Our Editor, Deepesh Patel, sat down with Meera Saunders, Underwriter within the Trade Finance team at AIG to discuss the complexities of AIG’s new instrument: a trade credit bridge.

What is a Trade Credit Bridge?

A Trade Credit Bridge (TCB) is an innovative solution to a problem that AIG is seeing more frequently. Corporates are increasingly looking to use their policies to leverage financing and banks are under more capital pressure. The Trade Credit Bridge provides an effective solution for both corporates and banks.

The traditional way corporates and banks obtain credit insurance policies

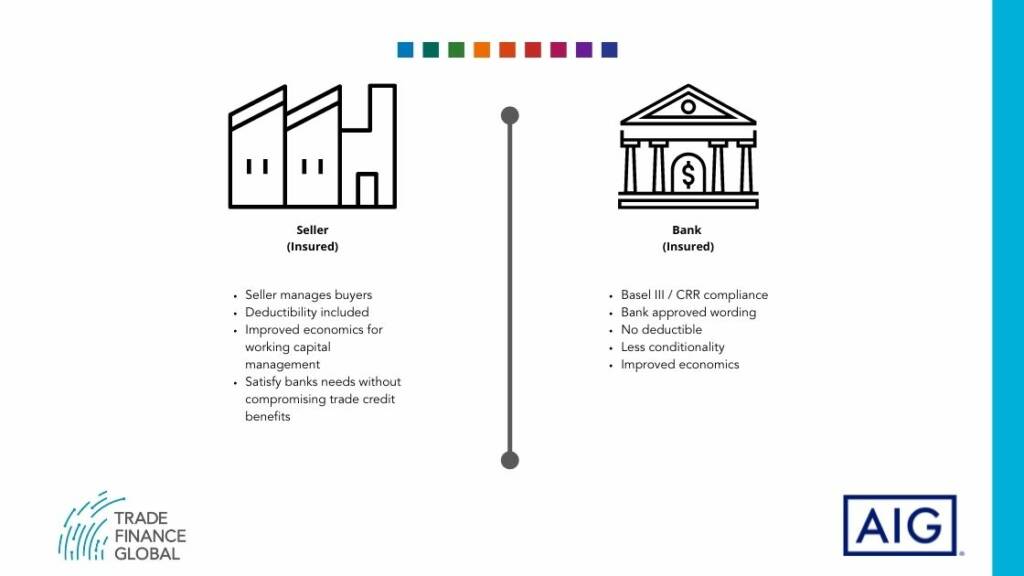

Corporates purchase Trade Credit (TC) policies often for risk transfer purposes as well as to utilise these policies for financing. Traditionally banks would have obtained a TC by including the Bank as a Loss Payee but AIG have found this may not be the most optimal for the bank.

Trade Credit policies are often quite conditional as the expectation is the Corporate will be managing their risks in a prudent manner while, simultaneously, allowing the Corporates to maintain control of their business and policies. However, a traditional Trade Credit policy often doesn’t work for a Bank as the conditionality means the bank may not be able to get Capital Relief.

Can banks using TCI get capital relief under current Basel regulation?

AIG’s Trade Finance team specifically works on Credit Insurance policies with a Financier as an Insured thus ensuring the banks’ needs are taken into account. In AIG’s experience, banks are often able to use their Trade Finance (TF) policies for Capital Relief as they are written specifically for a Bank rather than traditional Trade Credit policies that have a Corporate Insured.

Breakdown of a Trade Credit Bridge (TCB) – what it is and how it can help with capital relief

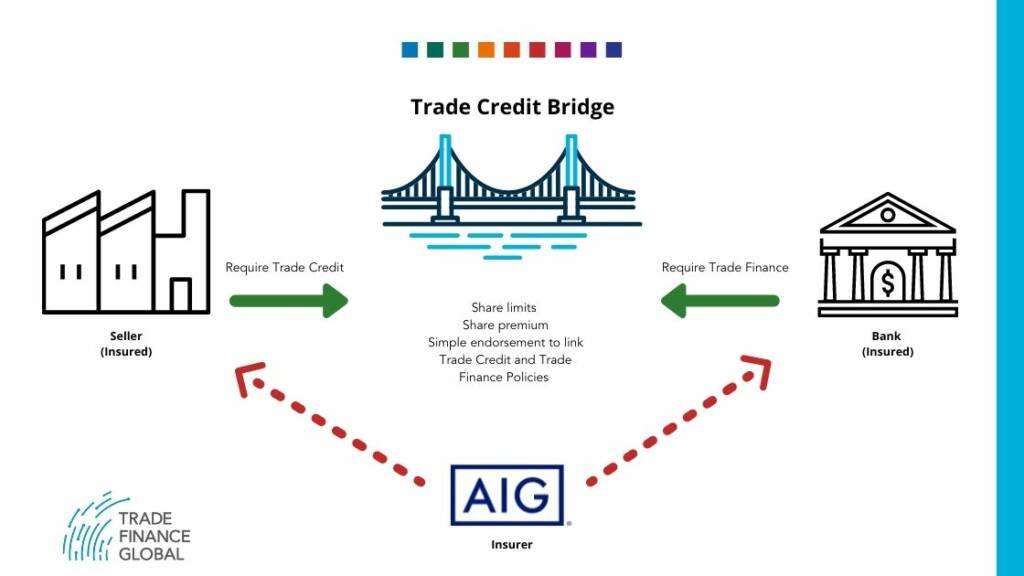

The Trade Credit Bridge allows both the corporate and the bank to have their own policies but an endorsement, bridges both of the policies together to share a limit. This works in the corporate’s favour as they maintain control of their policy, including those buyers that are not included in the financing.

The bank will be able to use their approved Trade Finance policy wording and conditions that would apply to the corporate’s TC policy. The Bank can have a policy with limited conditionality in order to get their required capital relief.

Are the limits and costs of premium shared, and do banks have more control?

The corporate can choose which of their buyers they want to be financed and those limits will be shared with the bank through an endorsement that applies only to the Corporate’s policy. The risk only assigns to the party that owns the receivable – if the receivable is sold to the bank, it attaches to the Trade Finance policy and the bank’s policy would be triggered in the event of a loss but if the receivable was retained by the corporate, the TC policy would respond.

There can be synergies between a bank achieving capital relief and the impact on a corporate’s all-in cost of financing. Premiums can be structured in various ways depending on the needs of the corporate and bank.

What are the benefits of a TCB for AIG?

From AIG’s perspective, as the limits are shared, the insurance company could have more capacity available for larger limits or further opportunities. Additionally, if the names are in high demand in the market it could be a struggle to get further capacity so again the shared limit option is a great alternative.

The simplified version of a Trade Credit Bridge

The idea for the Trade Credit Bridge product came about when a bank approached AIG trying to heavily change a Trade Credit policy to make it work for them. As a result, AIG offered the bank this solution that allowed them to use their approved Trade Finance policy wordings, without having to make changes to the Corporate’s Trade Credit working.

The corporate would choose which of their buyers they wish to use for financing, i.e. they are going to sell receivables owed by those buyers to the bank. The corporate would retain its AIG issued Trade Credit policy, the bank would have its own Trade Finance policy (which can be on its own approved wordings) and the policy limits of liability will likely be different to the TC policy. The TC Bridge endorsement would then attach to the Trade Credit policy and only be signed by the Corporate, effectively, bridging the two policies together to share the limits.

In a TCB, AIG would be the underwriter for both the Trade Credit policy, i.e. the Corporate Insured and the Trade Finance policy, i.e. the Bank Insured. This is crucial for the creation of synergies, otherwise, AIG would just be providing a standard Trade Finance policy with no bridge.

Why use a Trade Credit Bridge?

Using a TCB can prove to be a cost-effective solution as it presents opportunities for cost reduction for the parties involved, depending on the structure selected.

The main advantages are that both parties – the corporate and the bank – get their needs met from their respective policies and the bridge means they do not need to seek out separate capacity on the buyer risks as the limits are shared.

The flexibility with the shared limits is another advantage. The receivable attaches to the policy of whichever party owns it at the time, so the corporate can choose to retain it or sell it to the bank, in which case it would attach to the bank’s TF policy.

Banks often have approved wordings in their policies and any changes or new wordings require extensive approvals. Therefore, rather than being a loss payee on a policy and going through the entire process, banks can use their approved wordings through this TC Bridge solution.

Do other underwriters provide a TCB?

AIG has Trade Credit Bridge policies that are syndicated, therefore, include other Insurers in the product providing both the TC, TF policy and therefore the bridge. However, at the moment AIG is leading the execution of the TC Bridge product.

Case study

AIG had a long-standing Trade Credit client who sought bank financing but wanted to maintain policy and buyer limit control. They sought to assign their bank as a loss payee under their TC policy, but the client was surprised to learn their bank required a CRR compliant policy for capital relief purposes.

To further complicate matters, many buyer limits under the client TC policy were in limited supply, and, therefore, couldn’t be duplicated under a new bank-issued policy. Structuring a TC bridge allowed the client to leverage their TC buyer limits and the bank had a separate but linked TF policy while allowing the client to maintain an element of control over their buyer limits. The bank received the policy language and structure they required, and the client obtained financing while maintaining the control they required. Indeed, a win-win!

Please note, the views and opinions expressed in this article are the speaker’s own and do not reflect the official policy or position of AIG.