In a sporting moment that seemed so magical and unrealistic for all observers, the long-time and legendary Los Angeles Dodger announcer Vin Scully made a call that lives on in American sports history.

“In a year that has been so improbable, the impossible has happened!”

After years of dealing with the oppressive clouds of COVID-19, the world has since experienced the bloodiest land war in Europe since World War II, inflation levels unseen since the 1980s, rising interest rates, and large scale political instability across all regions. And now, a looming debt crisis in the US.

As Vin Scully’s voice rings on in broadcasting lore, he seems to have unknowingly captured the events of May 2023 pretty well.

The US government has long represented one of the most stable investments in international finance. US government Treasury Bills, also known as T-Bills, have long been considered a zero-risk investment.

As of April 2023, there are more than $23 trillion in outstanding US T-Bills.

The volume of T-Bill trading and perceived risk-free sentiment is because the US government has never defaulted on their debt, and the very idea of this concept seems utterly absurd.

Or does it?

The US is currently experiencing infighting within their government, with a Democratic White House and Senate and a Republican held House of Representatives clashing in negotiations. The contending parties have attempted numerous rounds of meetings, but reports have suggested there has been very little positive movement in recent weeks.

While the odds are still in favour of the US government passing a last minute deal to raise the debt ceiling, this is the recent political statement has made the global economic system ponder a new reality. What would actually happen if the US defaulted on their debt?

The implications would be far reaching, impacting almost every industry across all nations. But first, let’s look at the impact on the general economy.

Hello 2008, we didn’t miss you

The Global Financial Crisis (GFC) is a time that many across the world would like to forget. According to the US Bureau of Labor Statistics, the GFC directly led to 8.8 million unemployed Americans, and the UN has estimated that 27 million jobs were lost globally.

To put that into perspective, 26.4 million people live in Australia in 2023. That is a lot of unemployment.

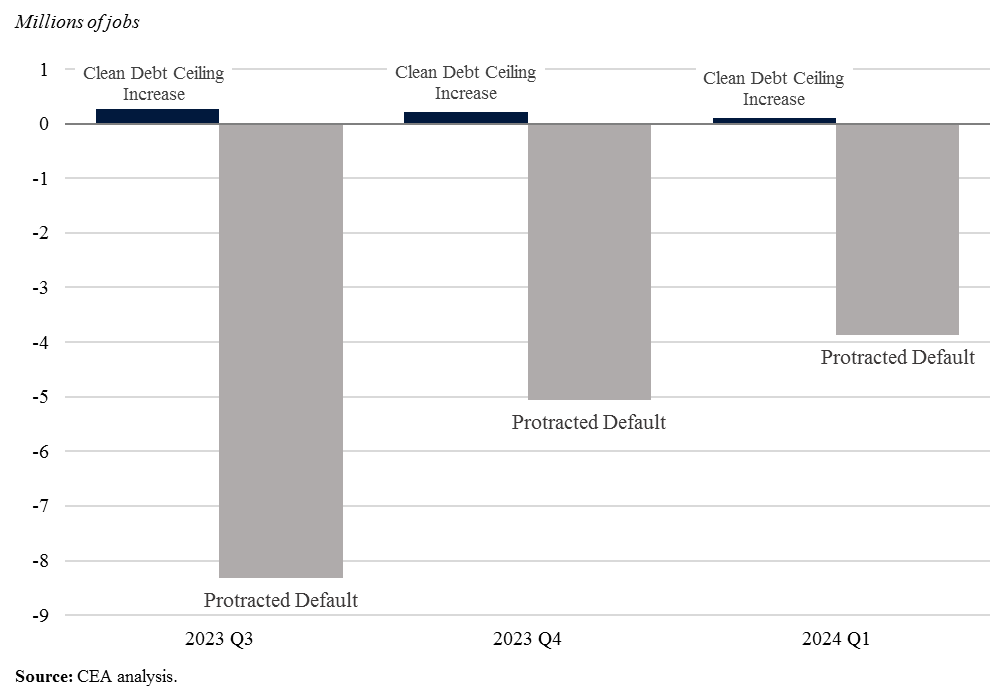

However, the Council for Economic Advisors (CEA), an agency within the US Federal Government, thinks that a debt default in 2023 could create an economic downturn that could match the smouldering wreckage that was in 2008/2009.

In the US alone, the CEA predicts that 8 million Americans could lose their jobs in Q1 of 2023, paired with a 45% decrease in stock market levels.

Source: CEA

There are no official studies on the impact on global employment rates, one could make a rough estimate and draw parallel lines to job losses in the GFC. If the US defaulted on their debt for any protracted period, the world could very easily see job losses in the 20+ million range.

Impact on credit ratings and interest rates

In early 2011, S&P downgraded the US credit rating from AAA to AA+, and Fitch and Moody’s followed suit later that year. Since this time, the US credit rating has once again reached AAA rating, but even a short term default on their debt could cause a downgrade once again.

Moody’s Chief Economist, Mark Zandi said, “A downgrade of Treasury debt would set off a cascade of credit implications and downgrades on the debt of many other financial institutions, nonfinancial corporations, municipalities, infrastructure providers, structured finance transactions, and other debt issuers.”

A downgrade in credit ratings will lead to a steep rise in interest rates, which could have a devastating effect on the economy. In a time where many are already criticising the Federal Reserve for aggressive monetary tightening, borrowers would be faced with an increased credit crunch.

On Wednesday, Moody’s announced that they might take action to downgrade the US credit rating even prior to a debt default due to “increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit.”

Fitch and DBRS Morningstar followed suit and warned that the United States credit was put on review for a downgrade.

International trade: a tsunami wave of downside

Though the US defaulting on their debt is technically a domestic issue, as the government has the ability to increase their debt ceiling, the fallout would hardly be contained by the American borders.

Globally, governments and individuals rely on the US dollar as a safe investment, and the dollar is the most prevalent currency used in international trade. According to the Federal Reserve, foreign investors hold 35% of all T-Bills, or roughly $7.5 trillion.

Since World War II, the USD has dominated international trade, and this trend has remained steady. Studies have shown that 96% of all trade in the Americas and 74% of trade in Asia was invoiced in USD from 1999-2019.

But this is only the tip of the iceberg. Central banks across the world are heavily reliant on the USD. The IMF reports that the USD accounts for 58% of all foreign exchange (FX) reserves, followed by the euro at 20%.

The USD stability underpins the entire international trade ecosystem, not only because of foreign-held assets, or central bank FX reserves, but also purely by the size of US consumer demand. In March 2023, the US imported $320.4 billion of goods.

If the US defaults on its debt, it will undoubtedly cut domestic consumer demand, creating a clear ripple effect into international trade. The US consumer will likely purchase less high end cars from Germany, or cut back on buying electronics from China.

If the dollar drops significantly in value, traders who receive payments in USD will see their balance sheets suffer. Though domestic American businesses and individuals may feel the brunt of the pain from a debt default, the entire international trade ecosystem will be severely impacted.

Geopolitical consequences

Economics, finance and politics are all inherently connected. And when a monumental event happens in one of these three spheres, the others face ramifications as well.

A debt default would signal that there are serious, underlying issues with the US political system in 2023. While there have been examples of debt ceiling standoffs before, most notably in 1995, 2011 and 2013, the government has always made a deal.

But the political fighting may have already caused far reaching damage. Investors are beginning to bet against the US Treasury. According to Moody’s, credit default swaps on treasury securities, the instruments used as insurance if the US defaults on their debt, have almost doubled in recent weeks.

One cannot see the rise in credit default swaps as anything other than the international world both losing faith and hedging against the US government.

Additionally, we have seen increasingly loud calls for the move away from the USD in international trade, most notable, Brazil’s President Lula. Even if the US passes a last minute debt ceiling deal, the intense fighting over a basic political instrument can provide credence to the opposition’s arguments.

With an agreement needed by 1 June, there is increasing urgency to strike a deal, leading to a meeting between Republican Speaker of the House, Kevin McCarthy, and Democratic President Joe Biden.

Though the meeting signals a possibility of increased cooperation, the two sides still remain far apart in terms of negotiations. Both parties publicly expressed frustration with the other side’s demands.

If the political posturing genuinely leads to a debt default, the geopolitical implications may have a longer lasting effect than the economic issues. Which is saying something, as upwards of 8 million American jobs, and countless international jobs would be lost.

However, it is still more than likely that a deal will be struck in the 11th hour, as everyone involved knows the magnitude of this situation.

While the general consensus seems that the US will not default on their debt, and this is mostly an exercise of political infighting, we cannot rule out the worst case scenario.

Mark Zandi summarised what many are thinking. “What once seemed unimaginable now seems a real threat.”

This article was updated on Thursday, 25 May to include the Moody’s statement.