Big Data Analytics

Contents

Big Data Analytics

According to IBM, “big data analytics is the use of advanced analytic techniques against very large, diverse data sets that include structured, semi-structured and unstructured data, from different sources, and in different sizes” to uncover hidden patterns, correlations and other insights.

Potential benefits for MSMEs

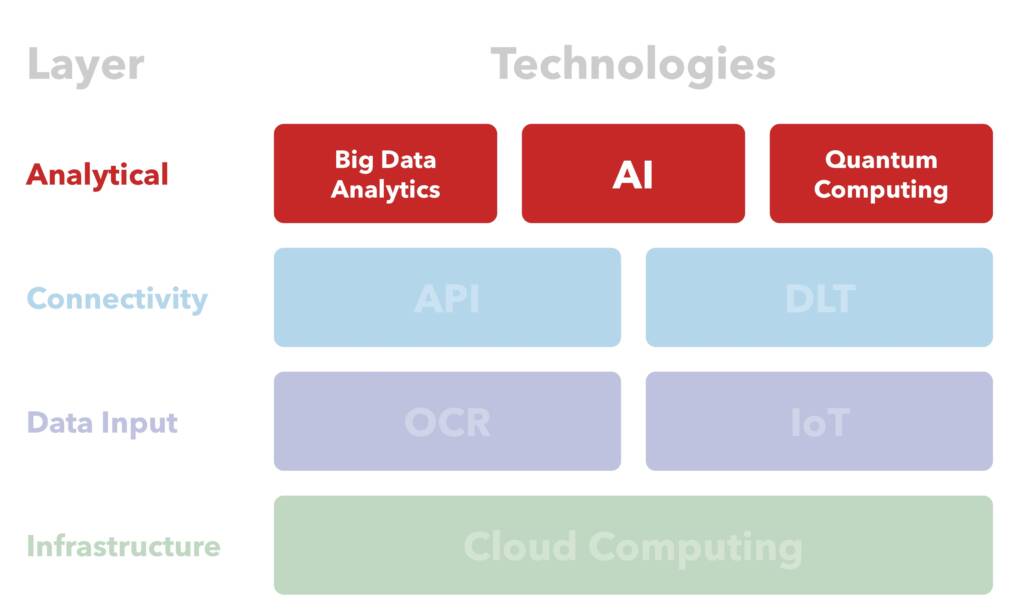

Data sit at the heart of nearly all business processes. As a result of this, analytical technologies are playing an increasing role in nearly every aspect of 21st-century commerce, including trade finance. Data input technologies, such as internet of things (IoT) and optical character recognition (OCR), are producing unprecedented volumes of raw data, but these are often unstructured due to a widespread lack of standardization. Big data analytics provide a means to organize and analyse these data points, generating a holistic view of customers across all products and markets. This increased sense of transparency will supplement and improve business decisions by providing critical insights into client usage of products and services.

Developing an increasingly digital-first approach to data will help solve the pain point of information asymmetry between banks and micro, small, and medium enterprise (MSME) consumers. This is because the connection capabilities of digital software will allow banks and MSME consumers to share information with each other in a mutually beneficial manner. Financial institutions will have the information required to determine an accurate risk profile for the MSME, and the MSME will have a greater likelihood of acquiring finance as it is able to divulge accurate financial information.

“With analytical technologies, small businesses can be given accurate credit scores which reflect their actual risk profile rather than their lack of credit history”

While analytical technologies are often thought of as a useful tool when there is too much data, they can also help in instances where there is too little. Many MSMEs, particularly newer ones, lack a credit history. This can make it difficult, if not impossible, for banks to assess their creditworthiness and offer financing. Using predictive insight capabilities, enabled by analytical technologies, small businesses can be given accurate credit scores which reflect their actual risk profile rather than their lack of credit history.

The capacity to organize and analyse large amounts of data also makes it possible to leverage alternative non-traditional data, such as logistics data, e-commerce data, social media data and mobile payments, and other transactional data, to better assess the creditworthiness of small companies. Financial institutions, as well as alternative finance providers, can thereby obtain the credit information they require to determine a more accurate risk profile for the MSME. This will give MSMEs a greater likelihood of acquiring finance, as they acquire the ability to divulge accurate financial information to a wide range of potential lenders.

Use cases

According to the ICC Global Survey, 23 per cent of banks use big data analytics in their operations. It is also used by many regulatory technology (or regtech) firms like Quantexa, a data and analytics software company that provides financial data analytics services to companies. Quantexa uses big data analytics techniques to provide automated, cost-effective decision-making for KYC and AML compliance.

Become is an example of a US-based online platform for small businesses to find and optimize funding solutions. The company uses big data analytics to help small businesses improve their “lendability” and provides a platform to match them with lenders.

Additional examples include MYbank and China Systems. MYbank is a Chinese digital bank established by a financial subsidiary of Alibaba (a China-based global wholesale trade platform) that makes use of big data analytics. MYbank utilizes the big data analytics service of Alibaba as well as Alibaba’s subsidiaries Ant Group and Zhima Credit to evaluate borrowers in order to provide funds primarily to help farmers purchase agricultural machines and tools. The credit information comes from big data analytics of information such as online transactions, rented car return conditions, and court reports about default debts, if any of these exist. This is an entirely different model for risk profiling, which not only uses MSME data but also other touchpoints such as transactions, to build a different credit profile.

Ant Group, also a member of the Alibaba Group, is another example of a company using big data analytics to facilitate MSME lending. The firm offers microloans to MSMEs using data from prior online transactions to evaluate potential borrowers. Ant Group relies on transactional history, such as bill-paying behaviour, rather than on collateral to make its lending decisions.

“This data could be used to construct risk profiles in a different way. The use of technology shouldn’t only be for composing the currently used profile, but also to invent new ways to assess (and prove) MSME risk .”

China Systems, a global software provider and trade solutions vendor, uses big data analytics to empower their analytics processes by sourcing data using open application programming interface (API) frameworks.

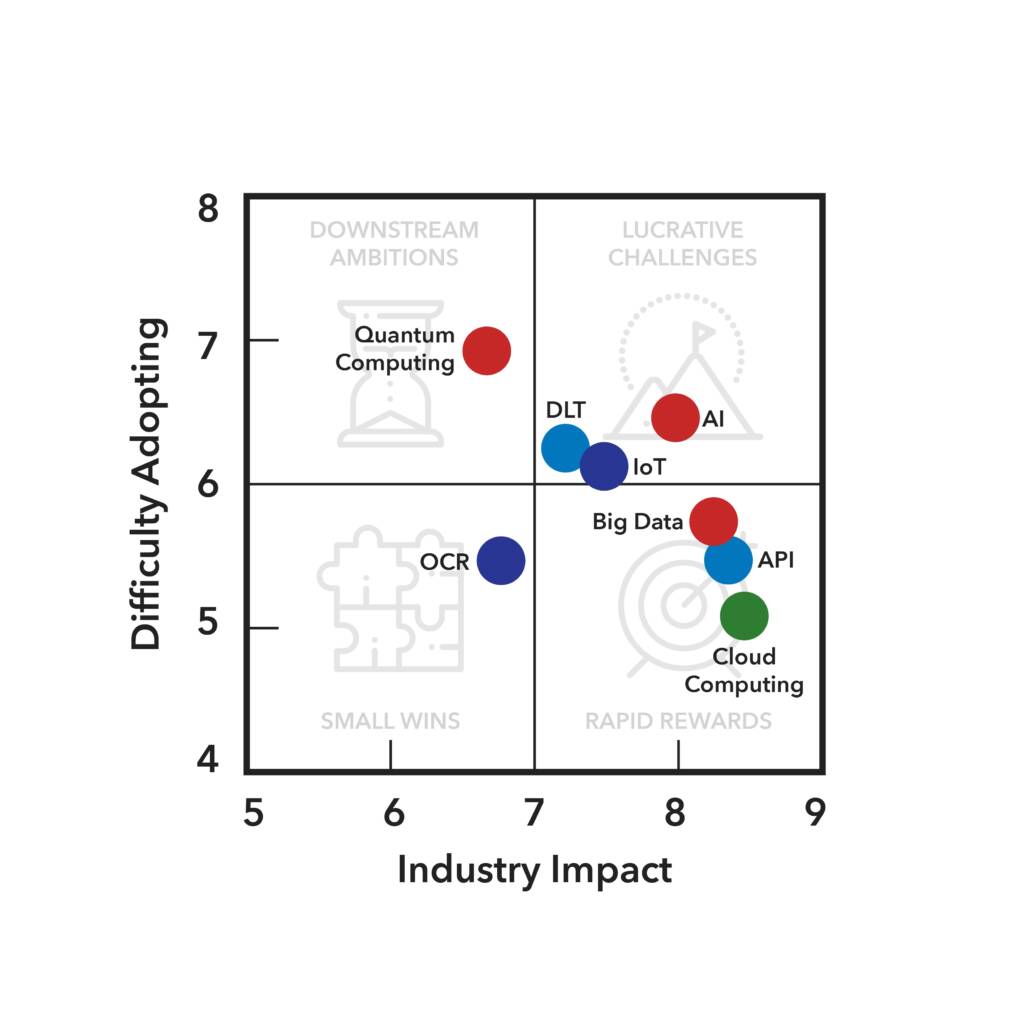

For more information about this diagram, visit our research methodology page.

Addressing big data analytics challenges

The challenges still confronting the adoption of big data analytics are centred predominantly around the procurement of quality data and the arrangement of human resources.

The real bottleneck is the data banks are able to acquire. With vast swathes of trade finance transactions still occurring on paper, acquiring data in digital formats is a slightly more difficult process, requiring the support of other technological innovations like OCR. Even if data are digitized, collating them may still not be straightforward. Legal data collection can only be done with customers who agree to participate. Data privacy regulations in many jurisdictions impose strict rules on the collection of private data to protect consumer rights. Firms leveraging big data analytics and artificial intelligence (AI) need to work within these bounds to maximize the availability of data while ensuring that any use of the collected data does not do so in a way that would violate companies’ and consumer’s trust. In addition, the use of alternative data such as logistics data, e-commerce data, and mobile payments may raise questions as to the relevance of some types of data collected to assess risk. Approaches to leveraging alternative data to assess the creditworthiness of companies vary significantly. A globally coordinated approach on this matter may be warranted. However, gathering large amounts of high-quality data is only part of the equation; the people and the models involved are just as important.

Aligning the human resources, both within organizations and within the industry as a whole, is necessary to turn raw data into actionable knowledge. Data need to be transformed into a suitable form for analysis and to be analysed using appropriate models, and the resulting output needs to be understood by the end-user. This end-to-end process will require close cooperation between operational and information technology colleagues to ensure that the best data models are selected and implemented. People are at the heart of decisions concerning these models, and people are responsible for coordinating beyond the walls of a single organization. Specialized big data analytics solutions that solve trade finance issues must be coordinated with broader solutions that can be applied to multiple businesses. Ensuring that the right people are in the right places and having the right conversations is a crucial challenge for big data analytics in trade finance.

Publishing Partners

- Tradetech Resources

- All Tradetech Topics

- Podcasts

- Videos

- Conferences