A new report has forecast that the UK economy will grow at a faster pace than any of its G7 rivals in 2021, but growth globally is losing momentum.

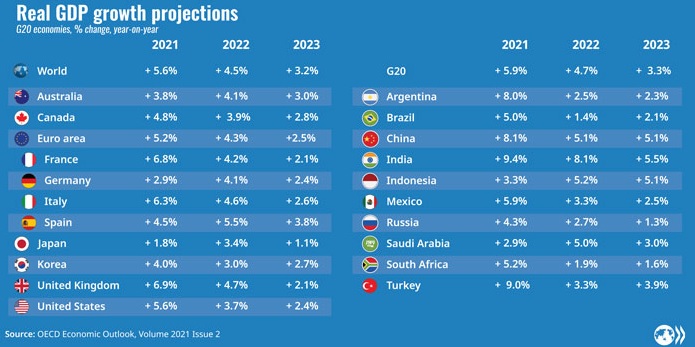

The latest Organisation for Economic Co-operation and Development (OECD) Economic Outlook, published yesterday, found that the UK economy is projected to grow 6.9% year-on-year.

The UK’s strong forecast among the G7 was closely followed by France at 6.8% and Italy at 6.3% – both comfortably above the world average of 5.6%.

Several G20 economies put in even stronger results, however, namely India at 9.4%, Turkey at 9%, China at 8.1%, and Argentina at 8%.

Overall, the OECD sees the global post-pandemic economic recovery continuing, but warned of growing imbalances and risks, including inflation.

The report found that output in most OECD countries has now surpassed where it was in late-2019, and is gradually returning to the path expected before the pandemic.

The OECD therefore projects a rebound in global economic growth to 5.6% this year and 4.5% in 2022, before settling back to 3.2% in 2023, close to the rates seen prior to the pandemic.

Challenges ahead

The strong pick-up in activity seen earlier this year is losing momentum in many advanced economies, the report warns, due to production bottlenecks, labour shortages, and inflation.

As Trade Finance Global reported last week, over 80% of businesses in the UK and the US say that their input prices have risen due to inflation during the pandemic, and many are now passing on those price hikes to consumers.

Moreover, rising food and energy prices threaten to put a brake on consumer spending, adding to a potential downward spiral that could lead to a stagflationary environment of inflation plus slow growth.

The OECD report notes that gas prices have risen sharply, particularly in Europe, and storage levels are around 28% lower than they would normally be at this time of the year.

On the bright side, the OCED expects that if key bottlenecks ease, capacity expands, demand rebalances, and more people return to the labour force, then inflation should begin to subside in 2022.

However, a potential slowdown in China driven by contractions in its highly speculative property sector could also disrupt the global recovery.

The OECD concludes that the impact of such a slowdown would spread rapidly to other countries, particularly if it generated uncertainty in global financial markets and added to the current bottlenecks in supply.