We recently attended a conference on African trade and infrastructure and heard from many financial institutions who have a specific interest in the continent; they all outlined the difficulty and challenges of the landscape. Even when a product or lend looks creditworthy and can be justified; there are usually problems that are encountered at Credit stage. Conversely, there are many investors who have a strong desire to fund into Africa.

It is important to explore this divergence and peel the layer back; to see what is actually happening. In order to do this we can look at Nigeria as an example, due to it being one of the main investment focuses. The challenges and issues can be characterised as follows:

- The stock market has risen as many local people have bought equities due to fear that any holdings in cash would reduce in value due to high inflation rates.

- Deals are usually denominated in dollars or there will be sub limits in the agreement that set out a US Dollar rate. There are dollar shortages owing to dwindling foreign reserves, and this is coupled with an increasing ratio of non-performing dollar loan portfolios due to the currency devaluation (which greatly inflated the original naira value of the dollar loans and is threatening their capital adequacy ratios), most banks are turning away dollar deals right now. This means that there is internal pressure that filters down to credit departments on deciding whether to write deals.

- Militant groups are on the rise and have been disrupting oil supply.

- Oil prices have been cut.

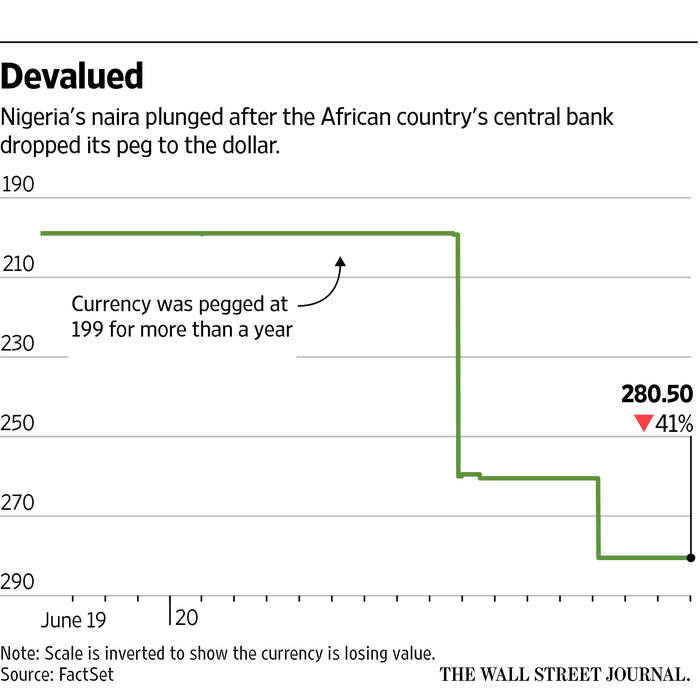

- The currency peg (referred to above) has been removed.

CAPTION: Brent crude oil prices in 2016. Source: MoneyFacts AM

We will delve more into the currency peg and volatility in oil prices. In economics-speak, a currency peg is when a country’s central bank artificially controls the value of its currency.

What is the reason for the naira fluctuation?

The naira was previously a pegged currency and this has been removed. In the last 6 months, at times the naira has fallen over 40 percent against the US dollar. The pegged or fixed currency was brought in only a few years ago, with an aim at stabilization. However, this has meant that almost a quarter of foreign reserves have been used to defend the peg. This impact on foreign reserves was continually shown as reserves fell to below $27 billion in May. This ‘unpegging’ was mainly due to expenditure to maintain the fixed rate and oil prices falling by over three quarters in value and steadying at around half of where they were only a few years ago. This has meant that revenues were reduced from the lower base price.

Nigeria has faced problems from all sides; interest rates are being maintained in the over 10% range to stem inflation; with thoughts that they will continually rise. Radical groups are disrupting oil supply, inflation has risen to over 15% in the last year and this is all on top of the economic reality; that Nigeria receive over 90% of export income from oil and the value of income is dropping by over 15% in some quarters.

Since the unpegging there have been suspensions by the central bank of dollar trading, as there has been a high volume of dollar orders but little supply. This has increased following the move from the central bank to sell over $4 billion to clear a backlog of demand for hard currency.

We see a situation where no one, including financial institutions, wants to sell dollars in case a loss is made due to the exchange rate falling in the short period after a sale.

The volatility in the market is thus susceptible to rumors relating to rate fixing, little foreign exchange being done and a wide differential between the headline exchange rate and black market value. This has been seen in some cases to be over 50%. Thus, there has been much fraud and unfair profiteering by those being untruthful about the use of currency and seeking official rate dollars; only to be sold on the black market.

CAPTION: The price of Naira vs. US dollar following the central bank ending its currency peg to the U.S. dollar.

Where does the problem lie?

The main issue is with foreign reserves and what a defense of the naira looks like when there is not the foreign reserves to defend the currency with; in times of difficulty. This is compounded with the lack of dollars due to the militants disrupting oil supply in the Niger Delta and low prices.

How does the Central Bank of Nigeria stem the issues?

They attempted this following the floatation of the rate in June, with assistance of where markets could not meet demand. They used both spot rates and forward contracts. However, their interference has been limited; partly due to not having the resources.

There have also been auctions by the large oil players, who will sell dollars and Nigerian banks will bid so that they can convert naira to dollars. This was making up over half the dollar supply. However, this has also stopped as they have been implored to sell dollars to those who import petrol. Those directing this are the Central Bank and ministry of petroleum; this hurts those traders that are outside of the petrol markets as they have further restricted access to currency.

Interestingly, those dollars left after sales to petrol marketers have been exhausted will not go on the interbank market. They will be sold to the Central Bank.

Other transfers of dollars from those outside Nigeria are being channeled by banks through the Bureau de Change operators. This is again at the direction of the Central Bank.

Investors have previously outlined that there was uncertainty due to an artificially supported currency and capital controls dictated by leadership aimed at keeping the peg; but the ‘de-pegging’ has been a major horror story.

Many foreign companies with operations in Nigeria are finding it difficult to exchange their naira earnt revenue.

Some financial institutions may benefit in the depreciation of the Naira; as their net dollar positions could improve depending on the make up of their capital and facilities. However, many of their clients will be starved from growth due to not being able to access US Dollars to import goods. Many have to buy on the black market and raise their sales costs to cover this higher margin; which is far away from the spot rate.

What problems does this bring?

Many businesses now have to source their foreign currency demand from the informal market. Thus, in the event that the bank does a deal, it will have to find the dollars to settle the transaction. Our contact recently told us that ‘at this point, that’s like passing the head of a camel through the eye of a needle’. This means that there are transactions that have been waiting in line for months, as the bank need to source the dollars to honour trade settlement obligations.

CAPTION: A market in Lagos following the 40% plunge in Nigerian naira after removing its peg from the US dollar.

What is the net effect on the Nigerian Naira?

Fundamentally, what this means is that those carrying out business in Lagos have to source dollars from the parallel market (which is much more difficult) and they make their sales and expense projections based on the more expensive rates.

In the event that oil is sold, which is a major export, the product is priced in line with the market realities and the higher cost of purchasing dollars is factored into this equation. Nigeria imports over 80% of refined petroleum products (being 36M litres per day); showing the importance of international trade. The de-pegging of currency is causing much unneeded volatility in an already fragile economic environment.

How does trade finance in Africa look?