Looking at the bigger picture of international trade flows and supply chains is crucial when looking at helping businesses access finance. We heard from Tony Brown at the Annual WOA Convention, discussing the world of open account pre-invoice, including purchase orders, transportation, distribution and pre-shipment finance.

Featuring: Tony Brown, The Trade Advisory

Host: Deepesh Patel, Editor, Trade Finance Global

So Tony, thank you very much for joining us on Trade Finance Talks TV. Please tell me who are you? What do you do and where are you from?

Well, I started life at a very early age. No, but seriously, I’m a trade financier. I’m the principal of my own consulting business, which is the Trade Advisory. And we provide finance advice, product development, market development strategy to corporate financial institutions, FinTech and others who are looking to add value in service development for trade finance.

Okay, great. And I guess a lot of the talks and your panel session earlier today were around Supply Chain Finance. What is the definition of Supply Chain Finance?

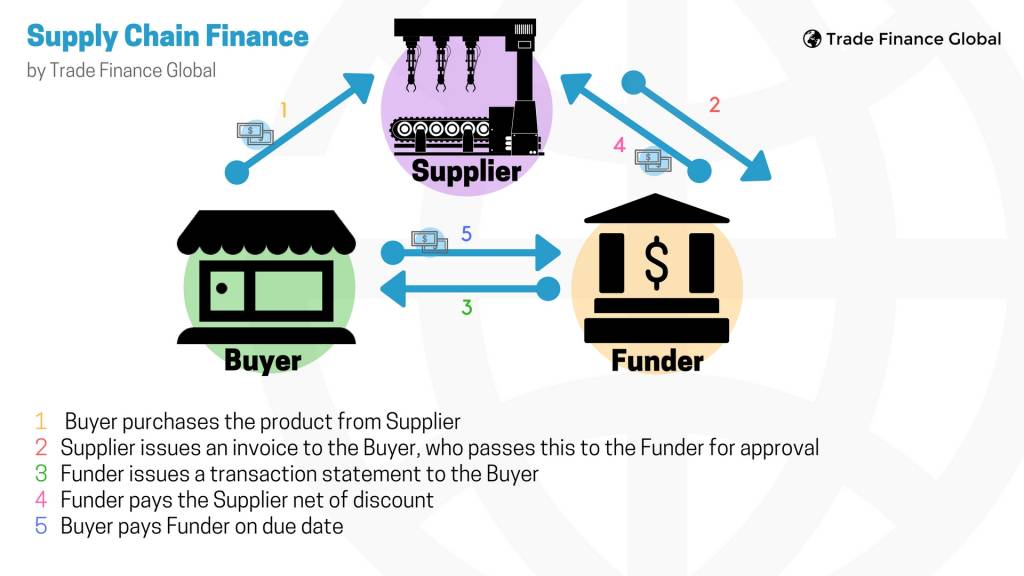

Well, actually, the European Banking Institute has created a very good document which tries to define all of it. But essentially it’s a misnomer. Unfortunately, many people regard Supply Chain Finance as just reverse factoring or approved invoice early funding or payables finance. That’s a far too narrow perspective. And so Supply Chain Finance is really the application of the appropriate financing to successive stages of extended supply chains. And it can be involved in production finance, in transit, inventory finance, warehouse finance, receivables finance and collection and involve the risk as well. So it’s actually looking at all of those aspects through successive links in extended supply chains.

Okay. So why do corporates use Supply Chain Finance and one of the key advantages?

Well the whole point, the whole game is called the Cash Conversion Cycle. And the test of the game is how little cash you use in your supply chain. And there are different ways to minimise the use of cash, you can push out your payables, you can extend out your receivables and then finance them and or you can delay ownership of inventory. So there are three component takers of capital in the Cash Conversion Cycle. So, receivables, payables, and inventory. Of those three, it’s quite interesting, the ownership of inventory consumes more working capital than either receivables or payables. So, right now, the markets focused on receivables and payables finance, but I think to answer your question, many corporates are going to be asking lenders: what can you do for me against the purchase order, not the invoice, and to help me make the goods that I have orders for, move the goods that I’ve sold, and then collect.

Great. And I guess in relation to that, what opportunities are created by the convergence of physical and financial supply chains?

Too numerous dimension, I mean that it’s a world of opportunity, which is why I’ve suggested WOT (W-O-T) as being the title for my particular group, and it’s too myopic, just to look at one stage. And so what’s going on now, thanks to the digitization of trade, and documents and processes is that what was previously blind, is now visible and transparent, so that people can see at every stage what’s happening. But not only the buyers and the sellers that can see what’s happening, that the service providers in trade finance and trade can as well. So all of a sudden now you’ve got revolutions going on in logistics, who are the people of course, who move the goods that are the lenders’ collateral. And if those logisticians can provide more data about the physical movement of goods, it can allay some of the fears that the lenders have about financing inventory.

Has it been sold? Has it been made? Where is it in the process? Who controls it? Can have logistician help control the collateral that the lender is lending against?

So that information, that data, is now becoming ubiquitous, transparent, analyse the ball and the basis for better credit risk metrics. Equally, the platforms are making a big difference. So procure to pay is now an electronic event. There are freight folders who are digital straightforward, as like Flexport, for example. There are programmes like Tradeshift, which are bringing in, creating apps rather like an iPhone. They create the sort of iOS of trade. And then various service providers provide their apps. And then finally, there’s companies like Infor Nexus, who are providing visibility along the procure to pay chain so that everyone can offer their service to the buyer and supplier at successive stages. It’s a very exciting time. And you’ll notice I haven’t even mentioned the B word, blockchain.

You’ve mentioned it now. Tony, thank you very much for joining us on Trade Finance Talks TV.

Thank you very much indeed.

Want to find out more about digital trends in the alternative and receivables finance? TFG has partnered up with BCR at both their Alternative & Receivables Finance Forum and Masterclass in November.