Cash Conversion Cycle – Definition and Uses

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

The Cash Conversion Cycle (CCC) is also known as the cash cycle or net operating cycle. It is referred to “net” because it is a subtraction of the number of days of accounts payables the business has outstanding from the operating cycle. The rationale behind this is that accounts payables are viewed as a source of working capital or cash for operations for the business. On the other hand, accounts receivables, or cash the business is yet to receive, decreases the cash or working capital available to the business to finance operations.

Simply stated, the cash conversion cycle measures the number of days it takes a business to collect its accounts receivables from customers who bought on credit and how long it takes the business to pays its bills or accounts payables to its suppliers. The cycle is a combination of several averages that include accounts receivable, accounts payable and inventory turnover. This metric is usually measured in days and is an important indicator of the financial health of a business.

The cash conversion cycle time is dependent on how a business finances the purchase of its inventory, how the business allows its customers to pay (credit terms and collection period), and how long it takes the business to collect money from those sales.

A lower cash conversion cycle average indicates a faster inventory-to-sales process for any business. A higher cash conversion cycle is a sign of a slower process. A low cash conversion cycle is considered as more acceptable and desirable, although this depends on the nature of the business, its industry, and capabilities.

Introduction to the Cash Conversion Cycle

The cash conversion cycle is an important metric that every business owner should understand. The cash conversion cycle is an accounting metric that measures the time it takes for a business to convert its stock or inventory into cash flows from sales. The cash conversion cycle involves the process where the business buys stock or inventory, sells that inventory on credit and the collects payments from customers who bought on credit.

This cycle is also known as the cash cycle or net operating cycle. It is referred to “net” because it is a subtraction of the number of days of accounts payables the business has outstanding from the operating cycle. The rationale behind this is that accounts payables are viewed as a source of working capital or cash for operations for the business. On the other hand, accounts receivables, or cash the business is yet to receive, decrease the cash or working capital available to the business to finance operations.

Simply stated, the cash conversion cycle measures the number of days it takes a business to collect its accounts receivables from customers who bought on credit and how long it takes the business to pays its bills or accounts payables to its suppliers. The cycle is a combination of several averages that include accounts receivable, accounts payable and inventory turnover. This metric is usually measured in days and is an important indicator of the financial health of a business.

The cash conversion cycle time is dependent on how a business finances the purchase of its inventory, how the business allows its customers to pay (credit terms and collection period), and how long it takes the business to collect money from those sales.

A lower cash conversion cycle average indicates a faster inventory-to-sales process for any business. A higher cash conversion cycle is a sign of a slower process. A low cash conversion cycle is considered as more acceptable and desirable, although this depends on the nature of the business, its industry, and capabilities.

Elements of the Cash Conversion Cycle

Calculating the cash conversion cycle average requires a business to make reference to its income statement and balance sheet in order to obtain the requisite information for the calculation. The cash conversion cycle is made up of three elements, and these are;

- Days Inventory Outstanding (DIO);

- Day Sales Outstanding (DSO); and

- Days Payable Outstanding (DPO).

Let’s examine each of these elements.

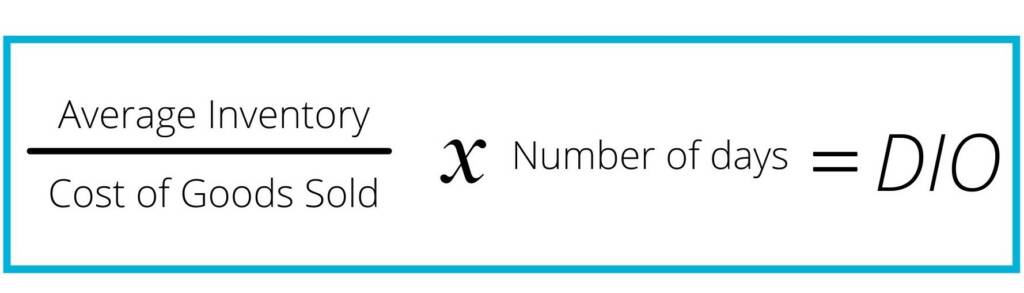

- Days Inventory Outstanding

The days inventory outstanding is the average number of days it takes a business to convert its inventory into sales. Simply stated, it is the average number of days that a business holds its inventory before selling it. A lower value of days inventory outstanding is recommended since it is an indication that the business is making sales quickly, and therefore implying a better turnover for the business.

The days inventory outstanding is calculated using the cost of goods sold. The cost of goods sold represents the total cost of getting or manufacturing the products of goods that a company sells during the period under review. Days inventory outstanding is obtained by dividing the average inventory by the cost of goods sold then multiplying that by the number of days in the period under review, typically 365 days. It can be expressed in the form of a formula as below:-

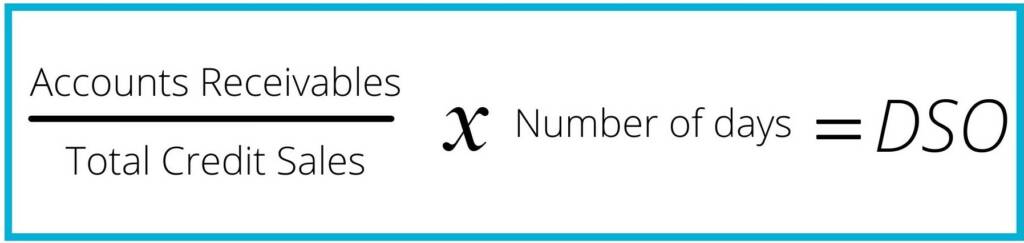

- Days Sales Outstanding

The second element of the cash conversion cycle is the days sales outstanding which focuses the collection of cash generated from sales. Days sales outstanding is the average number of days a business takes to collect payments from its customers after a sale have been completed. Days sales outstanding can be calculated by dividing the average accounts receivables by the total credit sales then multiplying the result by the number of days in the period under review. The period under review could be 30, 90 or 365 days. The days sales outstanding can be obtained by using the below formula:-

A lower day’s sales outstanding value is recommended because it is an indication that the business has the ability to collect cash in a short time and therefore enhancing its cash flow position.

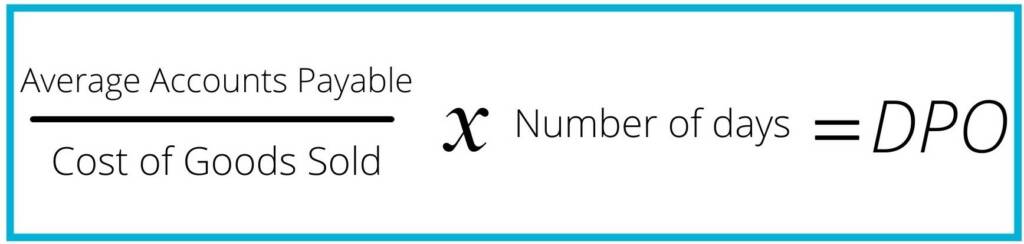

- Days Payable Outstanding

The third element in the calculation of the cash conversion cycle average is the days payable outstanding which takes into consideration the total money the business owes its current suppliers for the goods or inventory it purchased, and this element represents the total time in which the business must settle those obligations. Days payable outstanding represents the average number of days it takes a business to pay its invoices to suppliers or vendors and its bills to creditors or financiers. Simply stated, it is the average number of days a business takes to pay its accounts payables. The days payable outstanding can be obtained by using the below formula:-

It is recommended that a business have a higher days payable outstanding number because by maximizing this average, the busines

s is able to hold onto cash for longer periods thus increasing its liquidity and investment potential.

Calculating the Cash Conversion Cycle

The cash conversion cycle formula is as follows:

CCC = DIO + DSO – DPO

Where:

DIO is the days inventory outstanding

DSO is the days sales outstanding; and

DPO is the days payable outstanding.

The days inventory outstanding and the days sales outstanding are metrics associated with the business’s cash inflow. The days payable outstanding is associated with the business’s cash outflow. The days payable outstanding is therefore the only negative element in the cash conversion cycle calculation.

Alternatively, the cash conversion cycle can be looked at from the assets and liabilities perspective. The days inventory outstanding and the days sales outstanding are considered as short-term assets which are linked to the business’s inventory and accounts receivable and therefore treated positively. The days payable outstanding is a liability which is linked to the business’s accounts payable and is therefore given negative treatment.

Ideally, a business should strive to have a short cash conversion cycle which can be achieved through a combination of a short inventory turnaround time, a short accounts receivable time and a long accounts payable time.

Importance of the Cash Conversion Cycle

The cash conversion cycle formula is useful in evaluating how efficiently a business manages its working capital and cash flow. As is the case with other cash flow calculations, the shorter the cash conversion cycle, the better the business is at selling its products and collecting cash from those sales while settling its obligations and paying suppliers.

This metric should be used to compare businesses operating in the same industry and should be evaluated based on a trend e.g., on an annual basis. Evaluating a business’s cash conversion cycle to its cycles in the previous years can reveal the business’s financial health and whether its cash flow position or working capital management is improving or deteriorating. Also, comparing the cash conversion cycle of a business to that of its competitors can show whether the business’s cash conversion cycle is within the normal parameters compared to industry competitors.

It should be noted that the cash conversion cycle does not apply to some businesses, particularly those in the service industry that does not need inventory. Examples of such companies are software and professional services companies which can realise sales and profits without selling any physical inventory or stock.

There are several reasons why the cash conversion cycle metric is important for businesses. Some of these include the following:-

- Improving Supplier Relations

A business’s suppliers will take into consideration the business’s cash conversion cycle in deciding whether to supply the business with goods on credit. A supplier will be hesitant to supply any business with goods if in the opinion of the supplier the business does not have adequate liquidity.

- Obtaining Business Finance

Banks, lenders, investors, and other financial institutions will usually assess a business’s cash conversion cycle to determine its financial status and use that information to make a decision on whether advance credit or invest in the business. Most importantly, the cash conversion cycle will how the business’s liquidity and cash flow position. This is important for the lenders because they are guaranteed of being paid back. The more liquid a business is, the more likely it is for it to repay a business loan and meet its other financial obligations. A more liquid business is also likely to invest in its growth which is of importance to its financial partners.

The cash conversion cycle is one of the most useful ways to assess inventory-based businesses, like retailers and manufacturers. This is not the only financial metric that banks, lenders, and investors will use to assess the financial health of a business, but they will usually combine it with other financial metrics before making a decision.

- Knowing How Much Finance to Seek

The cash conversion cycle is an important metric to consider for any business when figuring out how much money the business needs to borrow. Business owners who clearly understand their business’s cash conversion cycle and liquidity are able to determine or calculate how much money they need to borrow to invest in the business.

- Evaluating Business Performance

The cash conversion cycle also shows whether a business is performing efficiently or not. A low cash conversion cycle average shows that the business is doing well in converting inventory to cash. It, therefore, shows that a business is operating efficiently. On the other hand, if a business has a high cash conversion cycle average, that could be a sign that the business has operational issues or is poorly performing in the mark. Business owners can use this metric to figure out where the problem is and therefore take correctives steps to remedy the situation. Some of the corrective steps include being more aggressive in collecting cash from customers on unpaid invoices.

- Cash Flow Indicator

The cash conversion cycle average is an important indicator of a business’s cash flow and liquidity position. It shows a business’s ability to maintain highly liquid assets. This is a metric that banks, lenders or investors and capital providers use to assess the business’s potential risk level. As a business owner, cash flow is important because it enables the business to meet its operating expenses such as payment of staff, purchasing inventory and stock as well as fulfilling customer orders. The cash conversion cycle metric will assist a business owner have a better grip of the business’s cash flow.

Video: how to shorten the cash conversion cycle

Read the full article here.

How to Shorten the Cash Conversion Cycle

Businesses should take all measures to shorten the cash conversion cycle because good cash flow in important to the success of any business. The amount of cash available to the business has a significant impact on the business’s day-to-day and long-term operations. Bad cash flow makes a business’s day-to-day operations challenging and also negatively affects the time it takes for the business to pay its creditors.

There are several ways to shorten a business’s cash conversion cycle and improve its cash flow. These include:

- Collecting Accounts Receivables Faster

The number of days it takes for customers to pay their invoices has a significant impact on a business’s cash cycle. Businesses can shorten this period by requesting customers to make upfront payments or deposits. Customers should also be billed as soon as a sale has been made in order to collect payments faster. Offering discounts for early payments can also increase cash flow because customers will have an incentive to pay on time. A business can also reduce its cash conversion cycle by giving customers shorter credit terms for thirty days or fewer and also actively following up with customers to make payments on time.

- Improving the Accounts Receivables Process

A business can reduce its cash conversion cycle by improving its billing and invoicing process. One way of improving and ensuring efficiency in the billings and invoicing process it by automating the invoice creation process This leads to a faster turnaround time from when a sale is made to when payment is received from a customer.

- Improving Cash Flow Management

Cash flow management involves tracking and monitoring the amounts of cash inflow and outflows and the time it takes for them to happen. Cash inflows happen whenever a cash sale is made to customers and a conversion of accounts receivable to cash is made. Loans and the sale of assets also counts towards cash inflows. Cash outflows arise from cash payments for expenses and the conversion of accounts payable to cash in the settlement of bills due to a business’s suppliers. Principal and interest payments on loans and debt also account for cash outflows. A business that has solid cash flow management policies will typically have a shorter cash conversion cycle.

- Pay Accounts Payables Slowly

A business’s cash in hand increases if the business takes a little bit longer to pay its creditors or accounts payable. Whereas it is recommended that a business pay its invoices according to terms negotiated and agreed with its suppliers, the business receives no benefit if it pays early. To increase the cash conversion cycle and cash flow a business should have a payables management system whereby all invoices are paid just as close to their due dates as possible.

- Efficient Management of Inventory

A business can reduce its cash conversion cycle by selling its stock or inventory much faster. The faster a business sells its goods, the sooner it collects cash from sales. A business should consider cutting its losses on slow-moving products and this can be done by selling them at a discount. By doing so, the business frees up much needed and valuable cash that can increase the cash conversion cycle.

Conclusion

The cash conversion cycle is an important business metric that shows how efficient a business is. Tracking it allows a business to see how quickly it is converting cash in sales and back into cash. It also assists business owners to have a clear picture of their cash flow position. A shorter cash conversion cycle allows businesses to grow faster and there if is important for businesses to decrease this metric whenever possible.

The cash conversion cycle cannot be the only metric used to determine the liquidity if a business. Business owners should combine other metrics to get a clear picture of the financial status of their businesses. However, it is important to note that by shortening the cash conversion cycle, a business is able to increase its cash flow and therefore improve on its operations, pay employees on time, deliver new orders, and invest in growth.