk management has taken on an even more important role as businesses are more frequently exposed to foreign exchange rate movements. Indeed, liquidity risk management is arguably one of the most important functions of the treasury department.

TFG has prepared this introductory guide to liquidity risk management to help you understand the basics of this vital role.

What are the Key Risks That Businesses Face?

There are four main types of risks faced by businesses: business risks, operational risks, compliance risks, and financial risks.

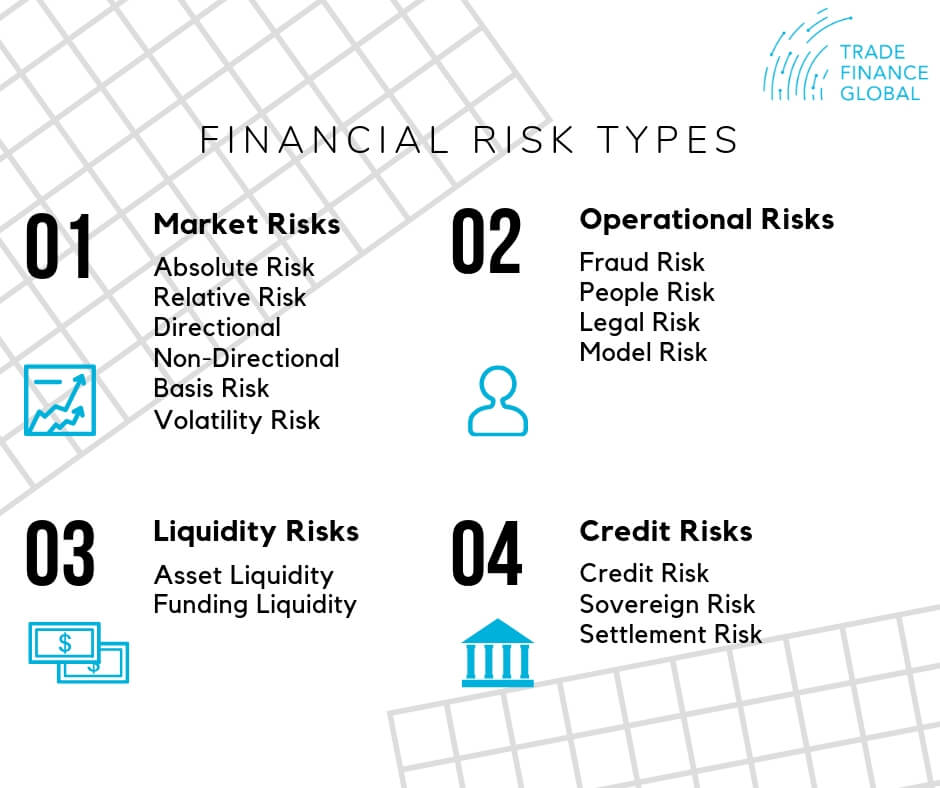

Of these four key types, treasury risk management is specifically concerned with financial risk. We can further subcategorise financial risk/treasury risk into the following categories:

- Liquidity risk

- Counterparty risk

- Market/currency risk

- Operational risk

Here is a diagram to illustrate this:

Liquidity Risk Management

There are many different sources of liquidity and each of these comes with its own set of risks. The job of the liquidity and risk management function is to assess and manage these risks effectively. But how is this achieved?

Well, the first step is ensuring that information on the amount of the amount of liquidity available – and forecasts of how much will be available in the future – is as accurate and complete as possible.

This information can then be used to minimise risks, which may include tasks such as maintaining a sufficient liquidity buffer, monitoring expected cash flows and applying corrective action to fix any variation, intraday position reporting, and setting up contingency plans.

Counterparty Risk Management

All types of funding come with some level of risk. Working with financial institutions and banks means accepting the risk that this third party will default on their financial obligations to your company. For example, if your company has deposited funds in a bank or invested in a different company, and that bank or company fails, those funds could be lost.

This is known as counterparty risk and is something the treasury department has to contend with in order to prevent it from having a damaging effect on the cash flow of the business.

Managing counterparty risk involves creating careful and considered policies regarding investments and deposits. It also includes monitoring and assessing your borrowing agreements and debt relationships with financial institutions and lenders.

If the company uses trade financing for working capital, it will also involve managing the risk that the trade financier will fail on their obligation to pay a final invoice balance. To do this, it’s important to carry out thorough credit checks on your trade financier, ensure you have adequate legal recourse, and potentially take out insurance against the loss of payment.

Currency Risk Management

The global consumer marketplace is expanding. As more and more developing economies go online, businesses are able to sell online directly to the end consumer without establishing a local subsidiary in their target market.

As such, businesses are engaging in cross-border transactions more frequently. Whilst this provides opportunity for huge growth in sales, it also brings certain challenges – namely, the challenge of FX (Foreign Exchange) risk management.

The goal of FX risk management is to minimise the potential of incurring currency losses caused by exchange rate movements. Different businesses choose to manage currency risk in different ways.

Some companies may choose to ignore FX risk as per customer net revenue isn’t one of their primary objectives. Others negate the risk entirely by only accepting payment in their functional currency.

The latter approach has the disadvantage of limiting sales as it fails to give off the impression that the products being sold are local, whereas the former may lead to monetary losses due to the devaluation of the foreign currency in relation to the company’s functional currency.

Others still aim to get the best of both and balance both risk and reward by monitoring exchange rate movements themselves and adapting their pricing to account for this. This allows them to manage FX risk whilst still using local currency pricing.

References:

https://treasurytoday.com/2002/04/managing-counterparty-risk-in-your-business

https://ctmfile.com/sections/background/liquidity-risk-management