TFG’s Editor, Deepesh Patel, spoke to Yves Mersch about the strategical priorities of the ECB in 2020. They discussed the importance of central banks’ independence for the foreseeing of their mandates. The ECB’s mandate is to ensure price stability with an inflation rate below but close to 2%. However, changes in the global economy are making it tougher to achieve this goal. This is why in 2020, the ECB will embark on a strategic review of its mandate and instruments to achieve its inflation target with an “open mind”.

Featuring: Yves Mersch, Vice-Chair of the Supervisory Board, European Central Bank

Host: Deepesh Patel, Editor, Trade Finance Global

Deepesh Patel: Mr Mersch, hello and welcome to Trade Finance Talks TV.

Yves Mersch: Hello, thank you for inviting me and welcome here in Frankfurt as well.

DP: So Mr Mersch, here we are at Frankfurt at the ECB during the time of the BAFT global annual meeting. Given your recent appointment as Vice-Chair of the Supervisory board at the ECB, can you give us a quick introduction? Who are you? What do you do and where are you from?

YM: Yes, just like you, I’m not a native Frankfurter. I am a guest-worker here. Since the beginning of the ECB, I have been a member of the Governing Council, because I was governor of a national central bank, which participated in the euro from ’98 on. And in 2012, I assumed the mandate of the ECB’s Executive Board, which is responsible for the daily management of the European Central Bank. And then last year, I was, as a member of the Executive Board, also put in charge of doing the hinge or the connection between the Executive Board, the Governing Council and the supervisory side, and as such, I have been appointed as Vice-Chair of the Supervisory Board.

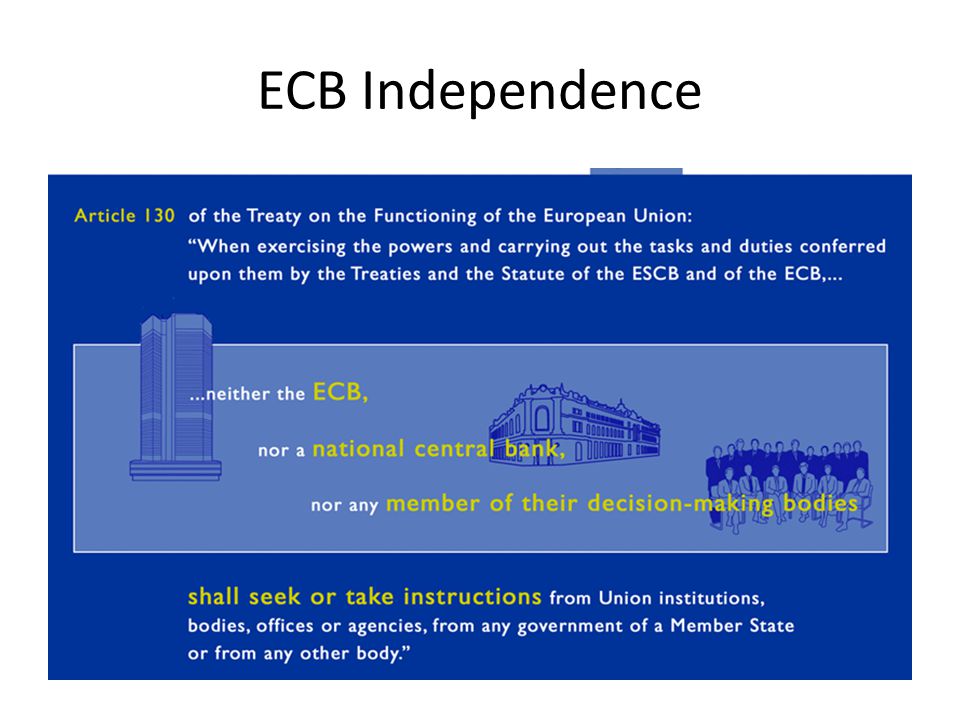

ECB Independence

DP: So with a lot in the news recently about the importance of the independence of the European Central Bank, can you tell me a little bit more about the mandate of the ECB, and also your role as a central banker?

YM: Certainly. We have seen a certain number of ‘body checks’ on governors over the last couple of months – but that is something that is not particular to the European area – we have seen it in other jurisdictions as well. We also regularly see legislative initiatives that are attempting to change the statute of Central Banks. Within the European Union, we are rather well protected because the principle of independence is enshrined at the constitutional level – in primary law. It covers not only the personal independence of each governor, but also the institutional independence of the national central banks, and of course, of the ECB. On top of this, each initiative in Parliament, taken at whichever level, ought to be submitted to the ECB, in order for the ECB to give an opinion. And in many of the opinions over the year, we have established a certain jurisprudence: what we see as compatible with central bank independence, and what we would see as threatening this principle. Then, thirdly, we have the possibility for each individual member to bring his case immediately to the judicial review. And this judicial review is done not by the national judge, but by the European judges. So, these are the protective mechanisms, the question is: what is the independence for?

Basically, independence is not an end in itself but it is supposed to serve the mandate that is foreseen in the treaty for the European Central Bank, that is to pursue price stability. This is a priority mandate of the central bank. Independence also comes with increased accountability requirements, which we have fostered, in terms of transparency, in terms of publication. So by and large, we are watching and monitoring all developments in relation to the issue of independence, because it is a means to achieve our mandate.

2020 Priorities: Strategy Review, Creating Resilient Banking System and Harmonisation of the Single Market

DP: What are the key priorities for you at the ECB for the rest of 2020?

YM: On the monetary policy side, there would be three issues.

1) Firstly, we have to show the same determination to do justice to our mandate, which is price stability in the way we have defined it.

2) The second is, we have announced that we will embark on a strategy review.

I hope that this will also incorporate all of the changes that have taken place in society, in technology, in transmission mechanism and in regulation over the years. We have not looked at our strategy since 2003. And I would say for me, something that is very close to my heart, is the idea that a central bank must have full confidence of the citizen -– and that it is also supporting its independence. I have seen that since 2014, 70-80% of the European population likes the euro, they like it so much that some populists have even lost out in the elections. But only 45% of that same population has confidence in the institution that is issuing it. That used to be higher. That has started to go down a little bit during the crisis, where all European institutions lost confidence, but in the meantime, we have not been able to close the gap. That has something to do with the introduction of unconventional measures. What people do not understand, is the idea of negative interest rates. And I think we have to monitor not only some of our measures from a pure model-based analysis, which is a mathematical analysis – where moving from positive territory to a negative is quite a linear continuity. But in political economy, in behaviour, in understanding I think we have hit a kind of wall where we pay a price in terms of confidence when we stay in negative territory too long, or too deep in negative territory. We have said that we continuously monitor eventual negative effects. In purely mathematical terms and also in observation of the banks, we have not seen that it is unduly affecting the banking system, but the longer it lasts, the higher the risk of financial instability consequences.

Our monetary policy assessment every six weeks remains separate from the strategy review – we are conducting two different exercises. @bloombergtv pic.twitter.com/RG0LNzlipw

— Christine Lagarde (@Lagarde) January 24, 2020

But what has not been captured by our models is that the public, by and large, does not understand the concept of negative interest rates. And I think we have to come to grips with this gap in confidence. On the supervisory side, I would say that confidence has also to do with providing certainty and with doing what you said you would do.

On the regulatory side, I think we should implement what we have agreed upon at the international level. And we should implement in Europe, what countries promised that they would implement at their national level as well. So, implementing the present regulation, which is aimed at making the banking system more resilient to avoid a future crisis, to de-risk it, and therefore to increase the capital requirements. I think we promised it to our population, and we should now deliver on it. The same thing applies to the Banking Union – this has not been completed and there are some elements, like the European Deposit Insurance Scheme, the regulatory treatment of sovereign exposures, the fulfilment of the European backstop for the European Stability Mechanism. All this is close to ready, and ought to be implemented.

But this is more in the realm of the regulator. We are only a supervisor that implements the regulation. But in implementation, we would have as a priority to pursue also simplification. We have at the beginning established a certain amount of processes; data collection, reporting requirements… I think it is worth after some time to take stock of what we have done, and see whether some processes could be alleviated or whether there is scope for some simplification.

3) The third priority would be to pursue the fulfilment in the supervision of a single market. That means more harmonisation, less diversity in national legislation, in national options and discretions to implement European legislative acts. And this would, for example, go in the area for the exit of banks from the market, in resolution, having a European administrative liquidation tool, in case we do not rely on the European approach for resolution, because the European Resolution Board would find that there is no public interest, but the majority of banks seem to not fall under this criterion of public interest. So they are being dealt with, according to national law and national law is quite diverse! I think that this is an issue that should be dealt with as well. Where there are still administrative obstacles or impediments to consolidation, we should look at it. But we should also encourage the banks to pursue their quest for increasing their cost control, because cost control is a prerequisite of being available in the market for scalability and for profitability, because that is one of the biggest issues that we face in Europe – insufficient profitability, and thereby in investability in our banks.

DP: Mr Mersch, I think to summarise – cautious, optimistic, but careful. I think those are some of the key take-homes and messages in terms of taking a forward-looking view. Thank you so much for your insight today on Trade Finance Talks TV, it’s been great to have you!

YM: You define the role of a central banker! Thank you very much!