To date, attempts to digitize trade and trade finance and to connect trading parties have been relatively unsuccessful. Internal processes have become increasingly digital but transactions involving multiple parties are still costly, complex, and largely paper based. This lack of success to date has been due primarily to the limitations of legacy technology systems, platforms, and networks that supported such digitization efforts.

We identified three key requirements that trade networks and platforms must meet simultaneously in order to achieve the levels of global scale and adoption required to address the structural deficiencies in the way we conduct and finance trade. Those key requirements are:

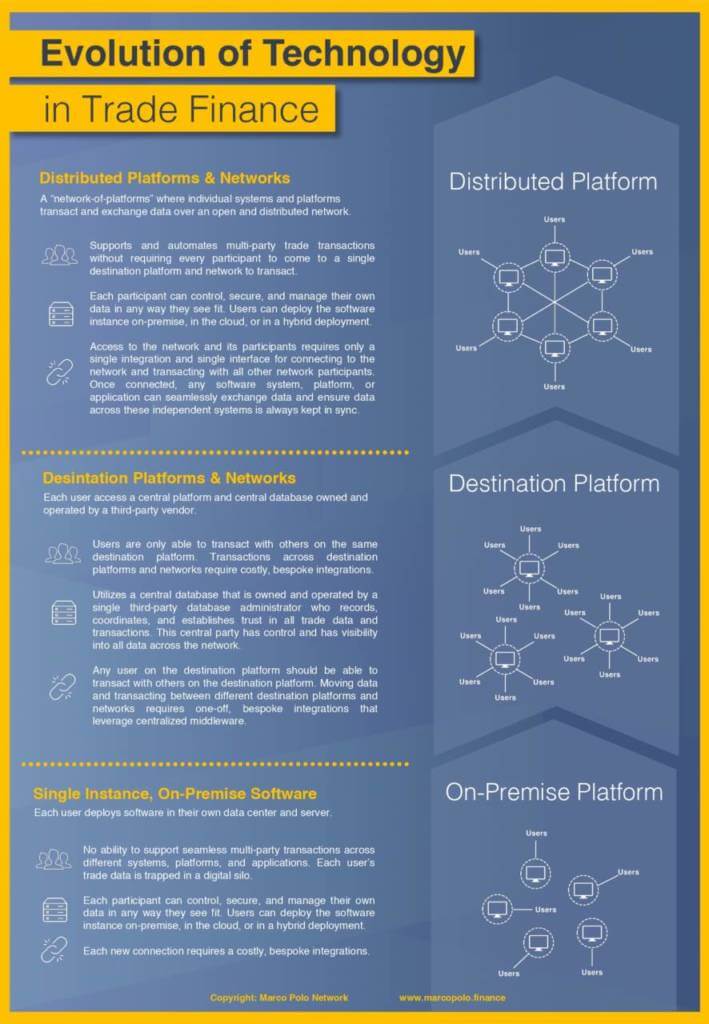

- Ability to support seamless transactions across different systems, platforms, and applications

- Ability for users to manage and control their own data and to support a wide variety of deployments

- Ability to connect-once-to-connect-to-many

While legacy platforms and networks can typically meet one or maybe even two of these requirements, none are able to meet all three requirements simultaneously. This places hard limits on their levels of global scale and adoption, and thus their ability to digitize trade and give rise to a truly connected ecosystem of trading parties.

The potential benefits of distributed platforms and networks cannot go understated. By meeting the three key requirements for global scale and adoption of trade systems simultaneously, these new types of platforms and networks have the potential to rewire and transform the way we conduct cross-border commerce and finance trade.

Just as TCP/IP, HTML, and HTTP provide shared and open standards and protocols that enabled the Internet to become what it is, so too can blockchain and related technologies create a flatter, smarter, more connected, and overall better world for global trade and commerce.