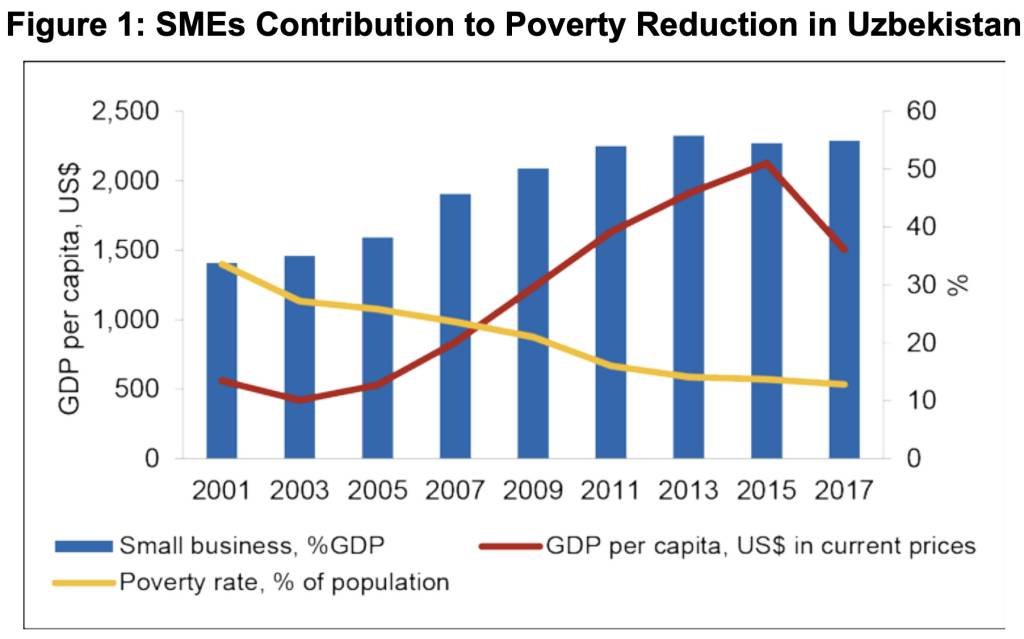

Small and medium-sized enterprises (SMEs) are the backbone of any national economy, a characteristic that is pertinent in Uzbekistan. Not only do SMEs account for almost 50% of the national GDP, but they also employ almost 80% of the workforce—the biggest source of employment in a nation where unemployment is high, at around 7%.

More than 60% of SME jobs are in rural areas, in agricultural businesses which may not initially come to mind when picturing typical recipients of supply chain finance.

But these businesses tend to grapple with a brutal cash flow cycle, characterised by payment delays. Businesses routinely endure waiting periods of 13 to 120 days for payment after delivering goods and services, a situation that has pushed countless promising enterprises to the brink of financial collapse. Contrary to conventional wisdom, most SME bankruptcies stem not from fundamental business weaknesses but from the chronic inability to manage receivables and maintain consistent cash flow.

Source: State Statistics Committee of the Republic of Uzbekistan

Uzbekistan’s novel, innovative supply chain finance programme promises to help surmount these barriers. The programme is spearheaded by the International Finance Corporation (IFC) in collaboration with the Central Bank of Uzbekistan, and funded by the Swiss State Secretariat for Economic Affairs (SECO).

Factoring

Speaking at the recent ‘Exploring Receivables and Payable Finance’ conference in Tashkent, Uzbekistan, Çağatay Baydar, Chairman of FCI, asserted that, “factoring is the ideal product for SMEs.” Its capacity to serve as a robust credit cover and guarantee mechanism makes it a robust solution. Baydar drew comparisons with Turkey, which underwent a remarkable journey from establishing its first factoring transaction 35 years ago to developing a robust industry now worth between 30 and 40 billion dollars.

Neil McKain, Uzbekistan’s Country Director for IFC explained the multifaceted approach. The programme is designed to introduce modern financial instruments that enable institutions to offer financing with minimal collateral by leveraging SMEs’ commercial transactions with larger enterprises. Factoring, in its simplest form, allows businesses to sell their accounts receivable to a third party at a discount; an immediate cash flow solution can be transformative for small enterprises.

The role of technology

The technological infrastructure underpinning this financial revolution is equally crucial. The programme aims to create a sophisticated digital platform that transcends traditional financial services. This is not merely about transferring money, but about creating an ecosystem that provides unprecedented visibility, automation, and risk management capabilities for businesses across Uzbekistan.

As Fevzi Tayfun Kucuk, SCF Technology Consultant at IFC, explained at the conference, technology plays a pivotal role in this transformation. The proposed platform will offer comprehensive functionalities including enhanced collaboration, process automation, robust risk management, and real-time transaction monitoring. It will create a transparent ecosystem that reduces operational costs, mitigates fraud risks, and provides unprecedented insights into financial flows.

Critically, the programme acknowledges the unique challenges faced by SMEs, particularly in terms of financial and digital literacy. The technology platform is designed to be intuitive, offering self-onboarding capabilities that lower barriers to entry and increase trust among small business owners. The platform will not only serve immediate financial needs but also align with local cultural dynamics, ensuring that the solution is truly tailored to the Uzbek context.

International support has been instrumental in bringing this vision to fruition; in particular, SECO’s contribution represents the international community’s recognition of Uzbekistan’s potential for economic innovation. SECO cited Uzbekistan’s vulnerability to external shocks and security concerns as a need to strengthen its resilience and is implementing Conflict-Sensitive Programme Management (CSPM) in response, bringing political economy analysis. Uzbekistan ranks 33rd on Transparency International’s global Corruption Perception Index (CPI), which is a key barrier to foreign direct investment, making SECO’s work with public services all the more important.

—

By addressing fundamental challenges of cash flow, access to credit, and technological integration, the country is creating a blueprint for economic empowerment that could serve as a model for other emerging markets.

The potential is enormous: a more dynamic, financially resilient SME sector that can drive economic growth, create jobs, and contribute to Uzbekistan’s broader aim to achieve the status of an upper-middle-income country by 2030.