The Role of Technology

Download our Tradetech Whitepaper

Accelerating trade digitalization to support MSME financing

Content

The Role of Technology

Many of the challenges that face micro-, small-, and medium-sized enterprises (MSMEs) in their search for financing are broad in scope and cannot easily be addressed by any single solution. It is easy to say that technology is the answer here, and while innovation will help banks distribute trade finance assets to smaller investors and better understand the risks associated with MSMEs, there is also a greater change needed. At this early stage of the adoption of such technological innovation, there is very little evidence to suggest that it is being utilized by corporates and MSMEs just yet. That said, it is difficult to dispute that technological innovation and the various emerging technologies in the industry are a critical piece in the puzzle of overcoming these challenges.

While acknowledging that technology is not a panacea, this article will examine the role that technology plays in the ecosystem, and will introduce some of the digital technologies that seem poised to play a crucial role in paving the way towards a comprehensive solution.

It is also important to note that MSMEs are often not aware of the opportunities that digital technologies can offer them and of the solutions that alternative financiers can provide. They are often under the impression that technology is simply not for them and view it as complex and costly. This may be due to the idea that some digital trade technology solutions focus more on trying to explain the technology itself rather than simplifying the explanation and service offering to MSMEs, leading to a lack of audience engagement. Continual efforts to make MSMEs aware of the plethora of opportunities available to them are important. Governments may have a role to play in this respect to raise awareness and provide education for MSMEs.

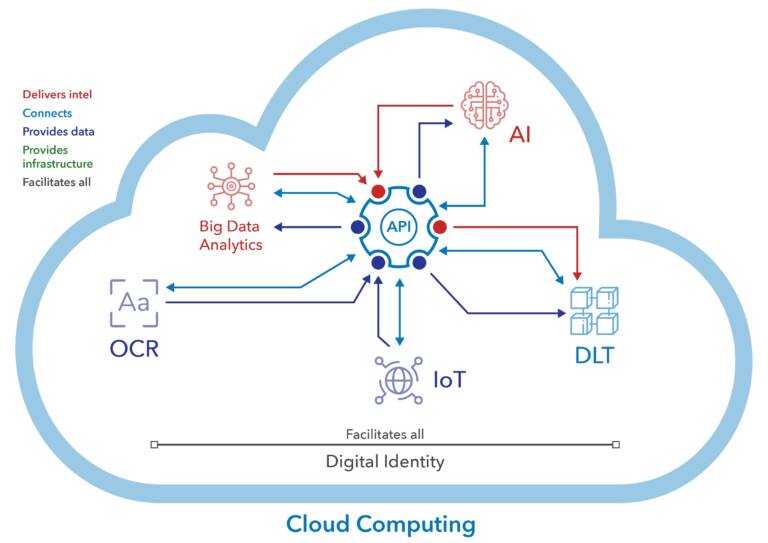

Technological interplay: stronger together

Over the past several decades, digital technology – from Artificial Intelligence (AI) to the Internet of Things (IoT) and Distributed Ledger Technology (DLT) – has slowly begun to penetrate supply chains, trade and trade finance. Figure 1 (below) illustrates the complex interplay between digital tools and demonstrates how each technology relies on the capabilities of others to deliver its most powerful benefits. Some of them work to collect and deliver data, others analyse and interpret this data, and still others provide the infrastructure which allows this communication to occur.

Take, for example, the role of the IoT in this relationship. IoT devices and sensors on their own provide minimal value. However, when they are combined with the secure transmission capabilities of DLT and the analytical capabilities of big data analytics tools enabled by AI, they are able to deliver meaningful and actionable information.

Based on this, the technologies should not be thought of in isolation, but rather in the context of their mutually complementary profiles. Figure 1 depicts some of the interactions that these digital tools have with one another.

Digital technologies – in particular the combination of Big Data, new algorithms and cloud computing – have been driving the rise of platforms and what is now referred to as the platform economy. The platform economy is reshaping global trade. Many of the most valuable companies globally are now based on a platform business model, such as digital marketplaces that enable groups to interact and transact. When it comes to MSME financing, in particular trade finance, many projects take the form of platforms. These platforms often leverage several of the digital technologies depicted above. The platform economy opens vast new opportunities but also raises considerable new challenges. A detailed explanation of the platform economy is beyond the scope of this article.

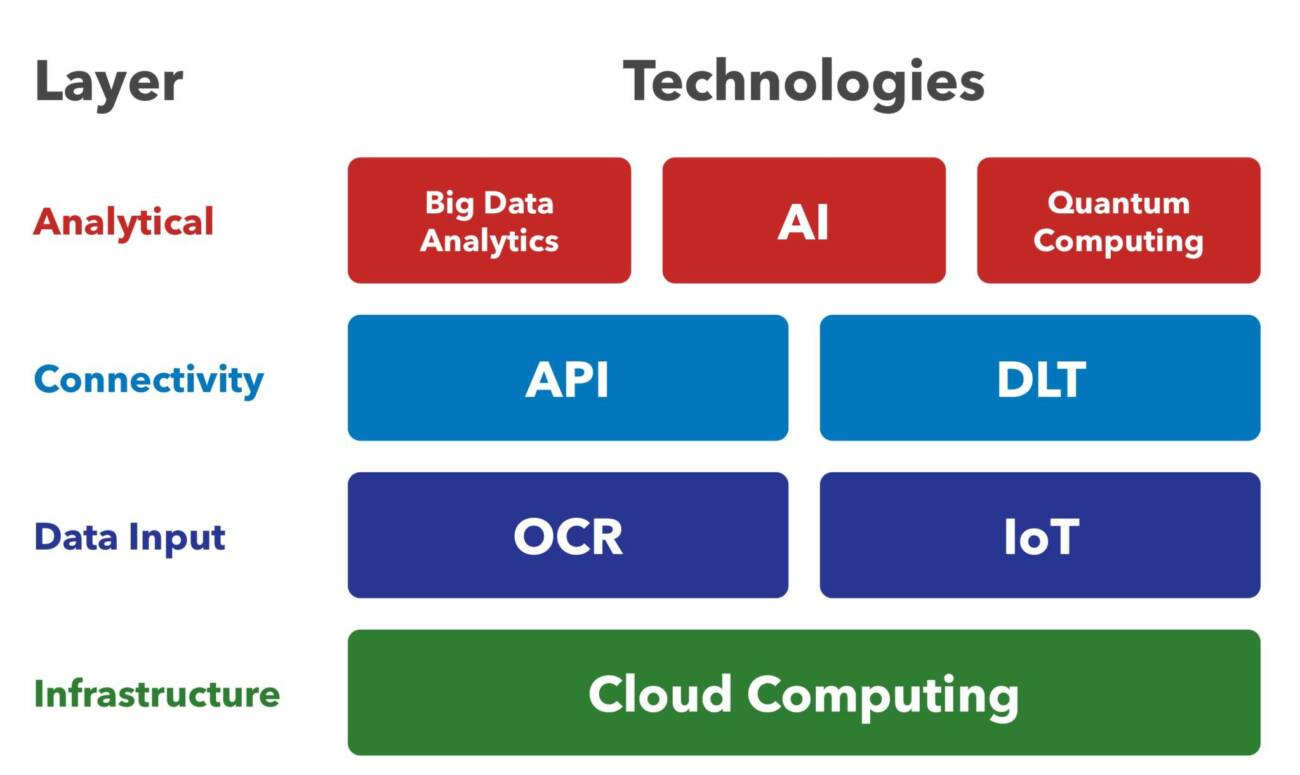

Digital technologies in trade

The eight technologies emphasized here can be thought of as existing within the framework of a technology stack. Each layer can be used to facilitate and enhance the layer(s) above. The stack is depicted below. The following sections will introduce the layers in this stack beginning from the foundation and working upwards.

*Note: This framework attempts to illustrate the interplay between the different technologies. We have chosen to display these categories from a business perspective – with emphasis on what each technology is used for – rather than from a purely technological perspective. For instance, from a purely technological perspective, DLT is a trusted database. However, from a business perspective, it is used to connect parties directly, on a person-to-person (P2P) basis, in a trusted environment. As such, it has been categorized as part of the connectivity layer.

Infrastructure technologies

Infrastructure technologies enable other technologies and software systems to interact with external data sources. They generally refer to an organization’s technological environment and can include cloud computing.

Data input technologies

Data input technologies are those that are able to provide data to a system. This can consist of digitally native data, such as those gathered by IoT sensors, or the conversion of non-digital data into a digitized format, such as those generated by the use of optical character recognition (OCR).

Connectivity technologies

Connectivity technologies are technologies that allow various systems and/or actors to connect, facilitating the exchange of data. Application Programming Interface (API) and DLT allow firms, networks, technologies, and applications to communicate with one another, sharing data and enhancing the services available to all parties involved.

Analytical technologies

Analytical technologies are those that take large amounts of collected data and convert those data into actionable insight.

Once data are gathered, there is still the issue of making sense of it. Developing practical solutions requires that the people working on them have strong trade industry expertise and data analysis skills. Unfortunately, this skill combination is not always readily available. Furthermore, as a traditional industry, trade finance suffers from a reluctance to adopt new technologies or processes. There is always the likelihood that companies will stick with the old, ineffective ways with which they are comfortable, rather than trying something new and innovative. Education will be a crucial step to develop trust in analytical technology, in order to foster adoption and trickle benefits down to MSMEs.

The new technologies in question include big data analytics, AI and quantum computing.

Publishing Partners

- Tradetech Resources

- All Tradetech Topics

- Podcasts

- Videos

- Conferences