Estimated reading time: 0 minutes

Despite volatility across much of the world, the global factoring industry has continued to grow for three straight years. In fact, according to the FCI 2024 annual review, the estimated volume for global factoring in 2023 reached €3.79 trillion.

What is the industry doing to continue to promote growth, what role does FCI play in these initiatives, and where are the further market opportunities?

At the 56th annual FCI event in Seoul, Neal Harm, Secretary General, FCI, was joined by Doaa Hafez, Executive Committee Member, FCI, to dive deeper into these topics.

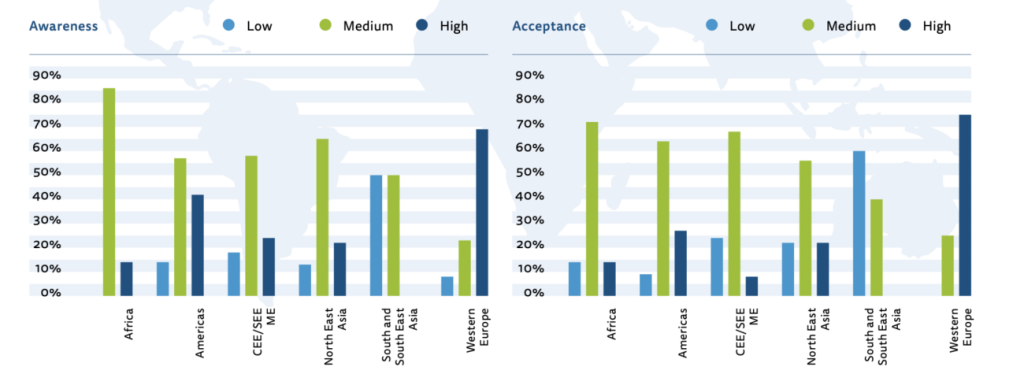

Regional similarities and differences

When it comes to factoring, there are many regional differences, as well as many commonalities across markets. One example from Egypt is from the beginning of the adoption of international standards.

Regulators and stakeholders in Egypt realised early on the importance of adopting international standards in the factoring industry.

This required extensive customisation to suit the market. Hafez said, “It depends on the readiness of the market, the infrastructure, the legal and regulatory framework, the culture, the economic and financial circumstances.”

By taking lessons learned from international experiences, the industry can tailor specific needs for the domestic market, regardless of how unique the needs may be.

Technology and factoring growth go hand-in-hand

Part of the process to bring factoring to domestic markets and properly customise the market experience is utilising the correct technology.

And FCI was one of the first fintechs in the trade finance space to help with this, dating back to nearly 50 years ago.

Hafez said, “It is a very good selling point, even in developing markets. When I am approaching new prospects, I say that we are an FCI member, and FCI has invested a lot in a brilliant platform, Edifactoring.”

Edifactoring is the FCI members-only platform, operating for more than 20 years. But Edifactoring 2.0 was released in 2022, creating a two-factor platform that helps bridge the foreign languages and local laws gap by allowing local factors to communicate with each other in one safe and transparent place.

In order to stay up to date, FCI invested a further €1 million into the Edifactoring platform to incorporate other supply chain finance solutions. This has been very successful as the platform is able to cater for multi-currency transactions across many compliance landscapes.

Hafez said, “This is one of the selling points of what we are doing inside Egypt. We want to offer this type of product to SMEs, corporates and other stakeholders to help them better understand.”

With supply chain finance being so ubiquitous, Edifactoring’s integration with new and traditional factoring products is crucial. Because of this, there is a high demand from FCI members for IT solutions focused on risk prevention and fraud, as well as the development of ecosystems that connect sellers, buyers, funders, banks, and non-bank financial institutions.

Hafez said, “The future will be going in this direction. Combining traditional ways of doing business with new technology.”

Linking factoring and supply chain transactions

Opportunities for factoring in supply chain finance are significant, particularly in terms of open account finance. Increasingly, there are cases of banks integrating factoring transactions into supply chain financial transactions.

Nevertheless, many continue to see them as separate products. But that is not the case, and there needs to be an effort to explain this to all parties involved.

Harm said, “Many banks and financial institutions view the products as separate, that factoring is separate from the supply chain. But here at FCI’s annual conference, we’re starting to hear that integration can work, and how a factoring transaction becomes a supply chain transaction.”

Having the flexibility to understand what the market needs, and how to utilise all available solutions is the key to gaining more support with banks, both domestically and internationally.

Hafez said, “We can do the service side, they can do the funding side, or we can even have this type of collaboration with the corporate buyer because now the technology is part of their system.” This is moving towards a state of “embedded finance” that is particularly beneficial for small and medium sized enterprises (SMEs).

Hafez said, “We have to be so energetic, smart, understanding, and have the expertise to provide tailored solutions. Because of our relationship with FCI, Egypt Factors developed a great and early understanding of the market. This has given us the leverage to do what we are doing right now.”

This educational perspective is one of the key value propositions FCI offers its members, enabling them to truly understand market opportunities.

A real-life example of this is deep-tier supply chain finance. Whilst deep-tier supply chain financing is not yet a widespread concept, its growth presents an important opportunity for the sector.

However, due to the buyer-driven market, an increasing number of Egyptian exporters are becoming aware of deep-tier and embedded financing and the associated benefits.

By integrating elements across IT platforms in enterprise resource planning (ERP) solutions, companies have been able to provide deep-tier financing in a complete solution across supply chain finance to great effect.

Fostering partnerships on a global level

According to Harm, Africa is one of the most exciting markets for the use of deep-tier supply chain finance. Harm said, “When considering deep-tier financing, Africa offers some of the largest opportunities.”

Hafez said, “The African market is the potential of the growth of factoring.” However, to leverage this opportunity, more stakeholders must actively engage with one another.

This effort requires the collaboration of supranational banks, regulators, financial supervisors, and commercial banks, given the broad and varied opportunities and challenges across the continent.

Hafez said, “For us to be able to do business in Africa and to grow the factoring business, we have to connect with supranational banks, regulators, and other commercial banks, to get one big solution across the board. And this, of course, will be supported by a digital platform. Digitalisation here is key.”

More specifically, FCI is positioned for great opportunities in terms of bringing partners – whether banks or non-banks – together at the global market level.

Hafez said, “Because the legal and regulatory framework and credit insurance are still difficult to find in most of the African markets, having the Model of Law coming from a supranational bank will help, the adoption of the Afreximbank model of law is a leading example, as well bank guarantees. By leveraging the Afreximbank or EBRD Trade Facilitation Programmes, the deal becomes much more comfortable.”