Cloud Computing

Contents

Cloud Computing

According to Microsoft, “cloud computing is the delivery of computing services – including servers, storage, databases, networking, software, analytics and intelligence – over the Internet (“the cloud”) to offer faster innovation, flexible resources and economies of scale”. This on-demand approach enables the use of computing power without direct active management by the user.

Potential benefits for MSMEs

Despite being a generally mature technology in most other industries, cloud computing is still just beginning to emerge in trade finance but has the potential to provide several key benefits. First, it lowers the cost of using technology by reducing the upfront costs of setting up infrastructure. A report from Pennsylvania State University shows that a full-fledged cloud migration can help reduce processing costs by upwards of 90 per cent, cost savings that would hopefully trickle down the value chain and result in lower costs for trade finance in general. Lower costs for trade finance transactions could facilitate financing for MSMEs.

An additional benefit comes from MSMEs themselves adopting cloud technologies. The lower costs of scalable ‘pay-as-you-go’ models allow smaller organizations to leverage robust security and infrastructural elements, established by powerful hosting providers, while themselves remaining agile. This approach of “processing power-as-a-service” is easily scalable to meet the needs of different company sizes, eliminating costly investments to scale up. From a general business perspective, this has created opportunities for MSMEs to easily build and deploy applications to facilitate e-commerce, which has been a matter of survival for many MSMEs in the context of the COVID-19 pandemic. As the trade financing ecosystem slowly becomes more digitally versed, such applications will be able to provide additional data streams to potential financiers, increasing visibility and reducing challenges associated with assessing MSME risk profiles.

Another fundamental benefit of cloud computing for the international trade industry is that it can be accessed by the user from anywhere. This is required due to the global nature of the trade business and the fact that end-users are spread across many countries. Without the location-agnostic setup of cloud infrastructure, globally distributed workforces would be sparsely connected at best.

Use cases

Cloud computing is used by many companies to provide enhanced customer service and allow for business continuity processes. With COVID-19 forcing companies to adopt remote working, big banks are increasingly looking to the cloud to accelerate a digital shift. In July 2020, Amazon Web Services struck a new deal with HSBC while Google announced partnerships with Goldman Sachs and Deutsche Bank. Some fintechs are also actively using cloud computing to provide enhanced financial services to MSMEs. Pollinate, for example, is a cloud-based fintech platform designed to take data feeds from existing banks and third-party systems to give a small business a single place to manage their business. In October 2020, the National Australia Bank partnered with Pollinate to transform their merchant acquiring offering for MSMEs across Australia and help them better manage and grow their business by giving them access to digital tools and payments solutions historically only available to larger businesses. Pollinate is in discussions with leading banks in South Africa, Canada, and other regions.

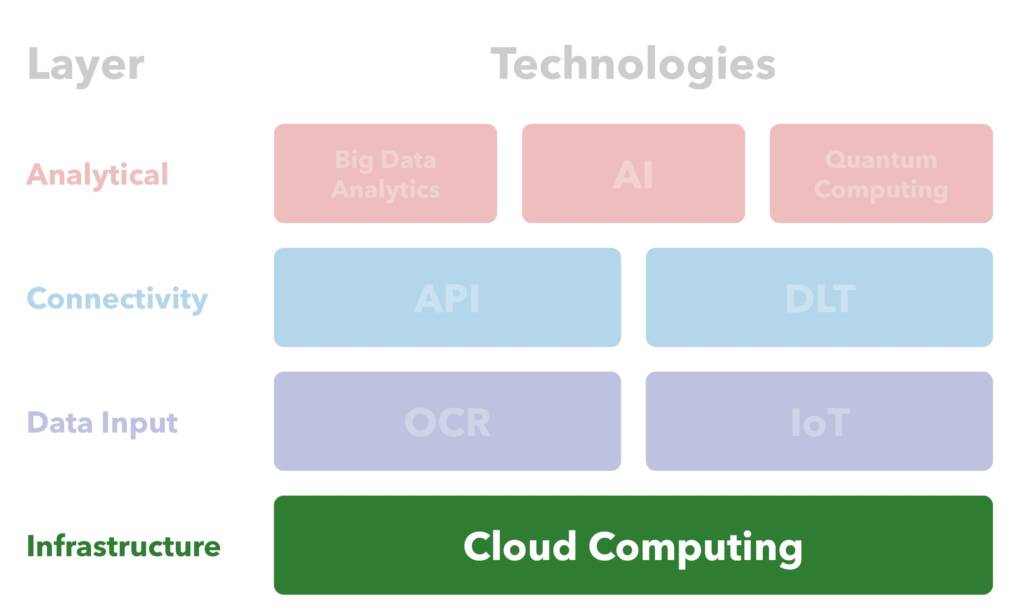

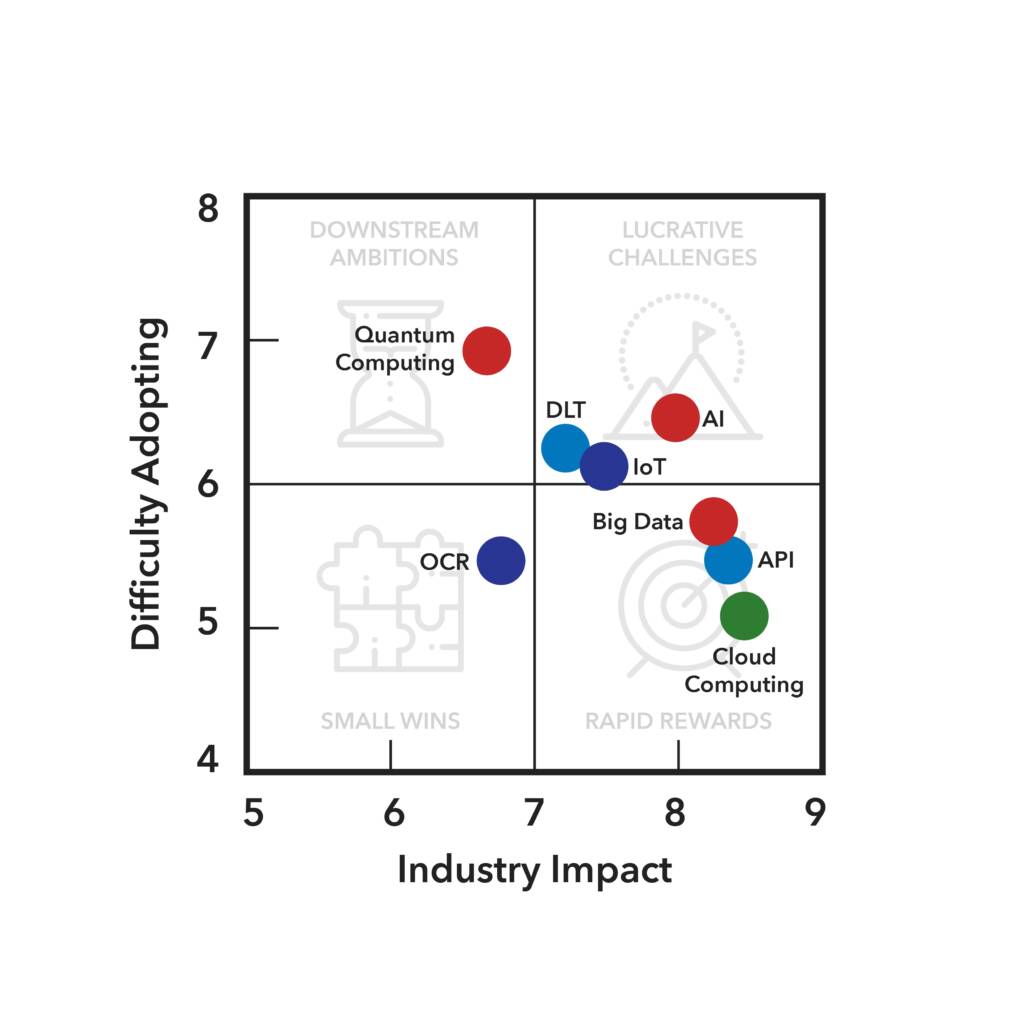

For more information about this diagram, visit our research methodology page.

Addressing cloud computing challenges

In terms of the adoption of cloud computing in MSME financing, two challenges need to be addressed. First, regional banks need to take a forward-looking stance and factor MSME needs into their decisions to adopt cloud in lieu of their existing infrastructural technology systems and second, ambiguous and outdated regulations need to be updated to enable the use of cloud technology and secure data in trade. There is still a need to adapt regulation where cloud-based solutions are not allowed for some financial institutions, an issue that some institutions interviewed report as having faced relatively frequently in the past, in particular in relation to the use of public cloud. According to experts, the situation is improving.

As cloud computing technologies are already generally available, leveraging them for assisting with MSME financing is primarily a matter of bank-level adoption. The largest challenge for adoption lies in evaluating the internal financial viability of cloud technology. Banks will need to compare the benefits of their currently deployed model with that of cloud solutions. If the benefits do not outweigh the costs of implementation, they will be hesitant to deviate from their current model, especially in regions of the world where cloud adoption is very much dictated by the core banking providers. This is particularly true given that the non-cloud systems they will be transitioning from will have come laden with large upfront investments. Increasing the availability of cloud-enabled tools through updated regulations is a good first step towards mitigating this transitory friction, but it is unlikely to be enough. A more forward-looking stance by small regional banks most serving MSMEs would help all parties reap the benefits of digitalization.

Since cloud computing has matured in various adjacent industries, many of the traditional technological, operational, and educational challenges have already been overcome where adequate infrastructure has been established (see the section on the digital divide below). However, some regulatory challenges exist regarding data localization requirements. These regulatory requirements have a tendency to contain ambiguous phrasing, making it difficult to parse their exact meaning, which poses an impediment to cloud adoption. The key to addressing this challenge is regulatory reform. To that end, it would be ideal if regulators would focus on the security of data instead of its physical location. The OECD observes that it is also important to raise awareness about digital risks and enhance digital skills as the continuous remote access that cloud enables implies cyber risks extend to the personal devices of employees. Fortunately, for many regions of the world, regulatory bodies are well on their way to addressing these risks and welcoming cloud technologies, even into highly regulated environments like banking. However, it is important to remember that technologies, such as cloud computing, are not constants and may change in the future. Therefore the real key is inclusive data and legal standards for any type of digital solution. The next steps for the total implementation of cloud computing involve easing the regulatory burden to encourage frictionless bank-level adoption.

The Digital Divide

In some areas of the world, cloud technology is hampered by a lack of stable internet speeds. Without adequate connectivity, many of the benefits that cloud technology and other cloud-based applications bring are rendered moot.

This digital divide is dual-faceted, pertaining both to access to the internet as well as the bandwidth of that connection. Substantial digital divides persist between and within countries. Only around half of the world’s people access and use the Internet and many of the unconnected life in the least developed countries, landlocked developing countries, and small island developing states.

There are significant gaps and barriers in several policy areas (ranging from ICT infrastructure and payment solutions to skills and legal framework) that need to be overcome to enable people and businesses to engage fully in the digital economy.

Publishing Partners

- Tradetech Resources

- All Tradetech Topics

- Podcasts

- Videos

- Conferences