Estimated reading time: 7 minutes

Latin America is alive with the energy of a digital transformation, offering unrivalled growth opportunities for international businesses. With a tech-savvy youth population and rapidly increasing internet penetration, the region’s e-commerce market is forecast grow by 25% in the coming years. This transformation is not only reshaping shopping habits but also unlocking new opportunities for innovation and expansion.

The unique combination of youthful demographics and technological growth makes this opportunity particularly compelling. Latin America’s young, digitally literate population is not just consuming online content but also actively shaping the trends that drive the e-commerce market. Meanwhile, improving infrastructure, growing financial inclusion and an openness to innovation are creating an environment ripe for businesses to thrive. The region offers a dynamic landscape where companies can test, grow, and scale in a way that few other emerging markets currently allow.

To capitalise on this opportunity, businesses must go beyond merely entering the market. They need to adapt to local customs and consumer behaviour. For businesses operating or entering into new markets accepting payments efficiently can be a daunting task. It is important for businesses to understand local markets and address their unique challenges.

Why Latin America is a prime growth opportunity

E-commerce in Latin America is flourishing. The pandemic accelerated an already strong shift towards online shopping, with the region recording some of the highest global growth rates between 2019 and 2021.

A key driver of this growth is the rise of digital adoption. Digital payment systems like Brazil’s Pix have significantly improved financial inclusion, bringing over 150 million users into the digital economy and achieving a 75% penetration rate—double that of credit cards. Pix exemplifies how innovative payment technologies can transform access to financial systems, recently reaching 122 million customers: more than half of the population.

Similarly, Rappi is a Columbian-based, on-demand delivery service with more than 30 million users and a presence in more than 100 cities in nine countries.

Furthermore, such technologies reduce friction in transactions, fostering trust and convenience for users. This trend is bolstered by a younger population that is eager for digital-first solutions and willing to adopt new technologies.

A 2023 study by Wunderman Thompson asked shoppers in the region’s four largest e-commerce markets — Argentina, Brazil, Mexico, and Colombia — about the most important aspects of making an online purchase. The product’s price and accurate description were the most important factors for 70% of respondents, while e-commerce logistics also played key roles: high proportions responded in favour of delivery speed (65%), free shipping (63%), or a simple returns process (62%).

While the infrastructure is in place, wallet providers must still provide a strong enough value proposition to convince the Latin American population to change spending patterns. In Brazil, half of the respondents to a McKinsey payments survey said they spent no more than 300 reais ($56) a month through their digital wallets. In Latin America, cash still accounts for 36% of widely used despite the pandemic.

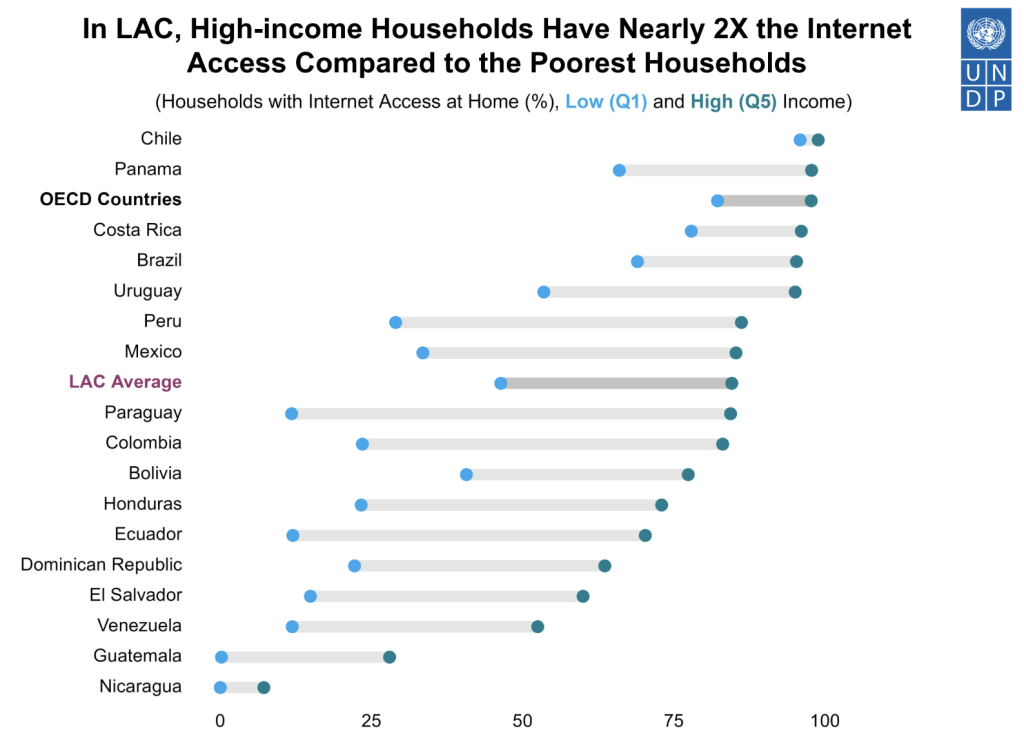

This problem is exacerbated by unequal internet access across the region, particularly across socioeconomic divides. But a crucial step forward has been countries like Costa Rica, Dominican Republic, and Panama including lack of internet access in their Multidimensional Poverty Indices.

As telecommunications infrastructure improves across the region, thanks to government investment, access to the internet is becoming more widespread, enabling even rural and underserved communities to participate in the digital economy.

Overcoming challenges in Latin America’s payment landscape

Entering Latin America’s e-commerce market comes with its share of challenges. Complex regulations, diverse consumer behaviours, and operational hurdles must be addressed to unlock the region’s full potential. While the opportunities are immense, businesses must be prepared to navigate these challenges strategically.

One of the most pressing challenges is the high proportion of unbanked individuals. About 26% of Latin America’s population lack access to a bank account, making traditional payment methods inaccessible for a significant portion of the population. Alternative solutions, such as cash-based systems, prepaid cards, and mobile payments, are important to cater to this demographic. Businesses that fail to consider these preferences risk alienating a large segment of potential customers.

Fraud and security concerns are also prevalent in the region, necessitating robust protective measures to build trust and ensure smooth transactions. Latin America has the world’s highest credit card fraud rates, and the highest revenue loss to fraud, at 20%.

As the Brazilian digital evolution is in its infancy, the shift online has resulted in an increase in authorised push payment (APP) scams: according to ACI Worldwide and GlobalData report, Brazilians lost nearly $247 million to APP scams in 2022; this value is set to increase at a CAGR of 21%, to reach $635.6 million by 2027.

The prevalence of fraud underscores the need for advanced fraud detection technologies and strong regulatory compliance measures. Moreover, inconsistent consumer protection laws across countries complicate efforts, making it imperative for businesses to understand the legal landscape thoroughly.

Regulatory complexities stemming from varying cross-border trade policies add another layer of difficulty. Countries in Latin America have unique regulatory requirements, which can pose challenges for businesses operating across multiple markets. From taxes and duties to data protection laws, businesses need to ensure compliance while managing costs and operational efficiencies. Additionally, operational inefficiencies, including high interchange fees, currency fluctuations, and variable transaction approval rates, add further obstacles to market entry.

Businesses that fail to address these challenges risk missing out on substantial opportunities and may struggle to make a meaningful impact in the region. However, for those willing to adapt and innovate, these hurdles can be turned into stepping stones for success.

Strategies for payment success

Success in Latin America’s dynamic e-commerce market depends on implementing a payment strategy tailored to local preferences and practices. Payment behaviours in the region are influenced by deep cultural and economic contexts, making it essential for businesses to adapt. Aligning with these preferences helps companies build customer trust and improve UX, thereby boosting conversion rates.

To achieve this, offering a wide range of payment options is essential. Businesses must incorporate traditional methods, such as cash and bank transfers, alongside digital alternatives like e-wallets, prepaid systems, and mobile payments. Digital wallets, in particular, are becoming increasingly popular due to their convenience and security, especially among the younger, more tech-savvy demographic. By tailoring payment solutions to reflect local practices, businesses can better meet customer expectations, drive engagement, and increase profitability.

Operational challenges such as managing transaction approval rates, navigating high interchange fees, and addressing currency fluctuations significantly impact profitability in the region. To mitigate these issues, businesses must work closely with payment experts who offer advanced payment technologies and in-depth local expertise. Tailored solutions that adapt to diverse markets and industries are essential for streamlining operations, reducing costs, and maintaining a competitive edge. These partnerships enable businesses to effectively address the complexities of cross-border commerce, ensuring consistent performance across varying economic and regulatory landscapes.

However, success in the region requires more than understanding market preferences — addressing regulatory complexities is equally important. Each Latin American country has distinct financial regulations, compliance requirements, and legal mandates. Businesses must ensure adherence to anti-money laundering (AML) laws, data protection protocols, and taxation compliance. For example, compliance with Brazil’s General Data Protection Law (LGPD) or fulfilling tax obligations in Mexico demands thorough attention.

By combining a localised payment approach with operational efficiency and regulatory compliance, businesses can capitalise on the vast opportunities within Latin America’s vibrant e-commerce landscape.

—

Latin America’s e-commerce boom reflects a global shift in economic priorities. The region’s growing middle class, increasing connectivity, and rising consumer power driving demand for digital solutions.

Latin America also serves as a unique testing ground for innovations that have the potential to scale globally. As businesses succeed in adapting to the region’s challenges, they can set the standard for best practices in emerging markets globally.