Asia’s digital trade landscape heads into a new decade

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

Editors note:

This report reflects the authors’ thinking as of January 2020 before the COVID-19 global outbreak

Introduction

As the region solidifies its global trade leadership, banks have an opportunity to serve new financial needs as long as they make needed technology and process changes.

A boom in Asian trade and a new challenge for banks

By the end of last decade, Asia had further established its position as an integral cog driving the global trade machine – but that’s just the beginning of the story for traditional banks serving businesses in the region. The continent continues to emerge as a leader on the world stage, producing, trading and consuming over two-thirds of the globe’s major commodities. The region is also on track to top 50% of global GDP and drive 40% of the world’s consumption by 2040.

Geopolitical and economic developments in the second half of 2019 further shifted focus from the Western seats of power to Asia. The majority of Asian countries have significantly reduced tariffs for trade among themselves, while signing a free trade agreement with India and China to capitalize on U.S.-China trade tensions. In addition, Japan, Australia, Canada and eight other countries ratified the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, from which the U.S. withdrew.

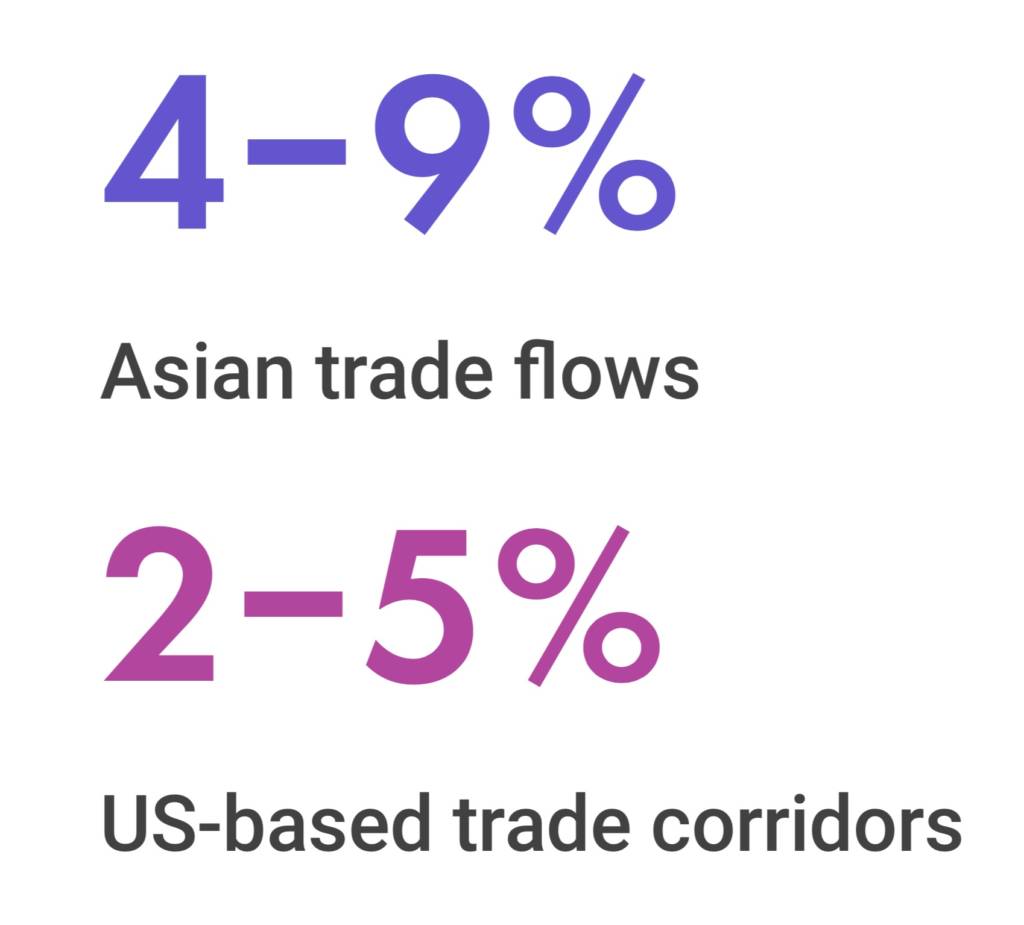

Oxford Economics has estimated the potential impact of the U.S.-China trade war to be US$360 billion. Even with Asian trade flows expected to grow 4% to 9% a year from 2017 to 2026, vs. just 2% to 5% expected growth in U.S.-based trade corridors, according to the International Chamber of Commerce (ICC), the region is far from reaching its full potential.

Projected growth 2017-2026

Source: International Chamber of Commerce (ICC) global trade report

An unprecedented year for trade

Last year saw an almost unprecedented amount of instability in the trade sector, which is set to carry over into 2020. Concerns include:

- Tariff wars

- Protectionist policies

- Regulatory uncertainty

- Weakening trade momentum

- Declining investments

What’s in stock?

“Banks are looking to provide a consistent operational process and experience for their corporate clients.”

Will 2020 bridge the trade finance gap?

The issue for traditional banks is that a large percentage of businesses in the region are unable to access the finance required for growth, particularly in the small- and medium-size enterprise (SME) sector. The financing gap in emerging Asian economies stands at $700 billion, according to the ICC and Asian Development Bank.

The challenges that traditional banks face in closing this gap – including a lack of agility, the high cost of offering new services and perceived risk – has resulted in more financial services being offered by non-banks. Previously focused on retail banking and small-business lending, non-bank financial services and platforms are making their mark in corporate banking. Traditional institutions understand the threat this poses to their business and are now partnering with these platforms to stay relevant.

While emerging business networks continue to gather pace, those who heralded 2019 as the year for lift-off will have been disappointed by these networks continuing to run pilots. Much of the talk has been around interoperability, as regional networks such as those in China compete with product- or sector-focused initiatives. Many corporate clients and banks continue to participate in multiple initiatives, hedging their bets on which will be successful and scale in the long term.

Regardless of the network or channel being used to manage transactions, banks are looking to provide consistent operational processes and experiences for their corporate clients, shielding them from any disruption in service that may result from embracing new ways of doing business.

“Because of the high costs of complying with increasingly complex sanctions and regulatory, KYC and AML requirements, banks are finding it difficult to reduce barriers to entry and capture the revenue opportunity of businesses struggling to gain access to finance today.”

What 2020 has in store for trade in the region

Rising regulatory challenges

Amid these challenges, increasing regulatory and compliance requirements are making it more difficult for banks to maintain margins on transactions or capture the SME opportunity. Since the global financial crisis, the financial services industry has been impacted by deep regulatory reforms and more stringent rules relating to capital allocation.

These stricter standards limit the availability of bank credit, and Basel IV will reduce this scope even further when it comes into full effect by 2022. The changes to SWIFT interbank messaging standards for trade implemented in 2018, and the subsequent changes due in November 2020, have also compelled many banks to assess their existing processes and platforms. These changes, along with the availability of new technologies and a mindset shift toward focusing on collaboration rather than competition, has driven the industry to look at redesigning the entire business paradigm.

The impact on trade finance so far

Because of the high costs of complying with increasingly complex sanctions and regulatory, KYC and AML requirements, banks are finding it difficult to reduce barriers to entry and capture the revenue opportunity of businesses struggling to gain access to finance today.

This is a particular issue in emerging markets, where a lack of historical data presents a challenge in meeting KYC requirements. At the same time, the situation is exacerbated by a lack of correspondent banking relationships and the exit of larger global banks from certain countries due to the perceived risk of doing business there.

While the market is aware of the opportunity and the current unmet demand for financing, particularly with emerging markets and SMEs, the challenge in resolving this situation remains. This has contributed to the rise of non-bank financial services and platforms.

How can financial service providers meet this need?

Emerging technologies and new business models, combined with more effective analysis of exponentially increasing data volumes, are seen by many as the panacea for solving these issues and removing obstacles that inhibit access to finance and the subsequent business growth.

Traditional trade finance products have historically focused on mitigating transaction risk, and have not typically been associated with low-cost, high-speed servicing. Corporate clients are increasingly demanding financing across the entire goods and services lifecycle, including pre-shipment, post-shipment and inventory financing. With corporate needs changing, it’s not enough to offer traditional trade finance without supporting end-to-end working capital finance and solutions such as guarantees and supply chain finance in a highly automated, low-cost fashion.

The growing gap between corporates’ expectations and banks’ offerings must be closed.

Mind the gap: The working relationship between corporates and banks

“To retain relevance to their corporate clients, financial service providers need to partner with technology companies to deliver the services these clients require, in a future-proof manner that is conducive to lowe costs.”

Mind the gap

The working relationship between corporates and banks

Different drivers for different stakeholders

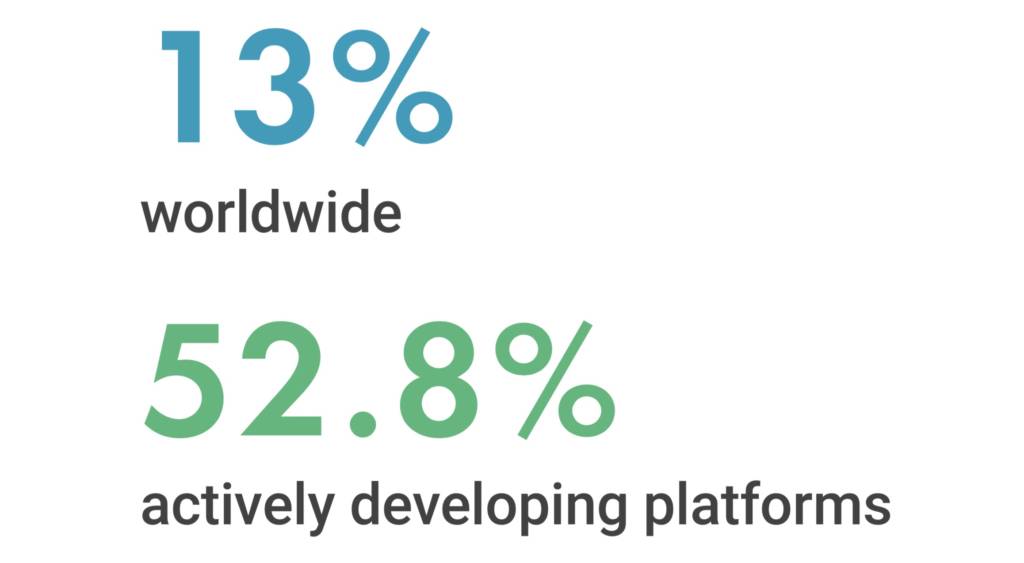

A recent study from Finastra and East & Partners indicates a widening gap between corporate expectations and the services offered by their banking partners.[1] This has contributed to a rise in alternative sources of funding. Particularly telling is the percentage of corporates that don’t trust their banks to deliver the technology services or products they need. To retain relevance to their corporate clients, financial service providers need to partner with technology companies to deliver the services these clients require, in a future-proof manner that is conducive to low costs.

To retain relevance to their corporate clients, financial service providers need to partner with technology companies to deliver the services these clients require, in a future-proof manner that is conducive to low costs.

Most banks and corporates are either already working with fintechs, trade networks or other third-party technology vendors, or are planning to do so, to achieve the innovation needed in working capital finance. What’s needed to meet both the requirements of banks and the expectations of corporates is a single solution that covers the full suite of working capital finance solutions, with integrated compliance capabilities and the ability to harness the platforms and technologies of the future.

By providing services in this way, banks can ultimately reduce the cost of supporting transactions across the lifecycle of the relationship, unlock new revenues and capture market share that has previously been unattainable.

How technology can help meet the needs of the industry

The trade finance sector has long embraced the value of digitization and automation. Wholesale industry adoption, however, has so far been slowed by immature technologies, the number of parties involved and the numerous interpretations of the rules.

While solutions for electronic trade documents have been available for decades, rulebooks and technologies that were not interoperable created “digital islands.” Transactions often subsequently defaulted to paper due to one or more participants not being part of the relevant electronic ecosystem. Even with emerging technologies and networks, there is a danger that these digital islands will be recreated unless interoperability is achieved on standards, formats and assets.

Paving a path from paper-bound to automation

According to some observers, global trade banks could save more than US$2.5 billion and increase revenues by about 10% by adopting an integrated digital solution that incorporates intelligent automation, collaborative digitization and future technology solutions.

Despite the excitement around distributed ledger technologies, regulatory and cultural factors will keep the industry operating in a hybrid world of paper, digitized and digitalized, for the foreseeable future.

“Despite the excitement around distributed ledger technologies, regulatory and cultural factors will keep the industry operating in a hybrid world of paper, digitized and digitalized, for the foreseeable future.”

To alleviate the cost and risk of manual processing, banks will need to harness technologies such as optical character recognition (OCR) to extract data from documents, automate sanctions and compliance screening, and populate the relevant fields in processing systems. These solutions will sit in parallel with digital channels and emerging networks, which will consolidate data across the ecosystem to support effective decision-making through analytics.

Regardless of whether a transaction is paper-based, digital or a combination of the two, banks will want to maintain a single source of records to support a standard operating model and process. Doing so will mitigate any impact on the user experience for the corporate as new initiatives and ways of doing business emerge. To respond to changing market forces and the needs of their corporate customers, banks will have to future-proof their landscape through the use of an open application programming interface (API)-based architecture and platform model.

Big Data and Blockchain

Is interoperability the answer?

In the current economic climate, supply chains are growing in number and complexity. In parallel, an equivalent number of sector-, product- and country-specific financial networks have emerged whose data sources and processes need to interoperate.

The flow of data and information must be carefully captured, analyzed and investigated to identify key trends and patterns that businesses can use to inform their supply chain strategies and, consequently, the end-user experience. As a result, banks are looking toward platforms capable of extensive data manipulation, as nearly all trade banks are fully aware of the importance of analyzing large datasets in real time to service their corporate clients.

“The Bank of China, along with three other major commercial banks, recently announced the launch of a blockchain-based forfaiting transaction platform, which aims to revolutionize how trade and supply chains are financed.”

The Bank of China, along with three other major commercial banks, recently announced the launch of a blockchain-based forfaiting transaction platform, which aims to revolutionize how trade and supply chains are financed. Powered by blockchain technology and big data, the platform facilitates forfaiting transactions between corporates and banks. In Finastra’s study, 50% of commercial banks in Asia agreed that blockchain is an effective technology for supply chain finance solutions, and 100% agreed on the usefulness of big data as a tool.

50 Percent of commercial banks in APAC that view blockchain as an effective tool in providing supply chain finance solutions

100 Percent of commercial banks in APAC that see big data as a useful tool

Source: Finastra

Other blockchain initiatives instigated by the Chinese government include the Bay Area Trade Finance Blockchain Platform. This platform aims to enhance trade finance accessibility, particularly to SMEs, but it also seeks to enhance the trade relationship between China, Hong Kong and other neighboring economies. Additionally, the Chinese government has announced the launch of China’s domestic digital currency within the next few years.

“This ‘network of networks’ allows banks, corporates, logistics firms and other ecosystem players to share data and information seamlessly in real time across regions and industries, while retaining a standard operating model.”

Look to a networked platform in the cloud

The flow of data and information must be carefully captured, analyzed and investigated to identify key trends and patterns that businesses can use to inform their supply chain strategies and, consequently, the end-user experience. As a result, banks are looking toward platforms capable of extensive data manipulation, as nearly all trade banks are fully aware of the importance of analyzing large datasets in real time to service their corporate clients.

“The Bank of China, along with three other major commercial banks, recently announced the launch of a blockchain-based forfaiting transaction platform, which aims to revolutionize how trade and supply chains are financed.”

The Bank of China, along with three other major commercial banks, recently announced the launch of a blockchain-based forfaiting transaction platform, which aims to revolutionize how trade and supply chains are financed. Powered by blockchain technology and big data, the platform facilitates forfaiting transactions between corporates and banks. In Finastra’s study, 50% of commercial banks in Asia agreed that blockchain is an effective technology for supply chain finance solutions, and 100% agreed on the usefulness of big data as a tool.

50 Percent of commercial banks in APAC that view blockchain as an effective tool in providing supply chain finance solutions

100 Percent of commercial banks in APAC that see big data as a useful tool

Source: Finastra

Other blockchain initiatives instigated by the Chinese government include the Bay Area Trade Finance Blockchain Platform. This platform aims to enhance trade finance accessibility, particularly to SMEs, but it also seeks to enhance the trade relationship between China, Hong Kong and other neighboring economies. Additionally, the Chinese government has announced the launch of China’s domestic digital currency within the next few years.

Adoption of integrated cloud-based platforms by corporates

While cloud-based solutions offer scalability and resilience, historical concerns around security – as well as regulations in certain countries – mean there will not be a one-size-fits-all model. The Finastra study found that consolidation of the cloud with existing systems and regulations/legislation are the two top concerns of cloud adoption for banks and corporates alike.

In Finastra’s study, 75% of corporates did not trust banks to deliver quality cloud-based solutions, which indicates continued concerns around maintaining data and security. As with the future of trade, a hybrid environment of on-premise, private and public cloud solutions will continue to exist for the foreseeable future.

A key consideration when investigating platform and cloud solutions is ensuring connectivity to an ecosystem of buyers and suppliers. Doing so will enable an agile response to changing customer demands. This should be coupled with seamless connectivity with multiple networks and channels, using a central transaction processing engine or source of records. By providing interoperability in this way, this ”network of networks” allows banks, corporates, logistics firms and other ecosystem players to share data and information seamlessly in real time across regions and industries, while retaining a standard operating model.

Any platform that is being reviewed for suitability must support the ability to access, exchange and integrate information across the ecosystem, thereby enhancing the overall supply chain management and financing process. To meet this need, an attractive starting point for both banks and corporates is a single platform with the means of connecting with multiple networks and an ecosystem of solutions.

“A more flexible pricing model and solution deployment can help banks build a business case for transformation and reduce ongoing IT expenditures.”

So why isn’t digitalization the standard, ready-to-go practice for all

A recent study by DBS Bank found that seven in 10 companies in the Asia-Pacific region risk being left behind in digitalization. The business case for implementing digital solutions has previously been challenging for banks, as they had to assess whether adoption would justify the cost of integration, which has often been bespoke and required maintenance and additional investments over the solution lifecycle.

High upfront capital expenditures for transformation can make it difficult for banks to create a business case for a like-for-like solution replacement. As a result, banks may opt to change and extend their incumbent solution with bespoke services and bear the cost of ongoing maintenance for interfaces and partnerships. A more flexible pricing model and solution deployment can help banks build a business case for transformation and reduce ongoing IT expenditures.

“A more flexible pricing model and solution deployment can help banks build a business case for transformation and reduce ongoing IT expenditures.”

Conclusion

“By using a consolidated processing engine and standard operating model regardless of the network or channel being used to transact, banks can maintain a single source of records and serve as the interoperability point in a network of networks.”

The trade paradigm of the future

It’s becoming more clear what banks need in order to offer the full suite of working capital finance solutions required by their corporate clients, seamlessly and consistently: a networked trade and supply chain finance platform that supports a hybrid processing model of digitized and digitalized transactions, delivered either on-cloud or on-premise. This is the paradigm of the future.

Financial service providers need a way to capture the potential revenue from businesses with unmet financing needs, while retaining relevance in the face of non-bank providers. They can achieve this through a platform-enabled solution that connects to the wider trade ecosystem and offers new products and services in a future-proof manner.

An architecture that supports open API integration enables this type of platform to seamlessly connect to third-party solutions. Doing so would enable banks to leverage technologies such as artificial intelligence and robotic process automation and interact with the new wave of digital trade networks built on distributed ledgers.

By using a consolidated processing engine and standard operating model regardless of the network or channel being used to transact, banks can maintain a single source of records and serve as the interoperability point in a network of networks.

References

Brendan Coates and Nghi Luu, “China’s Emergence in Global Commodity Markets,” Economic Roundup, The Treasury, Australian Government, 2012, https://treasury.gov.au/sites/default/files/2019-03/01-China-Commodity-demand.pdf.

“Asia’s Future Is Now,” McKinsey Global Institute, July 2019, https://www.mckinsey.com/featured-insights/asia-pacific/asias-future-is-now.

William Watts, “Here’s How Hard the Tariff Fight Could Hit the Economy,” MarketWatch, May 13, 2019, https://www.marketwatch.com/story/heres-the-hit-us-chinese-and-global-economies-could-face-as-trade-battle-heats-up-2019-05-09.

“Global Trade: Securing Future Growth,” ICC Banking Commission, 2018, https://iccwbo.org/content/uploads/sites/3/2018/05/icc-2018-global-trade-securing-future-growth.pdf.

“Mind the Gap: Building Effective Working Relationships between Corporates and Banks,” Finastra, Nov. 15, 2019, https://www.finastra.com/viewpoints/market-insights/mind-gap-building-effective-working-relationships-between-corporates-banks.

Joon Kim and Arnon Goldstein, “Harnessing Technology to Optimize Asian Trade,” Banking & Finance, Sept. 17, 2019, https://asianbankingandfinance.net/trade-finance/commentary/harnessing-technology-optimise-asian-trade.

“Chinese Banks Launch Forfaiting Trade Finance Blockchain,” Ledger Insights, 2019, https://www.ledgerinsights.com/china-forfaiting-trade-finance-blockchain/.

“China’s Central Bank Blockchain Trade Finance Platform Processes $4.5 Billion,” Ledger Insights, 2019, https://www.ledgerinsights.com/chinas-central-bank-blockchain-trade-finance-2/.

“Networked Trade Platform,” Singapore Customs, https://www.customs.gov.sg/about-us/national-single-window/networked-trade-platform.

“Seven out of 10 Companies in APAC Are at Risk of Being Left Behind Due to Lack of a Digital Strategy and Execution,” CFO, Oct. 4, 2019, https://cfo.economictimes.indiatimes.com/news/7-out-of-10-companies-in-apac-are-at-risk-of-being-left-behind-due-to-lack-of-digital-strategy-and-execution/71581492.

Our trade finance partners

- Supply Chain and Payables Finance Resources

- All Payables Finance Topics

- Podcasts

- Videos

- Conferences