- An MGA, or Managing General Agent, is a specialised insurance agent/broker.

- MGAs act as intermediaries on behalf of insurance carriers.

- They provide a value-added service with specific and unique benefits.

From political instability to buyer insolvency, exporters and importers face a wide range of potential challenges that could jeopardise their operations.

The role of the insurance industry is to protect businesses from financial losses while they evolve to meet growing trade demands. This reassurance enables businesses to trade with confidence, venturing into unknown and sometimes volatile markets without the looming fear of non-payment.

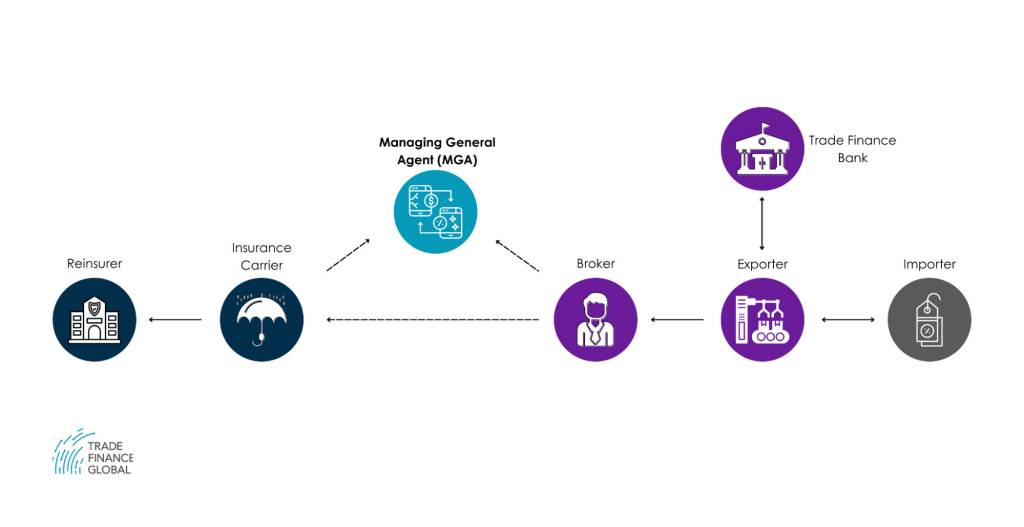

In an international trade transaction, a variety of players, including brokers, carriers, and reinsurers, work together to provide comprehensive coverage for businesses.

Among these, Managing General Agents (MGAs) have emerged as an important component in the ecosystem, offering specialised expertise and flexibility. This new model of insurance providers helps to bridge the gap between insurers and the businesses they protect.

For those unfamiliar with the complexities and functions of the insurance space, it can help to consider an example to better visualise how every party fits into the process, to better understand the role that MGAs play.

Understanding the insurance players in an international trade transaction

Suppose a manufacturer in the UK sells machinery to a buyer in Brazil. To safeguard against the risk that the Brazilian buyer might default on payment due to economic difficulties, the exporter will want to purchase trade credit insurance. The UK manufacturer (known as ‘the insured’ in insurance industry parlance) will approach a broker to help.

The broker acts as an intermediary between the insured and the insurance market. Its role in this transaction is to understand the UK manufacturer’s needs and find the most suitable insurance products from an insurance carrier or an MGA.

The carrier, or insurance company, is the entity that ultimately provides the risk coverage. It underwrites (accepts liability for) the risk and issues the insurance policy, assuming the responsibility to pay claims if a covered event (e.g., buyer insolvency or political risk) occurs.

In some cases, the carrier may rely on an MGA. An MGA is a specialised intermediary that acts on behalf of one or more insurance carriers and has the authority to underwrite policies, assess risks, and handle claims. It will typically have in-depth knowledge of particular markets or risks and can offer bespoke solutions that cater to the unique needs of international trade transactions.

Continuing the example above, our manufacturer’s broker has found an MGA with expertise in trade credit insurance that has been authorised by Allianz (the carrier) to underwrite and manage policies for exporters dealing with emerging markets. The MGA assesses the risk of the Brazilian buyer and tailors a policy that suits the UK machinery exporter’s specific needs.

At this point, we are already 3 steps removed from our original UK-based machinery manufacturer (Insured → Broker → MGA → Carrier), but we may not be done with the risk mitigation.

In international trade, the carrier may seek to mitigate its own risk exposure to non-payment claims by purchasing reinsurance from a reinsurer. In this case, Allianz may reinsure part of the trade credit risk it underwrote for the UK manufacturer through a global reinsurance company like Swiss Re.

Of course, this example doesn’t cover all of the stakeholders involved in this transaction. The UK manufacturer would likely be working with a trade finance bank to help with financing, and an export credit agency (UKEF in the UK) may also provide additional coverage.

This example serves as an illustration to dive in and take a deeper look at the role MGAs can play in international trade.

Benefits of the MGA model for trade finance

As an extra intermediary, MGAs add extra costs to a transaction. Yet they provide a significant value-added service to businesses engaged in cross-border transactions that can make added costs worth it. Or, to approach it differently, MGAs can potentially save a business from losses which would far exceed their cost.

For one, MGAs are more likely to have deep market knowledge in regions that insurers might not, giving them the agility to assess risks in more volatile, politically unstable, or underbanked markets.

Given their smaller size, MGAs may also be better suited to design policies that address payment risks tied to relatively niche yet complex trade finance instruments, like letters of credit. Such flexibility is essential for international trade, where businesses face different regulatory environments, payment terms, and credit profiles across jurisdictions.

Perhaps the most important benefit is their speed. Given the fast-paced nature of international trade, businesses often need immediate coverage or quick decision-making when it comes to extending credit to overseas buyers. MGAs, with their delegated authority, can respond more quickly than a traditional insurer which would require more extensive internal processes. This quick turnaround can be the difference between closing a trade deal and losing it.

And when claims do arise, MGAs can facilitate a smoother claims process by being closer to the insured business, understanding its operations, and having insight into the circumstances of the loss.

–

Robust, adaptable insurance solutions are imperative to allowing global trade to expand into new and often unpredictable territories.

This is where MGAs can shine. Their ability to bring flexibility, speed, and market insight positions them well to bridge the gap between insurers and businesses.

When every deal counts, the right MGA can make all the difference, ensuring that businesses can manage risks and seize opportunities with confidence.