Estimated reading time: 8 minutes

Trade and supply chain finance provide innovative solutions for the working capital gap faced by growing companies. They can unlock the potential in businesses by accelerating cash flows, providing finance, reducing the end-to-end trade cycle, improving financial ratios, and mitigating counterparty and other risks in cross-border transactions.

Traditional Trade vs Supply Chain Finance

Trade finance can be segmented into two broad streams, both of which address the contradicting interests of the buyers and the sellers:

– traditional or documentary trade, and

– supply chain finance

Traditional or documentary trade has been in practice for many centuries and involves banks acting as intermediaries to facilitate the exchange of payments for shipping documents. This is recognized as transaction/shipment-based finance, risk mitigation, and payment for underlying transactions between buyers and sellers.

Supply chain finance, on the other hand, is a flow-based finance technique where banks have a lower level of intermediation in the activities. The financing is structured based on agreements, representations, and warranties between the parties in the transaction.

Transaction structures will focus mainly on the undertaking to be paid by buyers or supplier’s right to receive the payments on an open account. Risk mitigation is also a feature of these transactions, and it is achieved by the implementation of various controls, such as risk-sharing, risk transfer, or by having third parties within the transaction flow/financing structure. Usually, clients will share transaction data with banks to obtain finance and the finance will be in bulk based on the data.

An estimated 90% of trade transactions are settled on open account terms, providing space for supply chain finance to grow.

Working capital solutions on trade and supply chain finance

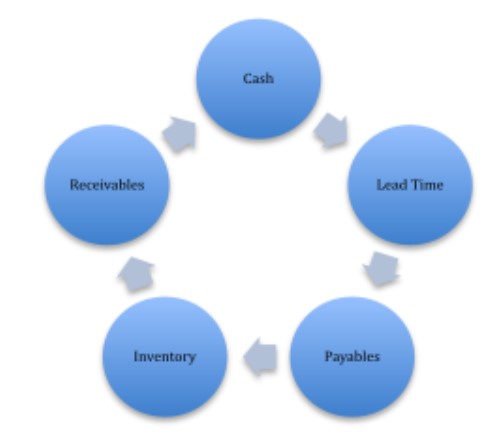

Understanding the working capital gap or cash conversion cycle (CCC) and finding competitive solutions to finance (such as increasing payable days or reducing lead times, inventory days, and receivable days) are of paramount importance to any business today. CCC starts with cash and ends with cash.

Figure 1.1 shows the cash conversion cycle for any business, however, some businesses may or may not have all components of CCC.

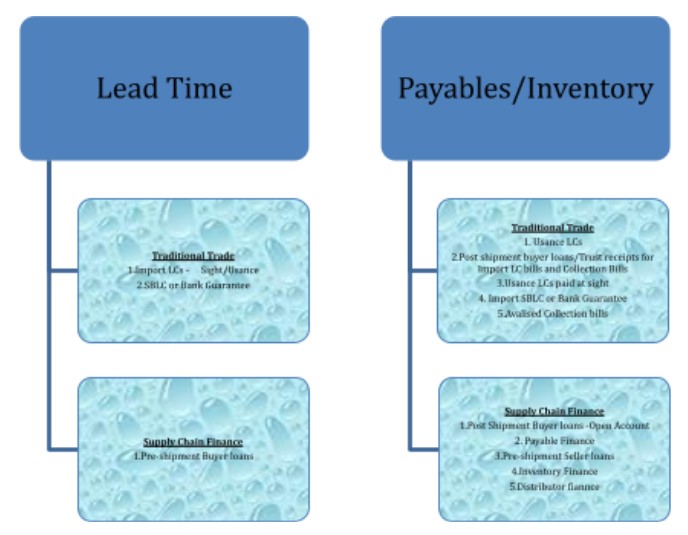

The cash conversion cycle shown above can be illustrated in another form to simply understand the role of trade and supply chain finance. Figure 1.2 illustrates the trade cycle transposed from figure 1.1. The CCC in figure 1.1 was detached from component “cash” and demonstrated horizontally to come up with the trade cycle in figure 1.2.

As shown in figure 1.2, a trade business will pay cash to their suppliers, go through lead time, inventory, and receivable phases to receive cash from the customers. The length of the trade cycle will depend on the total number of days that the business will take for each component/phase. Therefore, reducing the cycle and increasing the turnover will provide growth to any business.

Figure 1.3 illustrates traditional trade and supply chain finance products and solutions that can be applied to each phase in the trade cycle. Traditional trade and supply chain finance products and solutions will focus on providing:

- Finance

- Increased payable days (DPO)

- Reduced lead time

- Reduced inventory days (DIO)

- Reduced receivable days (DSO)

- Risk mitigation

- Improve balance sheet ratios, and

- Collection of payments

Evidently, all solutions attempt to unlock potential and reduce the period taken from cash to cash. Therefore, trade and supply chain solutions can be called products for accelerating cash flows for business growth.

What are the drivers for traditional trade and supply chain finance?

Drivers for banks

Control of goods considered as collateral through shipping documents – Most traditional trade products require shipping documents to be channelled through banks. Therefore, underlying goods/documents serve as collateral for any financing provided for transactions. Banks will be able to sell the related goods and recover their funds in an unlikely situation of default. This is not a feature in supply chain finance transactions.

Control of payments – Most traditional trade products require banks to make payments via MT202. The settlements will be made bank-to-bank, and the banks can maintain proper control over the settlements. If a bank has provided finance, the payment will be used to repay the related finance and the customers cannot use the payment for any other requirement as it will not be credited to their account. This may not be a feature in supply chain transactions. However, some banks will try to maintain the same control by having blocked accounts for supply chain finance payments.

Screening of documents for AML/sanction concerns – Banks are privileged to comprehend shipping documents in traditional trade transactions. This ensures that the information in the documents is screened for AML and sanction concerns. This makes traditional trade much less risky from an AML/sanction perspective when you compare financing clients via supply chain finance or OD/Loan products offered by banks.

Cost related to operations – Supply chain finance is flow-based finance and finance aligned with the data exchanged between parties. Therefore, the data exchange and finance under supply chain finance can be fully automated. As a result, supply chain transactions can be managed with fewer staff and resources compared to traditional trade finance. This will reduce cost and time in supply chain transactions.

Fee-based income – Traditional trade transactions provide fee revenue for banks. This is a major attraction for financial institutions since banks do not have to use their capital to be in this business. On the other hand, if capital is used for financing, then the profitability of the financing will be increased via fee-based income earned through transactions. Comparatively, supply chain finance may attract less fee-based income and is mostly seen as interest income earned through financing.

Drivers for clients (Buyers/Suppliers)

Costs related to transactions – Traditional trade finance requires the banks to provide services in issuing LCs, advising LCs, sending/receiving documents, checking documents, effecting, and collecting payments. The services will include charges. Therefore, this may be treated as expensive when compared to supply chain transactions.

Processes – The traditional trade finance process is governed by ICC publications such as UCP600, URC522, ISP98, URDG758, ISBP, etc. Hence, this may be complicated for new clients who do not have experience in this capacity. In addition, these processes may be less flexible in certain situations. Also, hiring staff who has trade experience will be a challenge as most of the relevant experience is spread across banks. Traditional trade is a niche, therefore, attracting trade professionals from other organizations will be seen as a major challenge. Comparatively, supply chain finance transactions are much easier to comprehend and can be cultured more smoothly than traditional trade.

Time for E2E process – Mostly traditional trade products may have to go through comprehensive verification before financing or receiving payments from the financier or the counterparty banks. As a result, may take an extended time for the clients to obtain finance and to receive the payments. As for supply chain finance, you can argue that it will take less time to obtain the payments.

Drivers for Fintech

Digital disruption – The banking industry is going through a major digital disruption and customer expectations are rising. fintechs are helping the banking industry to cope with the demand. You could say that the banking industry had been technologically rich in terms of supply chain finance relative to traditional trade finance. Also, it can be argued that supply chain finance is easier to digitize as it is flow-based and financing is based on data exchanged between various parties involved in the transactions. Furthermore, enhanced developments are being offered in the supply chain space.

However, the traditional trade space is going through an era where stakeholders are trying to be comfortable with the digital solutions offered by various fintech. Traditional trade is involved with manual documents, hence, digitizing documents as well as issuing and exchanging them digitally are major challenges faced by the traditional trade space.

These fintech solutions are fee-based and may be owned by fintechs while they add value to the banking industry. The users, comprised of mainly corporates, may need to pay fees to the fintech.

Conclusion

In summary, traditional trade and supply chain finance products can finance any stage of the customer’s trade cycle. Historically, a product’s innovation has helped clients to substantially grow their business. There are different drivers for banks, clients, and fintechs to choose between the two streams.

Trade flows are forecasted to reach USD27 Trillion in 2028, with effects of Covid19 and with a moderate V-shaped recovery. The ICC Banking Commission estimates that 90% of trade transactions are settled on open account terms. However, there is an expectation for traditional trade to grow in the short term due to the ongoing COVID-19 situation. Historic statistics and trends reveal that supply chain finance will be in growth mode for the next decade.

The digital disruption may make traditional trade finance more competitive in the future. Nevertheless, it is up to the industry to accept the digital solutions presented by various stakeholders to enable traditional trade to compete with supply chain finance.

This article was created as part of the International Trade Professionals Programme 2021.

Learn more about this incredible programme here.