Bankers and traders can now access a fully comprehensive digital platform by VERIDAPT called AdaptSCF that ensures security, reliability and compliance in the digital trade finance world.

VERIDAPT has been a global force in commodity monitoring for more than 15 years, working hand-in-hand with sector giants, including BHP, Rio Tinto, Glencore and others and is now zeroing in on the banking and trading industry with its latest technology.

“We were on a mission to find a next-generation solution to help our new customers reduce theft and fraud, while managing supply chain financing transactions and emerging ESG goals,” said Sean Birrell, CTO and co-founder of VERIDAPT.

VERIDAPT is uniquely positioned as both an IoT and fintech company to address the needs of the banking and commodity sectors to reduce risk and increase compliance.

The AdaptSCF solution provides:

- Real-time monitoring of hard and soft commodities and that means 24/7 access to in-depth inventory data to mitigate theft and fraud

- Up-to-the minute measurements of CO2 emissions to verify carbon offsets

- One-stop workflow management tool to simplify even the most complex of deals

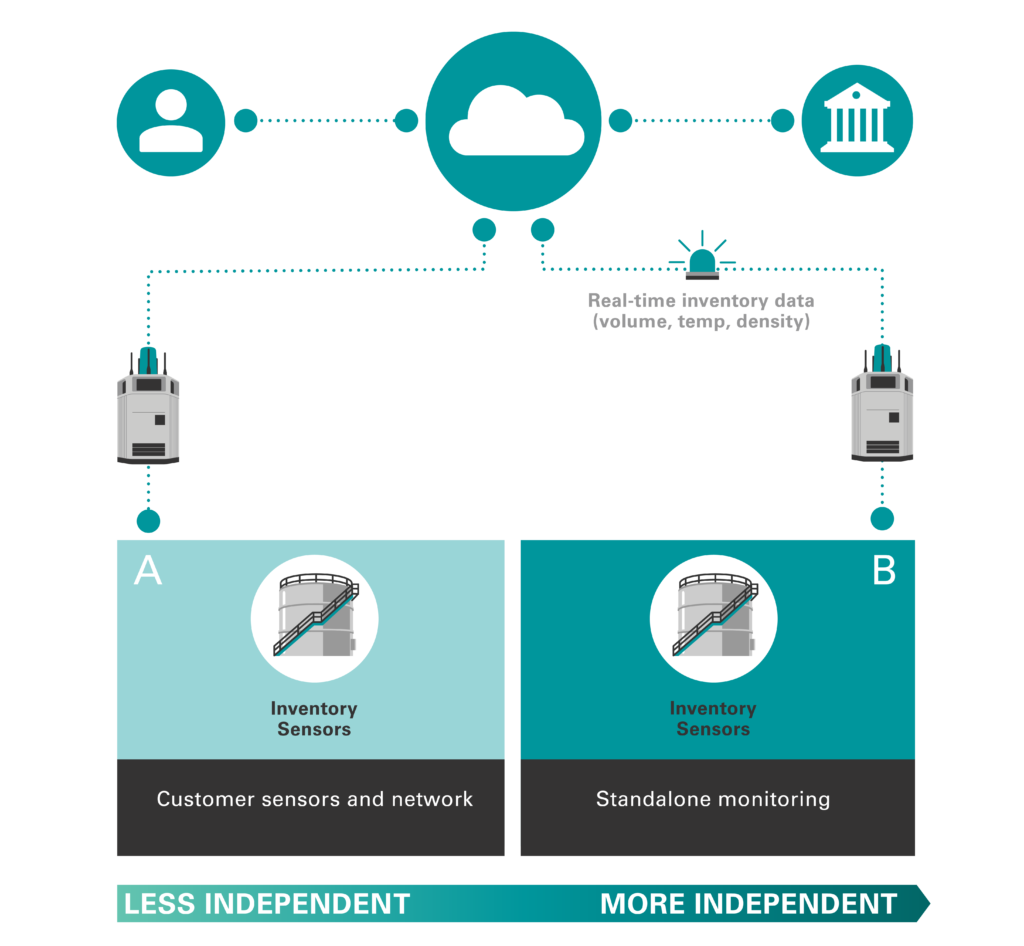

VERIDAPT’s platform verifies the physical inventory with the platform’s IoT (hardware and software) capabilities to mitigate operational risk and further reduce theft and fraud.

“Our IoT hardware is designed to ‘plug and play’ within 24 hours and operates under the most extreme conditions, ranging from 40 degrees below to 70 degrees above,” Birrell said.

“It also adds another layer of certainty by providing instant alerts to changes in the quantity or quality of any commodity located in bulk storage facilities, whether it be silos, tanks or free-standing stockpiles.”

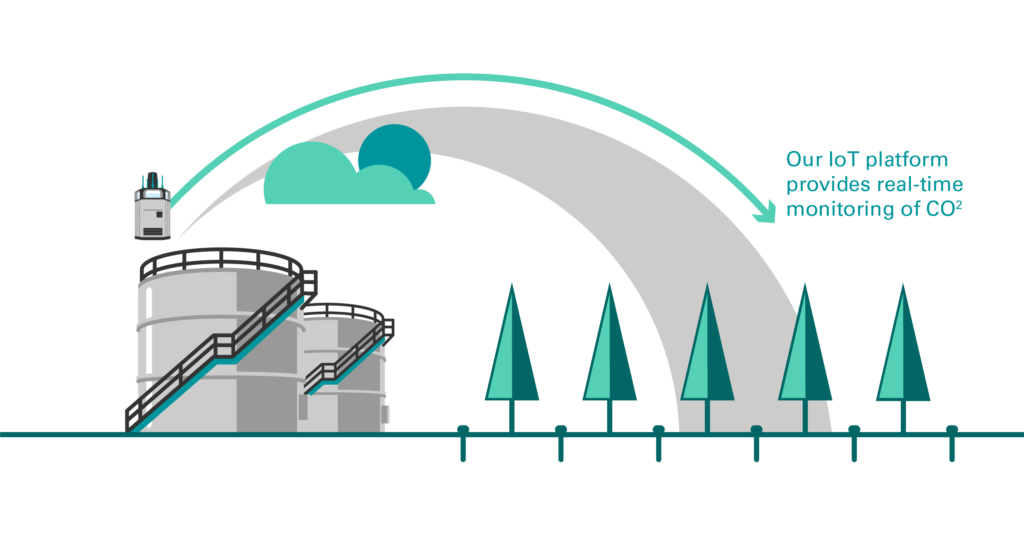

“VERIDAPT is also committed to enabling its customers to reach net-zero targets. Our IoT platform provides real-time visibility of CO2 emissions with accurate reporting, delivering reliable data to track their progress and help industries carbon offset,” added Birrell.

“Each year we monitor over 4 billion litres of fuel, that’s equivalent to more than 10 million tonnes of CO2 emissions.”

The VERIDAPT platform includes DealFlow a highly user-friendly solution to help the front and middle office manage the deal lifecycle.

DealFlow is frictionless and designed to provide certainty in deal process execution with the flexibility of customisation.

“Traders and financiers can confidently automate and control their deals with a tool that meets every need across the deal lifecycle without relying on a multitude of emails and spreadsheets in countless shared folders,” Birrell said.

“All parties have clear line of sight on what needs to be done and who’s got the ball”, Birrell said. “Now it will be much easier to find critical documents and have an audit trail.”

VERIDAPT recognises the need for the banking and commodity trading sectors to continually improve the way they do business, to increase sustainability and address social responsibilities. Our products are designed to meet and serve those goals.

Macquarie Group invested in VERIDAPT Pty Ltd in 2018 to advance technology in commodity trade finance.