An interview with Vittorio De Angelis, Executive Chairman at Velotrade.

The invoice financing market has been driven by growing European countries with an annual organic growth of around 10% per year over the last decade. The follower, coming from a slow-moving bank system, is the Asia Pacific region. However, in 2017, FCI reports that Asia made a comeback with an impressive increase of 18% in invoice financing volume.

The whole Asian market is dominated by large banks proposing traditional services. While their products have demonstrated a good track record, they are still extremely time consuming for the final users. Their application processes are paper-based, lengthy and bureaucratic. Recently Fintech is reshaping the market: technology allows for user friendly interfaces, flexible offerings, cheaper and overall more efficient solutions as an example, P2P lending platforms aggressively expanded from 200 in 2012 to more than 3,000 in 2015 in China.

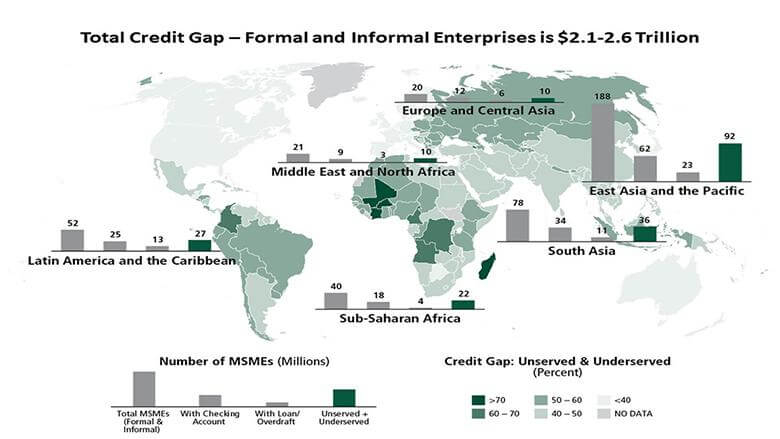

SME Finance is Poorly Served in Asia

According to the World Bank, SMEs financing needs are neglected by the larger financial institutions: SMEs received less than 25% of the loans provided by Chinese bank despite the fact that they accounted for over 60% of China’s GDP.

IMAGE: SME Credit Gap. Source: World Bank

Banks are traditionally self-oriented creating their product blindly. As they have a massive customer database, marketing is used to convince those who could fit in. While “Uberization” has reinvented some markets in creating value and comfort for users, the banking market has not kept up with the pace of change.

A living space was opened for companies providing alternative finance and Fintech starts to grow.

Fintech results from a confluence of factors: a disrupting vision of risk assessment, the consumer centricity emphasized by technology with the one unique goal of SIMPLIFYING access through 24-hours available mobile apps and e-signature; usage with pay-as-you-go options which abolish commitment; and the simplification of vocabulary by avoiding technical jargon.

Thanks to a flourishing Fintech scene, the Asia Pacific region leaped from traditional banking cash transactions straight to digital technologies. While in Europe the market has slowly developed with check notes and credit cards, Asia had kept traditional cash payment. Today, in Asia, banking operations have been replaced with digital solutions, even for B2B. I am talking about payment services, Alipay by Ant Financial, WeChat pay; lending, Baidu solution provided by Duxiaoman financial; or trade financing, where Velotrade stands to develop the invoice discounting for SMEs and corporates with the help of technology.

Invoice discounting means a corporate can get an advance of payment on an invoice immediately after issuing. The corporate thus receives most of the payment without having to wait. Invoice discounting therefore helps to manage cash flow, especially when the corporate needs working capital to increase productions, limit the FX volatility, face supplier payments or have timely opportunities to reinvest in their business.

The Fintech Ecosystem

A new ecosystem is born, following the example of Overseas Fintech, platforms have emerged occupying the grounds and breaking traditional models for on-boarding of new clients.

Through a simple online application process, a supplier can provide the main company information, upload documents for the credit analysis and KYC verification. With the use of technology, on-boarding, KYC process and receivables risk assessment procedures are efficiently done in a matter of hours.

As soon as the on-boarding is done, the Corporate is granted access to the platform and can immediately start discounting invoices. Investors provide the necessary liquidity.

Each platform has its own business model recipe: verification process, specific requirement on historical background, with or without recourse, guarantee requested, trade credit insurance included, country financed, type of investors, data analytics, blockchain connection, AI….

Once you spend some time in Asia, you can’t miss that the region is hyper-connected. At Velotrade, we made sure we would take advantage of the situation. We have paid particular attention to creating not only an online platform but also a powerful mobile App. Our corporate clients and investors can access the platform easily either on their desktop or can post or bid for invoices with their smartphones. We invested a lot of effort in developing expertise in deal analysis on the platform with the help of a skilled team and established trustful partners. We believe that clients and investors need the most user-friendly tools in the most secure environment and save time and money as a result.

Why choose a Fintech platform vs a bank?

Disadvantages

Fintech is flourishing globally in financial markets. Some are better than others in providing funding on a regular basis. The mechanism is a matching process between investors and cash poor companies. Some are offering insane yield for un-secured invoice. Others are doing well with investors by structuring a simplified access to reasonable attractive yields in a verified and regulated environment, insuring the buyer, even offering invoices that have been approved by the buyer. Still, there is never a 100% guarantee that you can be funded.

A few years ago, lack of regulation sparked the boom but also gave rise to scams for investors. In 2014, Ezubao a Chinese platform with promises of a too good to be true double-digit annual returns, attracted US $7.6 billion from 1 million users in 18 months before it was identified as a Ponzi scheme, with more than 95 percent of its borrowers being fictitious. This uncommon scary case opened the doors for regulation. China Banking and Insurance Regulatory Commission monitor platforms which are now asked to register and meet strict compliance requirements.

Often FinTech bases their credit assessment by focusing on the debtor credit, they mitigate the default risk with the help of trade credit insurers or information providers assessing buyer creditworthiness. In Asia, SME’s financial statements suffer from a lack of transparency and precision, making it harder to underwrite the credit risks, especially in emerging countries. In China, authorities are trying to improve the situation by establishing a national system for credit reference.

Advantages

It is quite obvious that the more archaic the processes are, the more significant the obstacles are for SMEs and corporates to access funding. Digitalization and electronic formats reduce processing times and costs.

Banks promote Letters of Credit (LC) as a really common and useful tool to secure deals, even if it does not offer a 100% protection for the seller. An overseas company has the option to cancel the payment in case of delay (LC simply expires), if goods specifications differ from what is stated on the certificate of inspection or if some documentation is missing. L/C is convenient and well understood by SMEs, even if they may underestimate their financial risks.

Asia will be the last region to abide to Basel III requirements in 2019. The set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007-09 aims to strengthen the regulation, supervision and risk management of banks. Such measures will increase the liquidity needs and the capital requirements for banks. As a consequence, we saw banks in Europe shy away from liquidity consuming operations even in factoring. Factoring could be a “balance-sheet heavy tool”, depending on the risk weight calculation. SMEs were adversely affected in Europe. Asian bankers are likely to have the same reaction to the imposition of new measures and limit the offering of factoring solutions as a consequence.

Asia is said to be the world manufacturing hub where business opportunities arise If your company is a lucky winner of a call for tender with an overseas wholesaler, the next step is cash flow management. While banks try to support growing businesses, their funding are mostly correlated with historic volumes: they are often unable to scale at the required speed. On the other hand, Fintech analyses the opportunities, the strength of the operational process and quality of debtors and therefore there are no barriers to fund a booming growth in sales.

Fintech is changing the way markets understand Financing, pushing the limits. Banks realise that Fintech could represent a threat to their business, the Global Head of Standard Chartered Ventures said that innovation is non-negotiable, it is not an option. The interest in Fintech acquisitions is growing, last October JPMorgan bought payments start-up We Pay. OCBC, Barclays and DBS also launched accelerator programs in Asia.

Where should you put your eggs?

Diversifying funding sources by tapping into alternatives serves the customer experience. “Don’t put all your eggs in one basket” is a sage adage and applicable to business. Seizing opportunities offered by Fintech, is the best way to receive effective high-level services, and push the whole market into competition at the benefit of underserved SMEs and small corporates.