Estimated reading time: 7 minutes

Business-to-business (B2B) transport and delivery practices are governed by Incoterms®, published by the International Chamber of Commerce (ICC). A typical contract for export/import is based on the Incoterms® rules and the contracts that surround it.

This covers:

- The obligation: which party organises the carriage and insurance of the goods, obtains shipping documents, customs clearance and export of import licences;

- The risk: which party bears the risk in the event of loss or damage to the goods at any specific point within the international journey, and at what point the risk is transferred;

- The costs: which party is responsible for which costs. For example, transport, packaging, loading or unloading costs, and checking or security-related costs.

The Incoterms® 2020 rules explain a set of the eleven most commonly used three-letter trade terms, e.g. Costs of Insurance and Freight (CIF), Delivered at Place (DAP). They should always be accompanied by the year of the publication of the Incoterms® referred to, and, most importantly, the precise place of delivery.

All Incoterms® other than DAP, Delivered at Place Unloaded (DPU)––a 2020 update to Delivered at Terminal and Delivered Duty Paid (DDP), are likely to subject the importing company to port and terminal handling charges at deep sea ports. Additional fees may include; handling and storage fees at the airport even if the exporter has paid for freight charges.

The term Ex Works (EXW) may imply a lower cost price, but it can present importers with a hurdle of challenges when booking freight forwarding and shipping in unfamiliar territory, requiring the buyer to arrange both export and import clearance.

Proficient importers may prefer to encourage the term Free Carrier–Shipper’s Address (FCA), in which the seller has a higher level of responsibility, but transportation obligations and risk end at the origin.

When moving goods under the FCA Incoterm®, the seller will be responsible for loading the goods, obtaining a despatch document and also for the export declaration––but not the transit documents if the goods are entering third countries prior to reaching their destination––particularly relevant for road freight.

A benefit for UK exporters that adopt FCA Incoterms rather than EXW, is ready access to the proof-of-export documents required to support zero-rated import VAT charged to overseas buyers.

Proof of export documents is a legal obligation to hold on file, used for supporting a claim to zero-rate overseas VAT. Simultaneously, buyers benefit from increased customs accuracy, as the exporter will have also had to have completed much of the same information required for import.

Free on board (FOB) is a frequently misused Incoterm® that should only be applied for non-containerised waterway transport.

In actuality, it is widely applied to containerised and air cargo. Its misuse may represent a higher level of risk for the seller, particularly the period between delivering the cargo to the harbour or airport and the cargo being transferred to the ship or the aeroplane by a crew external to the seller.

Incoterms to look out for

CIF and CIP

Cost of Insurance and Freight (CIF) implies a minimum insurance cover complying with Institute Cargo Clauses (C).

In this Incoterm®, the seller covers the costs of transportation to the destination; however, the risk of loss or damage to the goods transfers when the goods are on board the vessel.

It is possible that carriage may be transferred through several carriers for different legs of the sea journey. For example, first, by a carrier operating a feeder vessel from Hong Kong to Shanghai, then on to an ocean vessel from Shanghai to Southampton.

The question arises here whether the risk transfers from seller to buyer in Hong Kong or in Shanghai: in other words, where does delivery take place?

The parties would be advised to determine this in the sale contract itself.

Where there is no agreement, Incoterms® 2020 states the default position is that the risk transfers when the goods have been delivered to the first carrier (i.e., Hong Kong), increasing the period during which the buyer incurs the risk of loss or damage.

Should the parties wish the risk to transfer at a later stage, they should specify this in the contract of sale.

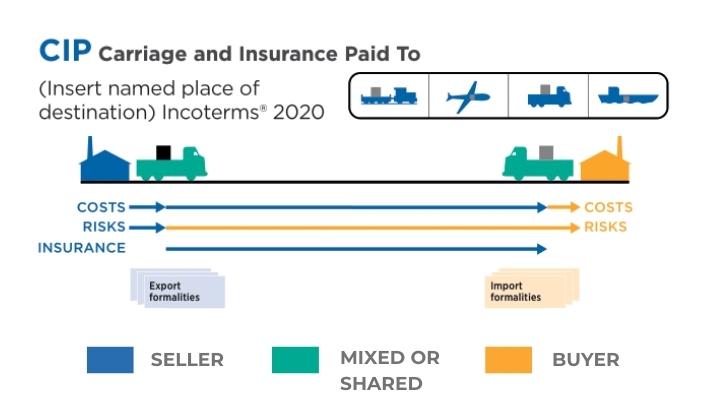

The CIF rule is to be used only for sea or inland waterway transport; when more than one mode of transport is used, which is common when transporting containerised cargo, it is advisable to use Carriage and Insurance Paid To (CIP) rather than CIF.

Under CIP a default level of insurance cover must be provided under Institute Cargo Clauses (A). The insurance shall cover, at a minimum, the price provided in the contract plus 10% (i.e. 110%) and shall be in the currency of the contract.

DDP

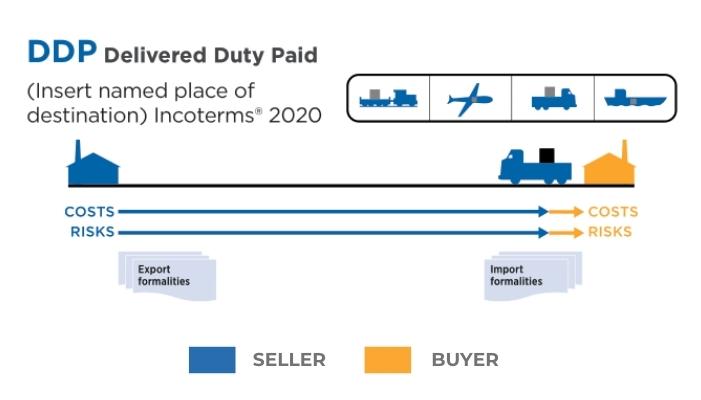

Another term to be used subject to careful consideration is “Delivered Duty Paid” (DDP), which may be the easiest to sell, but also may present as the most difficult to cost.

In situations where DDP is used, the exporting party must have established registered premises––and an Economic Operators Registration and Identification number (EORI) in the importing territory––or have confirmed a customs broker willing to act as an indirect representative in advance.

Indirect representation will occur when a company that does not have a registered UK presence appoints a customs agent to act as their UK representative.

HMRC identify that “if an agent makes a customs declaration as an indirect representative of the principal, the agent and principal will be jointly liable for any customs debt. HMRC may seek payment from either the agent or the principal.” (HM Revenue & Customs, 2016/2021).

Therefore indirect representation incurs a high level of risk to the importing customs agency as they are likely to have to pay a professional indemnity (PI) insurance premium for offering this type of service, as only direct representation––where the principal has sole liability for the customs debt, is covered in a standard PI policy.

Customs valuation compliance and DDP Incoterms®

As DDP Incoterms® present a higher likelihood for indirect representation to occur, the customs agency is likely to scrutinise the customs valuation methodology.

For low-value imports conducted on a business-to-consumer (B2C) basis on behalf of an established company, with a readily auditable compliance trail––for example, reputable e-commerce companies where a sale for export is evident and the price list is visible on their website––this may not present an issue.

For international branch transfers of goods (i.e., when an international branch sends goods to a third-party logistics (3PL) warehouse), the customs broker is likely to conduct significant due diligence concerning the customs valuation method of the goods, as there is an increased potential for an underestimate of values to occur.

For one-off shipments, high-value goods, excise, and for companies new to trading with little or no trading history, it may prove challenging to locate a customs broker willing to act as an indirect representative/Importer of Record due to the increased potential of fraud.

When presented with the option of DDP Incoterms® by an overseas seller, VAT-registered importers would be advised to suggest an alternative term such as DAP, and register for a CDS account with access to a cash account to pay customs duty if liable directly to HMRC, and adopt the use of postponed accounting (PVA). This is likely to result in a significantly lower invoiced price.