In 2020, the global macroeconomic picture was disrupted by the COVID-19 pandemic. In just a few months, the economic status quo changed dramatically worldwide, leading to an unprecedented global recession. One year later, the economic picture is still dominated by the pandemic, with a succession of waves fuelled in part by the premature relaxing of restrictions and the emergence of new variants of the virus. Despite this, vaccines have provided hope of an exit strategy, with a number now rolled out across the globe, and many more in the advanced phases of testing and development.

2021 promises to be a year of transition out of the public health crisis, driven by radical scientific advancements. While the first months of the year are likely to see the same restrictive measures we grew accustomed to in 2020, these should be gradually eased in the second quarter, with the further advancement of vaccination programmes.

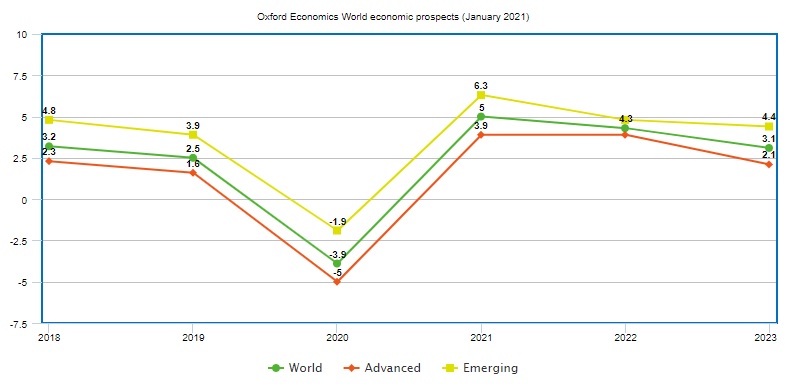

Although the exact timeframe is still uncertain, the majority of projections suggest a full recovery of world GDP. According to the recent forecasts of Oxford Economics (OE), in the base scenario, global economic activity is estimated to grow by 5 percent in 2021 (see Table 1 below), a rate higher than the one indicated in the latest OECD forecasts (+ 4.2%).

The recovery will be widespread, although, in developed economies, it seems unlikely that the rebound will be sufficient to recover from the contraction in 2020. This is partly due to a greater spread of the virus and the more restrictive measures that followed, as well as the structural weakening that was already underway before the COVID-19 shock. In contrast, there is expected to be a full recovery in many emerging markets, attributed both to greater efficiency in containing the health crisis in East Asian economies like South Korea and Vietnam and to the strong influence of China. Many of these have managed to achieve GDP growth already in 2020.

Source: Oxford Economics World economic prospects (January 2021)

In this base scenario, the volume of international trade is expected to return to growth in 2021, supported by a V-shaped recovery for goods that will sufficiently offset the slow recovery in services.

In particular, trade in goods is expected to advance by 8.7 percent after last year’s contraction (estimated at -6.8% according to Oxford Economics, in line with the available CPB data for the first ten months and equal to -6.6%). Meanwhile, the services sector appears to be most affected by the pandemic with trade collapsing by 21.8 percent in 2020 and growth estimated at a meagre 3.4 percent for this year. Tourism, transport and other hospitality sectors will be penalised in particular.

The risks to the global macroeconomic outlook remain significant, and evolve around an uncertainty about the future evolution of the pandemic. The recovery timescale is still highly variable, which makes any forecasts about the world economy constantly susceptible to revisions, both upwards and downwards.

“The recovery timescale is still highly variable”

There are, however, two broad scenarios, based on opposing hypotheses: (i) any significant and timely advancements in the availability and distribution of vaccines and therapies against COVID-19 represent an upward risk factor, which would allow the easing of restrictions in advance of the assumptions of the base scenario and would restart the world economy quicker, recovering the pre-shock trend; (ii) any worsening in the spread of the contagion would further strengthen the containment measures on a global scale, delaying the recovery of global economic activity. At the moment, the first alternative scenario is associated with a fair probability of occurrence (30%), while the second seems to be less likely (15%).

To add to an already complex picture of risks, non-viral factors, both old and new, are still likely to affect global economic scenarios. The resolution of the uncertainty about the outcome of the presidential elections in the United States represents a positive step forward. The new administration is expected to facilitate the return of a constructive dialogue with the USA’s central allies, including those of the European Union, alongside a broader commitment to multilateralism.

However, high levels of public and private debt could lead to a new financial instability; while political violence also remains high in some African countries, such as Ethiopia, and in South America.

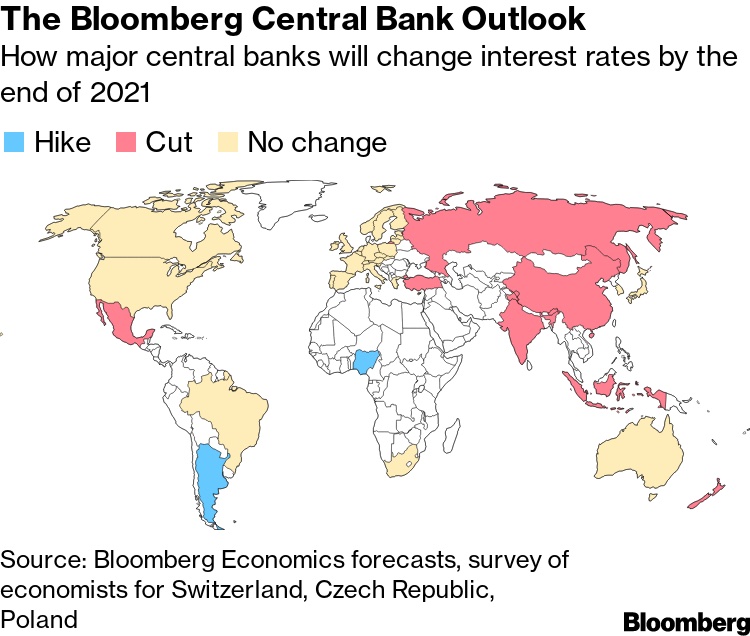

Low interest rates will be maintained in 2021, as no major Western central bank is expected to hike them up, while others may in fact cut benchmarks even further (see Image 1 below).

China, India, Russia, and Mexico are among those expected to do so, while only Argentina and Nigeria are forecast to raise rates. The assumption is central bankers will want to guarantee the recovery is safe before they even start to consider tightening policy. This means that both companies and governments worldwide will be able to refinance their debts, which is of paramount importance in order to really pave a way for the much-needed recovery.

Last but not least, global crises linked to climate change have become increasingly frequent and devastating, making it urgent to intervene with structural reforms based on technological innovation and renewable energy, as seen in the recovery and resilience plans that various governments are formalizing.

In short, there are plenty of reasons to be optimistic for trade in 2021, even though there will be an all-new set of challenges to look at. These could be a further stimulus for credit insurance, as CEOs and CFOs will be increasingly concerned about their trade receivables. ECAs will be there to help, fulfilling their mission to mitigate risks and thereby facilitate the pursuit of opportunities in international commerce.