Estimated reading time: 6 minutes

Creation of UK Freeport Programme

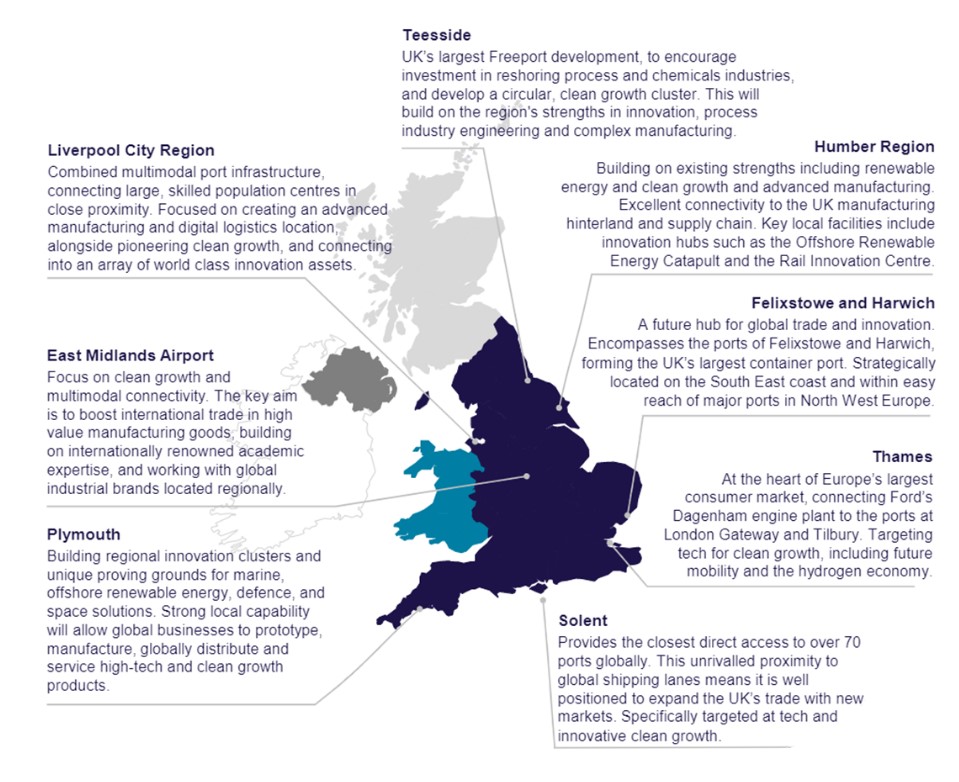

Large national infrastructure projects have rarely been delivered at the pace of the UK Freeport programme; in March 2020, the government launched its consultation document, and in March 2021 it was announced that, subject to completing the necessary authorisation processes, the above eight locations would become Freeports. By March 2023, all eight locations should have been officially designated, and each receive £25 million seed capital funding. The original eight sites will be followed by more Freeports in Scotland and Wales.

The timing of government designation for the Freeports and corresponding delivery launches early in 2023 is crucial to the recovery of the UK economy as it deals with the results of a sequence of unprecedented challenges; Brexit, COVID-19, the accidental blocking of the Suez Canal, global industrial unrest, and war in Eastern Europe.

Global supply chains are currently undergoing a period of transformational change, and new business models are rapidly evolving to cope with continual international disruption. For UK based businesses, supply chain sustainability and resilience are becoming a priority. This factor, combined with new trade agreements, is driving change in trade flows as the trend for near and on-shoring of manufacturing and energy capacity accelerates. The three core objectives driving the UK Freeport programme are aligned to:

- Establish Freeports as national hubs for global trade and investment by focusing on delivering a diverse number of investment projects within the Freeport regions. Make trade processes more efficient, maximise developments in production, and acquire specialist expertise to secure Freeports position within supply chains.

- Create hotbeds for innovation by focusing on private and public sector investment in research and development. This can be done by being dynamic environments that bring innovators together to collaborate in new ways; and by offering spaces to develop and trial new ideas and technologies. This will create new markets for UK products and services, and drive productivity improvements, bringing jobs and investment to Freeport regions.

- Promote regeneration through the creation of high-skilled jobs in ports linked to the areas around them, ensuring sustainable economic growth and regeneration for communities that need it most. Local economies will grow as tax measures drive private investment, carefully considered planning reforms facilitate construction, and infrastructure is upgraded in Freeports.

The first objective, to establish freeports as national trade hubs and play an ever-increasing role in accelerating the UK’s international trade and investment strategies is clear. The government claims that Freeports will be significant “in boosting international trade, attracting inward investment and driving productivity across the UK”. All freeports will be targeting industries and sectors that will be driving the development of advanced logistics, manufacturing and research, and development activities that highlight the region’s existing strengths and trading partners.

Beyond the direct support for import and export activities, Freeports will become special economic areas within a 45 km boundary, whereby a broad range of general tax relief will be available for businesses to regenerate areas known as “Tax Sites”. Each Freeport has three such tax sites development areas, giving the UK several thousand hectares of prime port-based development land with significant tax breaks. Those measures will include the following:

- Enhanced capital allowances. Companies in Freeport zones which invest in qualifying plant and machinery will be able to offset the cost against any taxable profits in the first year. That gives them an immediate increase in post-tax profit as well as helping improve cash-flow. With the abolition of the original enhanced capital allowances scheme, it provides a replacement in Freeports and an added incentive for businesses to invest.

- Enhanced structures and buildings allowances. Capital spent on renovating non-residential buildings and structures will attract an annual 10% relief against taxable profits spread over ten years. This is much better than the relief currently available nationwide, which is set at 3% p.a. over thirty-three and a third years. The new relief will be available on defined expenditure, providing building contracts are signed and the qualifying assets are brought into use between 1 April 2021 and 30 September 2026.

- Employer National Insurance contributions rates relief. Freeport employers won’t have to pay any employer NI contributions on their staff salaries, provided these employees spend 60% or more of their working hours in the Freeport.

- Business rates relief. Up to 100% relief on business rates will be available on certain business premises in Freeports. Local authorities will be given the power to set the details of this scheme in their own Freeports.

- Stamp duty land tax relief for purchases of land and buildings within a Freeport tax site, subject to a ‘control period’ of up to 3 years and the land being acquired and used in a ‘qualifying manner’.

Complementary to building trade connections is the ability to ease cross-border friction for goods, particularly for a net importer such as the UK. Multiple customs site operators (CSO’s) currently being established within all the UK Freeports benefit from a suite of customs easements such as:

- Duty Deferral. Available whilst goods are on the freeport site

- Duty Inversion. Available where the tariff on the finished goods is lower than on the component parts

- Duty Exemption, where goods are imported into a freeport for processing and subsequently re-exported

- Suspension of import VAT

- Simplified import procedures

Conclusion

Innovation goals for UK Freeports are wide ranging and adapted to the unique characteristics and strengths of each area. Many are concentrating on green energy such as offshore wind farms, and enabling a low-carbon multimodal infrastructure based on accelerating the shift to alternative fuels for road, maritime and port facilities, and facilitating modal shift from road when appropriate.

The Department for Business, Energy and Industrial Strategy, together with Innovate UK, is responsible for delivering the UK Innovation Strategy, which aims to create the conditions for all businesses – including those within Freeports – to innovate.

As part of this, the Freeports Regulation Engagement Network (FREN) will help businesses innovate within the Freeports, and help them overcome the challenges of understanding regulation as they develop, test and apply new ideas and technologies. The network is intended to launch as Freeports become operational. The Department for Business, Energy and Industrial Strategy champions innovation, clean growth, and net zero goals and is responsible for engagement to help Freeports play a role in meeting those goals. The Department for Transport is responsible for engagement with the transport stakeholders to make sure all the core objectives align with existing departmental objectives.

Once operational, Freeports can successfully be integrated into the wider transport sector. Freeports support the Department for Transport’s ambition for a freight strategy which builds on the UK’s status as a global facing port nation. Freeports will amplify UK ports of all modes as hubs for innovation and investment, transforming our freight systems.