Quantum Computing

Download our Tradetech Whitepaper

Accelerating trade digitalization to support MSME financing

Content

Quantum Computing

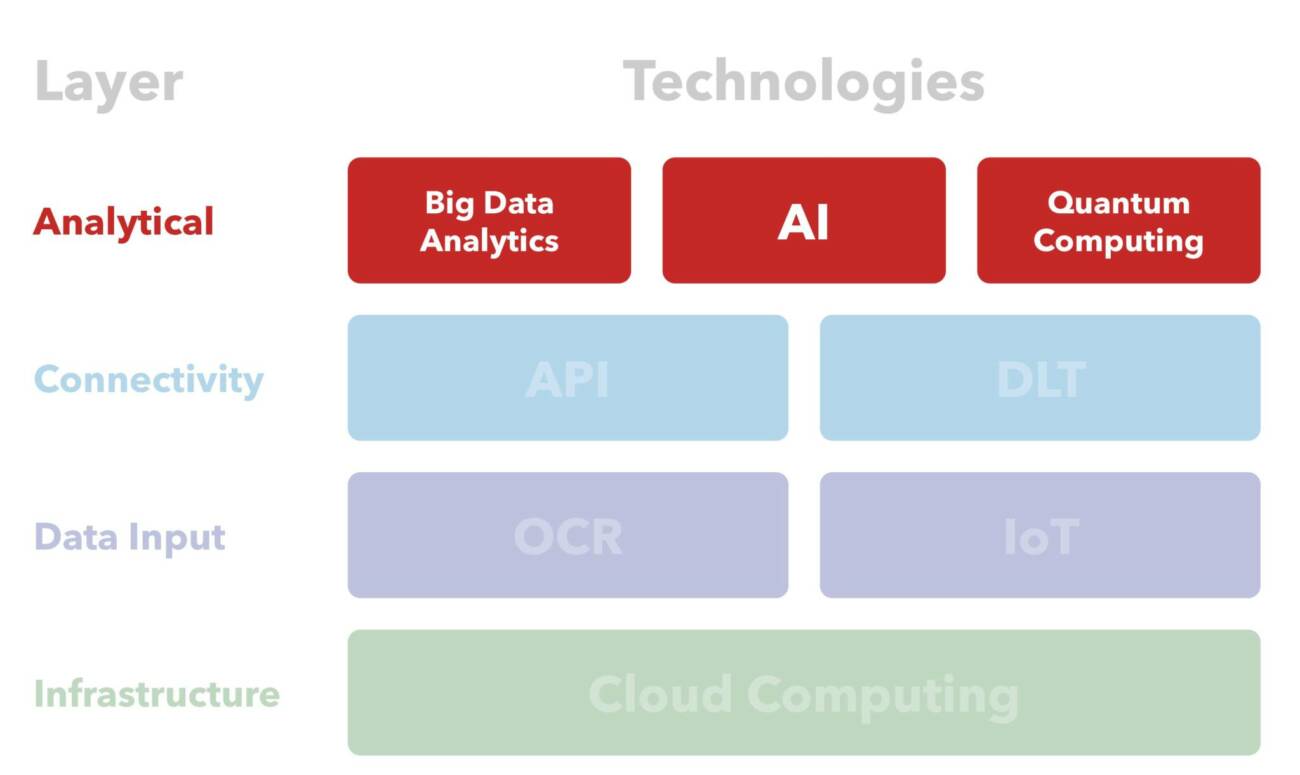

According to the University of Waterloo’s Institute for Quantum Computing, “Quantum computing is essentially harnessing and exploiting the amazing laws of quantum mechanics to process information. A traditional computer uses long strings of ‘bits,’ which encode either a zero or a one. A quantum computer, on the other hand, uses quantum bits, or qubits”, which are both 0 and 1 at the same time. Quantum computers have the potential to process exponentially more data than classical computers. Quantum computing can be considered as both an infrastructure technology, because quantum hardware is required, and as an analytical technology.

Potential benefits for MSMEs

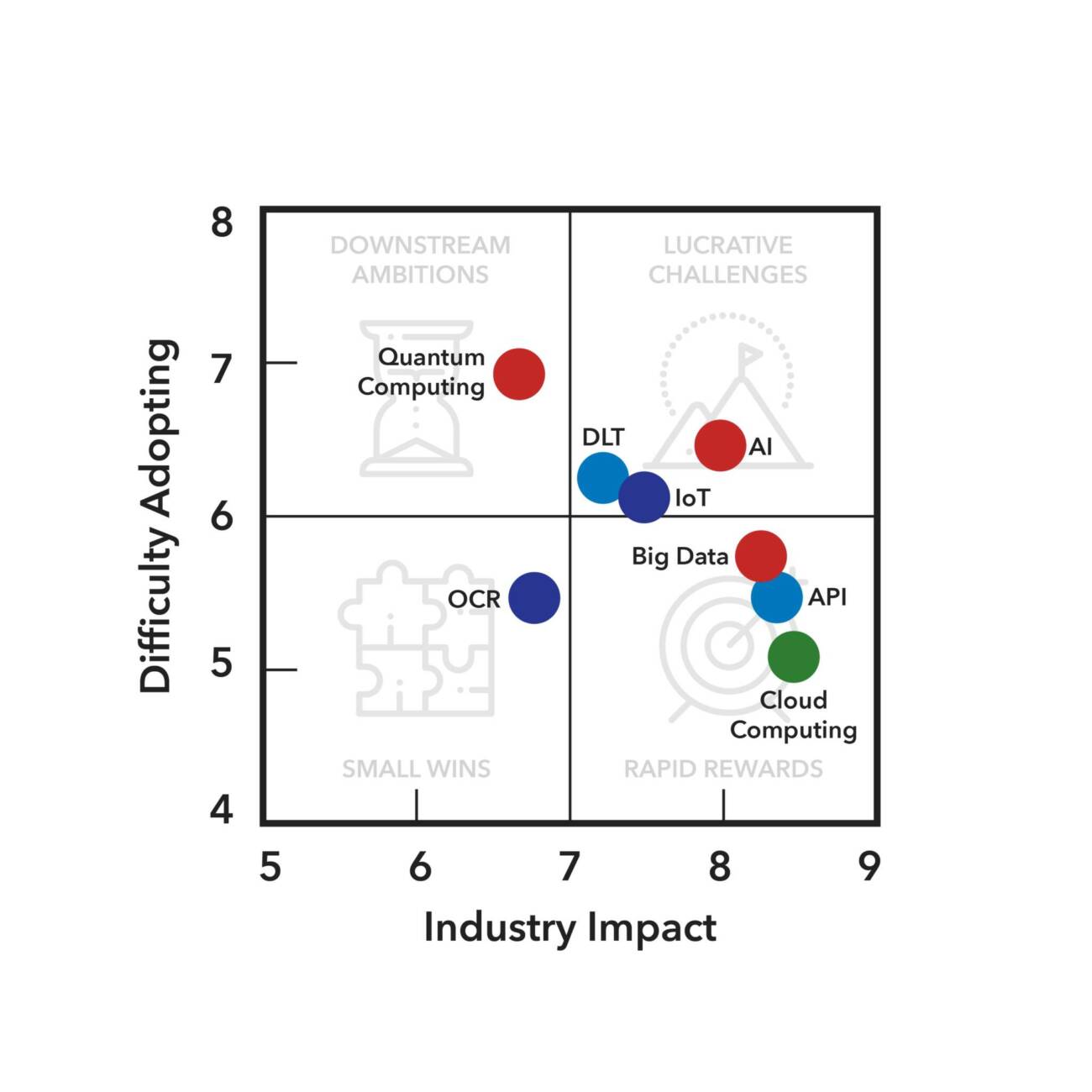

Compared to artificial intelligence (AI), quantum computing allows analysis of much vaster pools of data and is currently being explored as a means to improve the credit rating of companies seeking financing. However, most experts do not see any particularly strong use case for quantum computing in trade finance at the present time. This seems to stem predominantly from the notions that the technology is still in its infancy and that it will mainly be required for heavy computing activities, while trade digitization is, likewise, still in its infancy. Beyond that, the concepts of quantum computing are difficult to grasp and it is difficult at this stage to demonstrate the value. In general, it is too early to say which applications this technology will have for the trade finance industry.

Use cases for Quantum Computing

- AI-powered fintech company Tradeteq recently began a collaboration with the Singapore Management University (SMU) with the support of the Monetary Authority of Singapore (MAS) to explore quantum-computing-based solutions for the industry. While quantum computing is still very much in its infancy, and the technology does not yet exist to build a large-scale quantum computer, SMU and Tradeteq believe their work may be the first to show a practical advantage for a financial application of the technology as quantum computing continues to improve.

For more information about this diagram, visit our research methodology page.

Addressing quantum computing challenges

Given the present state of affairs, the specific challenges for quantum computing have yet to be fully discovered. Initial research by firms in the field indicates that there is a strong infrastructural challenge, as any data must be turned into a quantum state before being used. This creates an infrastructure challenge due to the need for quantum hardware. The technology still needs time to mature and be better understood if it is to attract the capital needed to invest in hardware and if it is to attract and build the talent needed to operate it in order to optimize the supply chain and orient research activities.

When it comes to applications in trade finance, quantum computing will have to wait until it grows up a little bit for its turn in the spotlight.

Publishing Partners

- Tradetech Resources

- All Tradetech Topics

- Podcasts

- Videos

- Conferences