Blockchain and Trade Finance

At the start of 2016 Trade Finance Global were cautiously optimistic for the blockchain being used as an application for trade and supply chain finance. But low and behold, using the blockchain to successfully execute a simple Letter of Credit transaction was done this year, and we don’t see this momentum slowing down.

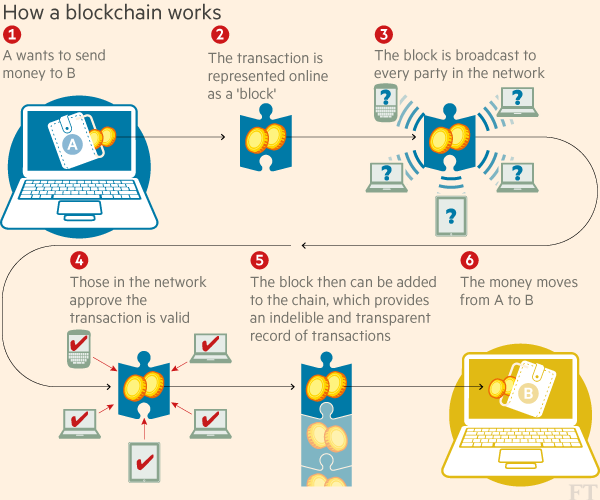

The blockchain is a distributed data structure which allows the creation of a digital ledger of transactions which is shared across a peer-to-peer network. Seemingly similar to the disparate elements of a trade finance transaction, the blockchain has the power to synchronise records of several parties across the supply chain, allowing the exchange of data values without the need for a central authority.

September 2016 marked the world’s first global trade finance transaction using blockchain technology. WAVE, an Israeli startup graduating from the Barclays TechStars accelerator programme, facilitated a Letter of Credit transaction between a dairy supplier and a buyer, sending payment via Swift, which was validated and approved on Wave’s blockchain platform.

Although trade finance is ripe for innovative disruption, we must not forget about eBills of Lading and Bank Payment Obligations which were launched several years ago to ‘make trade finance paperless’. Fast forwarding to today, paper-heavy Letters of Credit and Open Accounts still dominate most the world’s global trade.

Digitalisation and utilisation of new technologies such as the Internet of Things (IoT) and Blockchain will open doors for efficiency and a reduction in the cost of trading goods. However, the complexity of trade finance across multiple jurisdictions, and the shipping / freight processes still remain, coupled with the need for security and transparency. We still remain cautiously optimistic for blockchain transforming trade finance.

A step change in compliance, KYC, and anti-money laundering

According to the International Chamber of Commerce (ICC), 2016 was the fifth consecutive year of global trade falling below 3 percent (not yet recovering from pre-financial crisis levels in 2008); 61 percent of respondents citing a global shortage of trade finance.

The cost or complexity of compliance requirements relating to anti-money laundering (AML), know your customer (KYC) and sanctions were reported as a major barrier for trade finance provision, shortly followed by a general withdrawal from banks of finance trade in many emerging-markets as a result of Basel III regulation.

The reality however is far from this. The default rate for Letters of Credit in the past 7 years has been reported as 0.01 percent, and trade finance is generally seen as low risk.

When we spoke to Ben Singh-Jarrold, Corporate Banking Strategist at Misys, he said: “We are rapidly approaching a point where KYC and sanctions screening must be further enhanced and complemented by techniques that support the sustainability agenda.”

“In the future, banks will increasingly be required to perform due diligence to confirm the provenance of goods, conforming to accepted standards of ethical sourcing. KYC will extend to KYG (Know Your Goods), supported by supply chain mapping and traceability solutions linked to key social and environmental issues.”

Risks in trade finance

Taken from David Gustin at Trade Financing Matters, who interviewed Michael Clain, a lawyer at Windels Marx Lane & Mittendorf about the most common risks that should be managed in receivables finance:

- Supplier fraud risk – the risk that the PO or invoice presented to the lender for financing may be fake or duplicative or may have been altered;

- Receivable title risk – the risk that the supplier may have already assigned or pledged the receivable to another financial institution;

- Receivable transfer risk – the risk that applicable law may not allow the lender to take good and marketable title to the receivable, free and clear of third-party claims, or that it may require the lender to take actions it was not aware it was required to take;

- Dispute risk – the risk that the buyer may claim that the goods or services provided by the supplier did not satisfy the requirements of the PO; this is a broad term that covers a number of different risks and possible claims against third parties, but our analysis doesn’t necessitate that level of granularity;

- Discount risk – the risk that the buyer won’t pay the full amount of the invoice for reasons other than the supplier’s performance in connection with the transaction at hand – the buyer may, for instance, take discounts for supplier nonperformance of prior transactions, may take discounts in the ordinary course of its business (some large retailers for instance are known to return to their suppliers goods that don’t sell) or may hold back a portion of the payment as retainage (standard in the construction industry, for instance);

- Payment delay risk – the risk that the buyer won’t pay in a timely fashion;

- Payment direction risk – the risk that the buyer will make the payment to the supplier or some other party instead of the lender; and

- Buyer credit risk – the risk that the buyer won’t pay due to financial inability.

2017 – Year of Exports?

Following a tumultuous year of foreign exchange movements following the UK’s vote to leave the European Union and Donald Trump’s presidency, both markets want to drive exports with ‘Made in the US’ and ‘Exporting is GREAT’ campaigns in the US and UK respectively.

Official statistics on export figures following the EU referendum revealed that a crash in the pound sterling seemed to help drive British exports; and the UK’s deficit on trade in goods and services had narrowed by £1.1bn in July 2016.

For GBP and GBP pegged markets, given the weak sterling, it makes sense for UK based businesses to consider exporting to other markets so that they can grow and compete on a global marketplace. Given affordability for overseas buyers is greater, it is likely that the UK government will invest into encouraging and assisting businesses to export as a tool to drive economic growth.

GBP:USD Exchange Rate in 2016

SOURCE: Bloomberg

GBP: EUR Exchange Rate in 2016

SOURCE: Bloomberg

At Trade Finance Global, it is likely that we might see a slight bounce back in exports, given the political appetite to boost trade overseas. Given the long term uncertainty around trade relationships and the short term drive to boost exports, it’s likely that governments will support and facilitate trade in 2017 as a stimulus to drive economic growth.

Securitised trade finance

Trade finance has struggled to attract serious institutional investment over the years, despite being one of the biggest (by volume), and historic forms of finance. The securitisation of trade finance however has always been a challenge due to a lack of appetite and limited understand compared to other areas.

Only at the start of this year, did we see Deutsche Bank close the largest ever Collateralised Debt Obligation (CDO) representing securitised trade finance worth $3.5bn US (TRAFIN 2015-1).

At Trade Finance Global, we believe that the market for the securitisation of trade finance and receivables finance is potentially opening, as margins have tightened on mainstream asset classes, banks want to reduce leverage and exposure, and export finance is growing as a market. Adrian Katz’ interview on Trade and Export Finance explains this in more detail, highlighting the potentials of receivables securitisation, from a funder, client and investor perspective.

Oil Prices Continue to Rebound

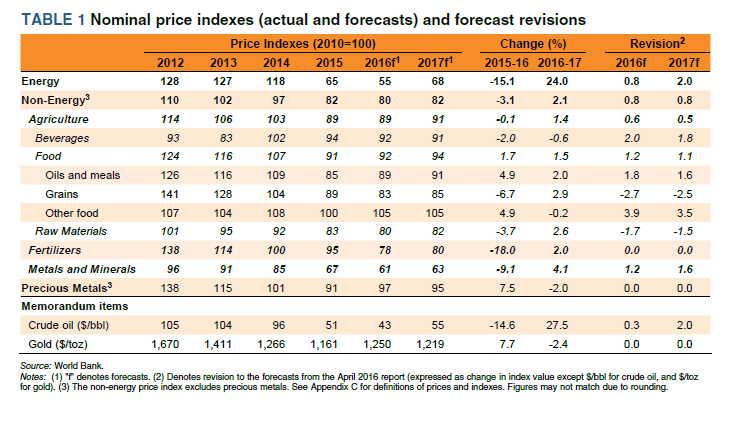

2016 marked a tough year for oil prices. As predicted however, the oil prices did rebound towards the back end of 2016, driven by an OPEC landmark agreement to cut oil production by roughly 1.2m barrels / day at the end of November.

The relatively low oil prices in 2016 have enabled production costs for goods and transport to remain low, a positive sign for growing businesses.

CAPTION: Crude Oil Prices (USD/bbl.) in 2016. Source: MoneyAM

The World Bank has forecasted a rise in commodities values in 2017, with oil prices forecast to rise to $55 per barrel next year from $43 per barrel in 2016 as markets readjust after an era of abundant supply that outpaced demand.

Energy prices, which also include coal and natural gas, are forecast to jump 24 percent in the coming year. The decision in September of the Organization of the Petroleum Exporting Countries (OPEC) to resume limiting oil production is another important factor behind the higher prices forecast.

CAPTION: Nominal price indexes (actual and forecasts) from 2012 – 2016 and 2016f – 2017 across energy and non-energy commodities. SOURCE: World Bank

Concluding Remarks

It would be remiss of us to say that 2016 didn’t go without challenges and unexpected outcomes. However, we believe that 2017 will see strong momentum in trade and supply chain finance. The increase in the digitalisation of trade finance (be that through blockchain or electronic processes), as well as the step change of approach around AML, KYC and anti-terrorism will certainly flow into 2017.

The global economic volatility and uncertainty in relation to trade flows has been evident and widely publicized. We believe 2017 will bring an increase in trade partly due to capitalisation off currency volatility and government action to boost trade (providing fiscal stimulus in the US and UK).

We believe that the trade finance industry will continue to step up and raise the bar with further structures used to cater to the complexities of financing requirements, as well as increased innovation in the space.