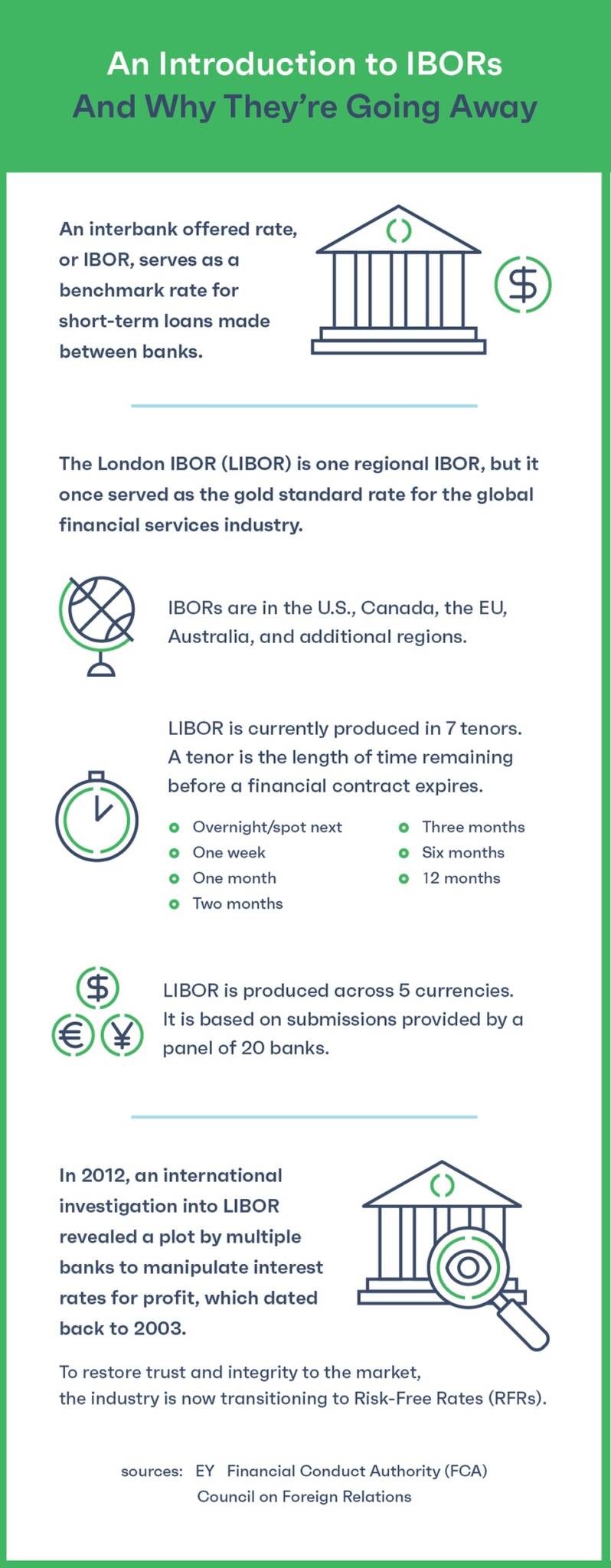

The UK Financial Conduct Authority (FCA) plans to transition from the London Interbank Offered Rates (LIBOR) to Risk-Free Rates (RFRs) by the end of 2021, to restore trust and integrity in the market.

This shift comes after several banks manipulated their interest rates for profit, disturbing trust in the global economy.

To protect future transactions from manipulation, banks will transition to these alternative reference rates based on overnight RFRs anchored in sufficiently liquid money markets.

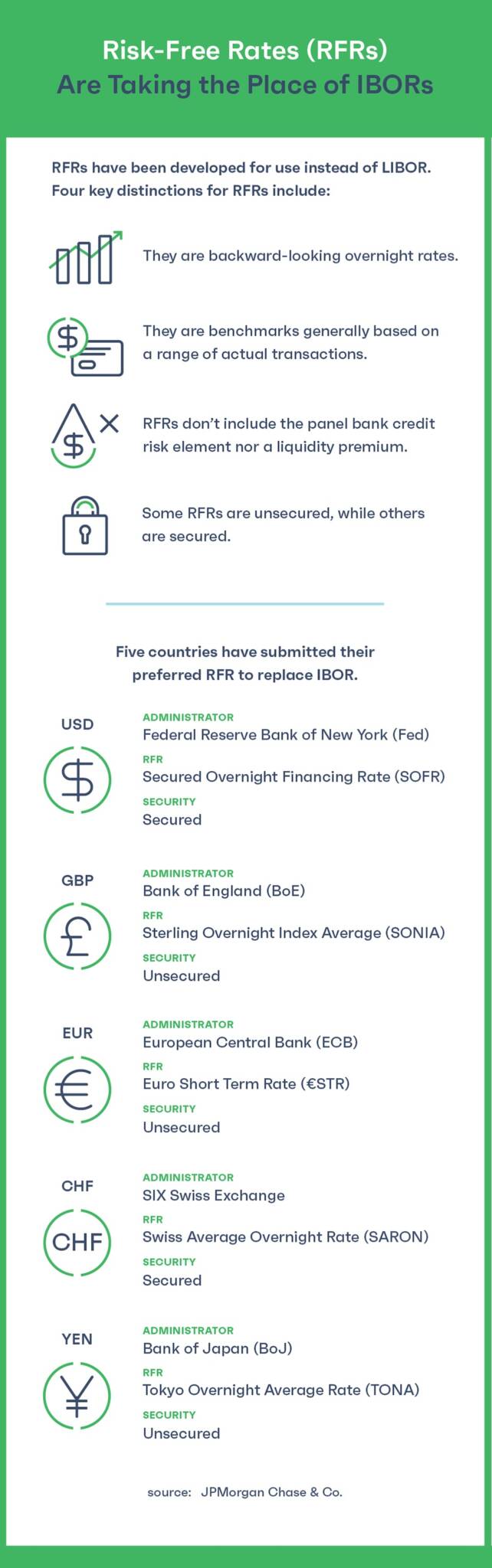

RFRs offer a more accurate picture of the economy than LIBOR. The LIBOR benchmarks are forward-looking term rates based on banks’ estimating the future borrowing of funds.

RFRs take current data of actual transactions, giving a real snapshot of the current economy. A group of large, globally active banks submits their rates on a daily basis.

Then they are published and serve as the foundation for the trade of several currencies and loans. LIBOR contains a higher implied credit risk aligned with the length of the interest period.

However, RFRs don’t have a credit risk because they’re short-term overnight rates.

By March 2021, five countries had submitted their preferred RFR to replace IBOR, including CDOR in Canada, BBSW in Australia, and EURIBOR in the EU.

The United States’ RFR, Secured Overnight Financing Rate (SOFR), is secured, while other RFRs are not.

The switch to RFRs is bound to be chaotic. More than $400 trillion of wholesale and consumer global contracts defined their reference rate by LIBOR submissions, according to one estimate.

LIBOR allowed central management of multiple currencies. Each country’s RFRs contain different characteristics, which could be confusing.

Multiple rates will co-exist depending on the government, industry, or market. However, specific institutions can provide guidance, and RFRs are well suited for many niche market needs.

The IBOR transition may impact many complex considerations, including maturity dates, a firm’s role in the contract, benchmark uses, and jurisdictional concerns.

Although it will take some time for banking institutions to switch from IBORs to RFRs, global markets and institutions are already feeling the impact as they work to review, amend, and research impending changes.

The transition is certain to cause a ripple within the global economy. To anticipate this market shift, financial institutions, investors, and legal counsel, especially those dealing with international transactions, need to tackle a giant challenge.

They need to assess their documents and contracts to determine how the IBOR transition will impact them.

Large commercial organisations have no choice but to identify and review a high volume of documents related to the IBOR transition.

Investment funds and commercial entities that deal with large debt transactions must determine which contracts need to be repaired, and contact clients to notify and request amendments.

The parties involved must understand the impact of alternative RFRs, mitigate conflicts, and share transition costs.

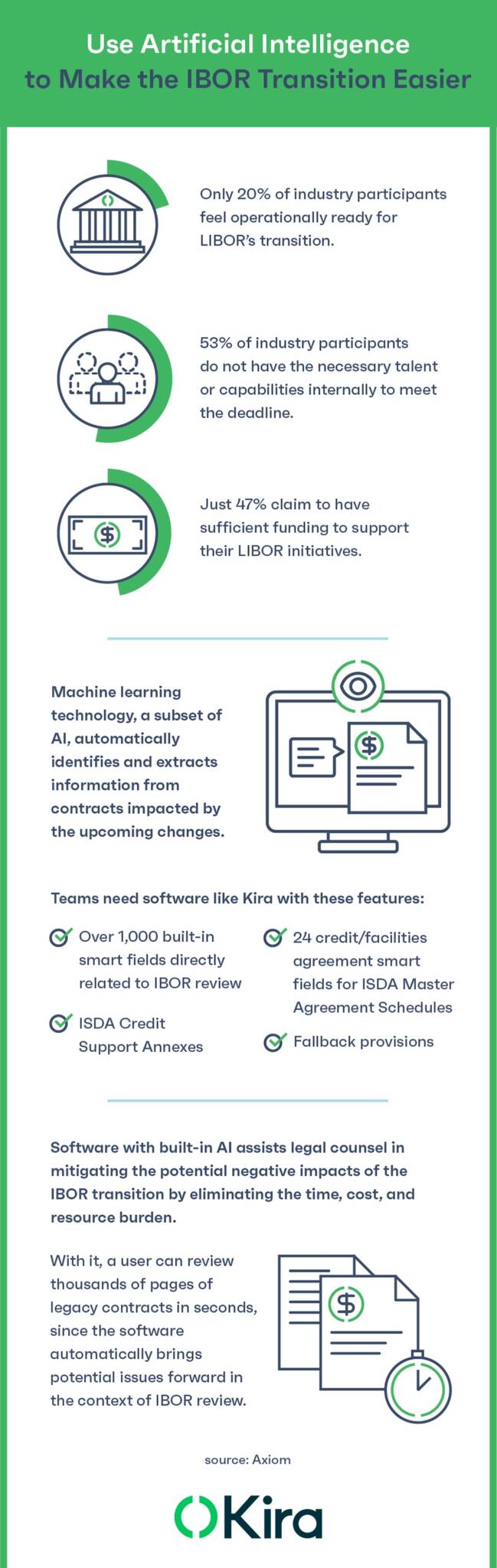

Fortunately, AI software can help companies and law firms with this considerable challenge. Legal tech provides powerful and invaluable digital tools.

Check out these graphics to better understand the IBOR transition and discover how artificial intelligence can make it easier.

This article was originally published here by Kira Systems.