While some in trade finance struggle with green fatigue, ITFA’s Johanna Wissing isn’t one of them.

Having joined the International Trade and Forfaiting Association (ITFA) as a board member this year, Wissing has since become the front-woman for the association’s work on environmental, social, and corporate governance (ESG) issues.

In addition to her role at Credit Suisse in Zurich, where she is part of the trade syndication team, Wissing is now the head of ESG at ITFA, and is one of the founding members of the newly launched ITFA ESG Committee.

According to Wissing, ITFA’s work around ESG used to focus mainly on cooperation with development banks, which is where her position at ITFA began.

But given the sheer number of issues that ESG now overlaps for trade finance, Wissing said it became necessary to delegate.

“When I joined the board earlier this year, ITFA Chair Sean Edwards and I were talking about the role that I could fulfil, and we decided to have an ESG board position, which is great and really relevant,” said Wissing.

“But I later said to Sean, ‘well, I can’t do all the work myself: I need dedicated individuals that can work together with me’, and hence we created the ESG committee.”

ESG to the fore

Wissing said that awareness of ESG priorities has grown over the last 2-3 years, and has become particularly acute during and after the pandemic.

Describing it as a “global seismic shift”, Wissing traces much of this awareness back to 2018, when Swedish climate activist Greta Thunberg launched her ‘Fridays for Future’ movement.

“There is definitely a complete rethink, and that’s not to say that before people weren’t focused on the environment or sustainability before,” said Wissing.

“There has definitely been more news on climate change, pollution, and also on labour conditions, and I’d say these issues are becoming a business imperative these days.”

Supply chain crunch

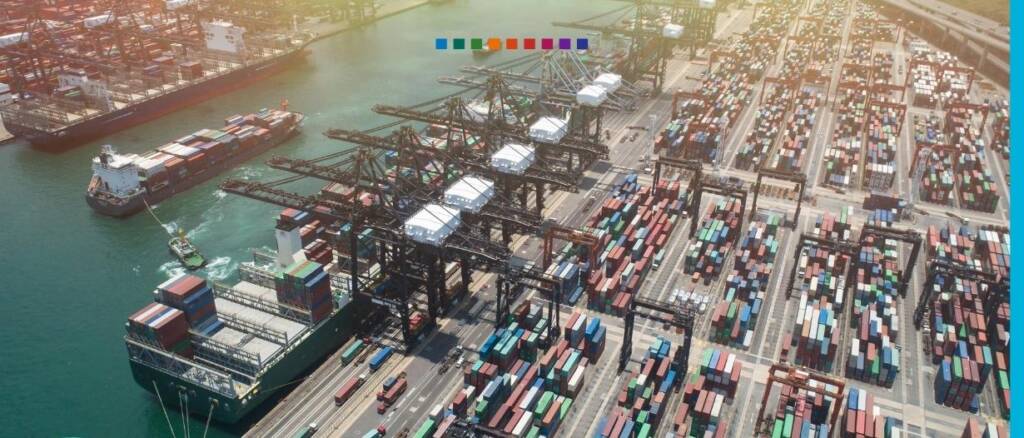

Due to a mixture of inflation, bottlenecks, shipping costs, and the virus itself, supply chain disruptions have affected every country during the COVID-19 pandemic, and Wissing believes that this has led to a greater curiosity around supply chains both from businesses and consumers.

“All of a sudden, there was a lot more of a focus from people who would have never thought about this,” said Wissing.

“Consumers are now asking: where do things actually come from? How are they made? And how do they end up with me?”

As Wissing points out, the issue of supply chain resilience has become particularly urgent in certain industries such as automobile manufacturing, where a global microchip shortage has led to a supply crunch and unfulfilled demand.

Fast fashion

Labour conditions have also become a major concern for the modern consumer, which is something that Wissing intends to focus on at ITFA.

“There is a lot more talk nowadays about child labour, for example, and exploitation of people in certain developing countries. If you’re in the commodity space in particular, that’s become a big focus area,” she said.

“So I guess the pandemic has also changed people’s mind in terms of: the way we used to live: is it really sustainable?”

The Rosetta Stone of ESG

Asked what role ITFA can play in helping businesses adapt to and comply with ESG priorities, Wissing pointed to the growing number of jurisdictions that have – or will have – their own ESG taxonomy.

“I would love for there to be some harmonisation – I’m not saying standardisation – but some harmonisation in terms of how institutions, for example, look at ESG implications internally,” she said.

This would allow ITFA to act as a “Rosetta Stone” for ESG, as Wissing suggests, helping to decipher its terminology for businesses in plain English.

“We shouldn’t reinvent it, but maybe we could give a bit more guidance – that would be really important to me,” she said.

Divide and conquer

In order for ITFA’s work around ESG to have the most impact, Wissing said the trade finance industry must be careful not to duplicate its efforts.

Instead, she proposes a “divide and conquer” strategy, whereby skills, resources, and expertise can be allocated to the right areas most effectively.

“Other industry bodies are indeed doing great work around these topics, such as the ICC, for example,” she said.

“So, if we know that others are already working on certain topics, then we should focus on other areas that are relevant for the trade finance world.

“And let’s be fair, trade finance is such a vast, complex topic, that there is enough to keep us all busy.”