SPV Financing

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

A Special Purpose Vehicle (SPV) or Special Purpose Entity (SPE) is a separate legal entity created by a parent company. This SPV is a distinct company with its own legal status and an asset/liability structure, generally holding off-balance sheet. The SPV can take the form of limited partnerships, trusts, corporations or limited liability companies.

SPV are usually created with the aim of securitising assets and isolating the financial risk from the parent company, by ensuring independence from it. Indeed, since the SPV is an independent entity, if the parent company becomes insolvent, the SPV will not be affected and will keep its obligations.

In brief, the SPV is used as a method of breaking down the risks associated with a pool of assets held by the parent company. SPV can also be referred to as ‘bankruptcy-remote entity’ in that its operations are limited to the acquisition and financing of specific assets in order to isolate financial risk.

Why create Special Purpose Vehicles?

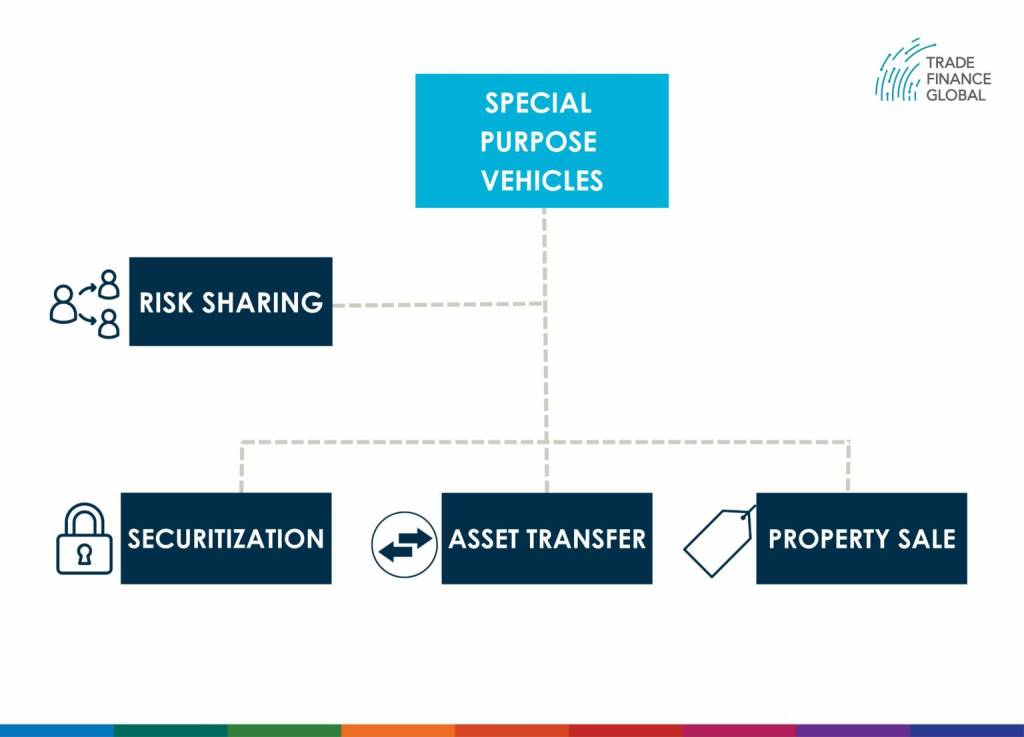

FIG.1: A Special Purpose Vehicles can be established by a parent company for various reasons, such as risk sharing or asset transfer.

Reasons for creating a SPV

Risk sharing:

SPV are mainly used to relocate a part of financial risks from the parent company to its subsidiary (SPV). By that way, the risk is shared between several investors. The goal is to isolate the financial risk in case of bankruptcy or default. Following the principle of ‘bankruptcy remoteness’, the SPV acts as a distinct legal entity from the parent company.

Securitisation:

SPV can also be used for a securitisation of loans or other receivables. The process of securitisation can be defined as a “tranching” of the credit risk associated with exposure or a pool of exposures.

To illustrate, when mortgage securities are issued from a pool of mortgages, a bank may divide the related loans by creating a SPV, which purchases the assets by issuing bonds secured by the related mortgages. However, in light of the implication of SPV in the 2007 financial crisis, several courts have recently ruled that SPV assets should be consolidated with the parent company.

- Regulatory changes: Since the global financial crisis of 2007–2008, regulatory authorities have implemented stricter regulations and oversight on SPVs and securitisation activities. These rules are designed to improve risk management, transparency, and investor safety. The Dodd-Frank Wall Street Reform and Consumer Protection Act of the United States introduced regulations for SPVs and the securitisation markets, including risk retention standards and more stringent disclosure obligations.

Asset transfer:

Some assets are non-transferable or difficult to transfer. In such cases, having an SPV that owns these types of assets enables the company to sell the SPV as a self-contained package when they decide to transfer them. Through this process, the parent company avoids trying to split the asset in order to transfer it.

Financing:

A SPV can also be created to finance a project, for example a venture. By financing a project through the establishment of an SPV, the debt burden of the parent company will not increase. In addition, this allows investors to invest in specific projects without investing in the parent company. This process is commonly used in the financing of large infrastructure projects.

Raising capital:

Finally, SPV can be used as a funding structure to raise additional capital at more favourable borrowing rates. In fact, the credit quality is based on the collateral owned by the SPV and not the parent company. Through this process, companies are able to lower funding costs by isolating assets in a SPV.

How does a SPV work?

For instance, let’s take the example of an SPV created for securitisation purposes. In this case, the parent company establishes an SPV that will acquire specific assets or loans owned by the parent company. Once these assets are purchased, they will be grouped into tranches and sold to meet the credit risk of various investors to raise funds, by issuing debts in the form of bonds or other securities.

Steps to be taken in creation of SPV:

- Ensuring the SPV is a new entity with very limited operating history

- Ensuring the SPV is a distinct legal entity capable of holding assets

- Appointing directors that are independent from the parent company

- Restricting the activities of the SPV to reduce the risk of liabilities created outside those related to securitisation

- Corporate activities of the SPV are kept separate from those of other transaction parties

- The SPV has not given any security for the obligations of another company

Risks and Benefits of creating a SPV

Establishing an SPV can bring important benefits for the parent company. However, this process is not without risks.

Main benefits:

- Isolation of financial risk: by establishing a SPV as an ‘orphan company’ and transferring assets, the assets held by such an SPV are effectively insulated from insolvency in the event of bankruptcy or default by the parent company.

- Single asset ownership: a SPV allows the ownership of one asset by multiple parties.

- Legal protection: by structuring a SPV, the parent company limits the legal liability in case of a failure of the SPV’s project.

- Minimal red tape: setting-up a SPV is relatively easy and cheap, depending on the choice of jurisdiction. Generally, no governmental authorization is required.

- Tax benefits: SPV’s assets can be exempted from certain direct taxes.

Main risks:

- Complexity/lack of transparency: The complexity of SPVs can make monitoring the level of risk involved, and determining who bears it, really difficult.

- Reputational risk: the parent company’s perceived credit quality may be damaged by the underperformance or default of an affiliated SPV.

- Liquidity/funding risk: the poor performance of an affiliated SPV can affect the parent company’s access to capital markets.

- Regulatory risk: regulatory standards that apply to SPV’s assets are not the same as to the parent company’s assets on the balance sheet. This lax regulation can pose an indirect risk to the parent company.

References:

https://www.investopedia.com/terms/s/spv.asp – 25/10/2018

https://www.investopedia.com/ask/answers/063015/what-are-major-laws-acts-regulating-financial-institutions-were-created-response-2008-financial.asp – Accessed 14/06/2023

- International Trade Law Resources

- All International Trade Law Topics

- Podcasts

- Videos

- Conferences