We spoke to the Finastra’s CEO Simon Paris about the future of trade and challenges of capitalism, during the World Trade Symposium at New York. We discussed key themes around bilateralism and multilateralism in global trade and why we need to turn our eyes to plurilateralism. A typical SME trade finance transaction is $25,000, but the average cost to trade finance instruments is $4,000 and this is not particularly helpful in addressing the trade finance gap. Is the technology the remedy here?

Featuring: Simon Paris, CEO, Finastra

Host: Deepesh Patel, Editor, Trade Finance Global

Simon Paris, thank you very much for joining us on Trade Finance Talks TV.

My pleasure. Thanks for having me.

So we’re here at the World Trade Symposium. You’re the CEO for Finastra and also the chairman of the World Trade Board. Why is Finastra as a technology company involved with the World Trade Symposium?

So there are two answers, one as a software company, and the other is as a concerned individual. So as a software company, what we do is write software code to enable business processes and industry standards. What is lacking to some degree in the world of trade finances is too many standards and too many manual business processes. And we need these group of people, policymakers, corporates, financial services and other technology firms to agree to the standards that we can write software too. So that’s kind of one part of why I’m here. We’re very large as Finastra in trade finance, we handle maybe 6 – 7% of global trade finance every day.

The second reason is as a concerned individual, which is if you look at the last five years, trade finance activity typically grows at two times the rate of GDP, but that has not been true. So one of the ironies or unintended consequences of globalisation is less trade. And one of those consequences is more and more people struggling to get out of poverty, when in fact, trade is the fastest way to prosperity. I think most economists would agree with that.

So what are the key challenges within global trade that we face right now? And what’s been discussed in the last couple of days at the World Trade Symposium?

I think there have been different levels of challenges depending on who’s speaking. So right now, there’s a lot of concern about the role of bilateralism versus multilateralism versus plurilateralism and there’s a lot of debate about the area. I think most people will agree that multilateralism is good and going to plural is even better. I think at the operating level, however, it’s more around friction and transparency, and how can we collectively reduce friction and increase transparency. And that’s where technology, standards, policy, best practices, can really play their part.

A lot have been discussed around open trade. And I guess the idea of boosting growth and also innovation within trade and trade finance, what are the enablers to driving this change?

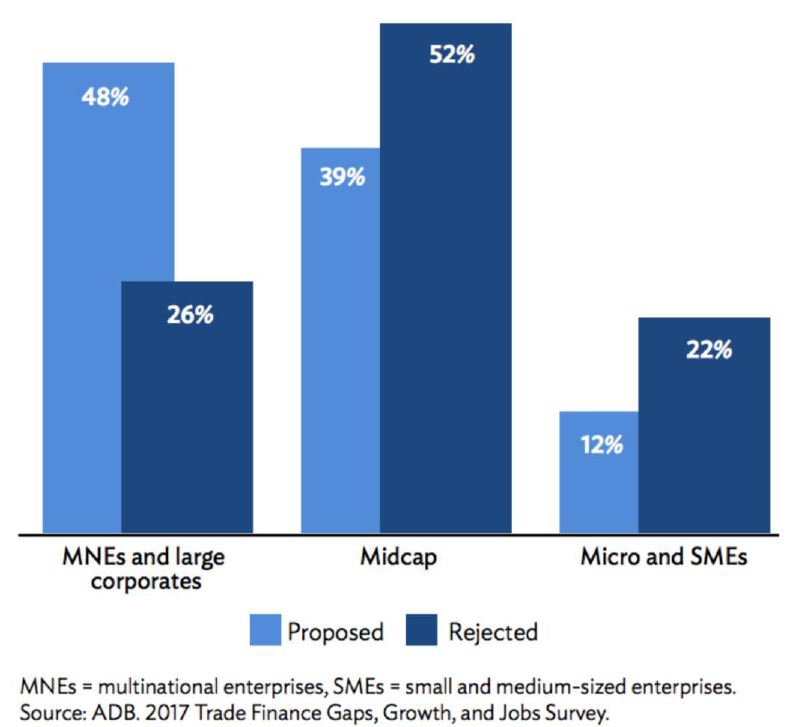

Yeah, so I’ve actually heard like four or five words in use here – open trade, sustainable trade, equal trade, reciprocal trade, free trade. I think those five words mean different things. Let’s stay with your question – open trade. So open trade should mean the ability to have open standards and open practices and open data flows and open workflows, and the outcome of those things should be less friction, and less cost and more transparency. Now one of the speakers said today that the typical SME transaction is $25,000, but the average cost to trade finance instruments is $4,000. So that doesn’t work if you want to address the SME trade financing gap.

How can technology help bridge this 1.5 $ trillion trade finance gap for SMEs and also within emerging markets?

Yeah, so you can think about it in two different ways. One is the role of trade finance for the lowest providing component of the supply chain and the other is access in finance. So let’s look at a use case. If I’m a cashew nut farmer in Kenya, it would help me a great deal to know what the market prices of my cashew nuts were. How much I might be losing in transportation? Am I getting a fair price? Are people in open trade or fair trade or sustainable trade helping me with my crop cycle, with my pesticides, with my fertilisers? Am I getting the best value that I can in the spirit of fair trade? So that’s one thing that technology can play the role in, right, you can digitise those flows and bring that information to him or to her. In terms of trade finance, then the trade finance gap says many of the institutions of the world can’t reach those people. They can’t finance a crop or they can’t finance a merchandiser. They can’t finance the fabric. So we can use technology to increase reach and to reduce the cost of reach.

If you had one key takeaway from this conference, what would it be?

I’m going to re-quote, Roberto Azevêdo, from what he said during the World Trade Symposium two years ago. He said it very simply in his closing remarks: “Trade is good, more trade is better”.

Simon, thank you very much for joining us on Trade Finance Talks TV.

Thank you for having me.