The Italian Banking market continues to face headwinds and pressures around new payment service directives (PSDII), challenges from the regulator, and changing customer needs. TFG caught up with the CEO of RegTech innovator CBI about their latest product CBI Globe, and how this is positioned to help Italian banks succeed and grow.

Featuring: Liliana Fratini Passi, CEO, CBI S.c.p.a.

Host: Deepesh Patel, Editor, Trade Finance Global

What are the main challenges currently facing the Italian Banks

The Italian banks, like most continental retail banks, are facing different challenges at the same time. They relate to improving profitability, fulfilling the regulatory requirements, facing competition from new and innovative market players and adapting to a more sophisticated customer demand for security, transparency and operability.

All this can be tackled by effectively embracing technology.

CBI further proved this, at the request of the Italian banking industry, by analysing the costs of technical and operational adjustments for the banking sector deriving from the implementation of the PSD2 Directive in the domestic market.

The analysis unveiled that a shared technological solution compliant to PSD2 could allow Italy’s banking sector to save up to 185 million Euros, equal to roughly 40% of the total investment that it would otherwise have to bear to upgrade its systems individually.

This evidence led to the development of CBI Globe, which has then been adopted by 80% of the market.

How does CBI help the financial sector deal with them?

For over 20 years, CBI has supported Italy’s financial industry in keeping up with the challenges of the digital economy, providing guidance, tailored services and innovative solutions. Thanks to its know-how and longstanding experience in addressing technological and regulatory change, CBI helps banks to transform themselves, improve their competitiveness and profitability, and reinvent their role in a fast-evolving financial ecosystem.

Along with its clients, CBI also contributes to reshaping the relationships between financial institutions, their customers and the Public Administration.

What are the benefits of open banking to customers?

The objective of Directive 2015/2366 / EU, known as PSD2, is to expand the scope of the PSD by increasing payment security and consumer protection, promoting innovation and competition, ensuring the same “level playing field” to all the market players, including the new and future players in the payment market

The PSD2 is a true “digital transformation” that has introduced for the first time a signaling of the payment chain, involving all the main actors – intermediaries, customers and technological partners – and allowing the entry of new Fintech operators in the financial sector.

The PSD2 offers consumers greater opportunities to choose even in the right to use services offered by non-bank PSPs for payment transactions, but also to request loans or to make investments.

This, if on one hand improves the customer experience for the consumer, on the other it forces the “traditional” financial industry to invest important resources in technological innovation and design of new technical and compliance processes.

By their very nature, Fintechs often cover different aspects of financial services and almost always extend to value-added services. For them, the concept of the customer includes the banking world itself, as demonstrated by the number of Fintech that operates in banking support services. Banks are called to choose a model that takes into account the presence of the Fintechs in the new competitive arena.

To transform the challenges of the PSD2 into opportunities, CBI strongly believes that the collaboration between all the actors of the new chain of payments can create a value ecosystem, in order to develop new competitive services.

CBI Globe is making waves in the Italian market, tell us a bit more about it?

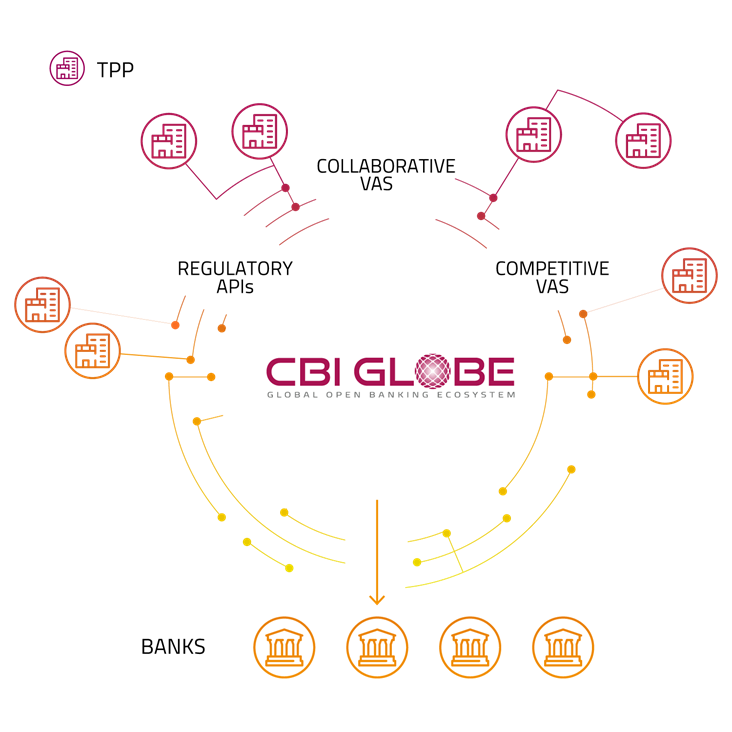

CBI Globe allows the consumer to operate in a secure manner, facilitating the dialogue between their bank and other operators offering device services (Payment initiation service providers – PISP), information services (Account information service providers – AISP) and card payments (CISP -Card Issuer Service Providers), through Open API technical interfaces (Application programming interfaces), in line with what is defined in the European context by the PSD2, and to support the development of value-added services to move from the open banking to data sharing.

To date, around 300 banks has joined. From January 2019 and in particular with the opening of the «Sandbox» on March 14, 2019, they requested information on the specific CBI Globe API over 50 PSPs in the role of AISP / PISP / CISP.

CBI Globe from its inception has achieved many goals:

- It has brought Banks and Payment Institutions to be compliant with the PSD2 (e.g. exemption from the obligation to implement a fallback mechanism granted by the Bank of Italy to all the CBI Globe ASPSPs that have requested it);

- It has allowed Banks to expose all the PSD2 Mandatory APIs (i.e. AIS, PIS, CISP);

- It has been chosen by the Italian banking market as the system solution;

- It has enabled ASPSPs to develop and offer new services to their customers;

The use of the platform creates benefits and opportunities for all the players in this new framework dictated by the PSD2:

- It has brought a higher level of security and reliability, the opportunity to reach the widest range of their bank accounts and It will bring new Value Added Services to End Customers (PSU);

- Also, Banks and Third-Parties will benefit from Value Added Services and from this wide range of connectivity through a unique standard access point;