2022 was a year of ups and downs for trade technology, but we expect to see technology play an increasingly important role in trade finance in 2023.

There are many questions about how these new technologies will be integrated into trade finance. It is imperative that conversations continue to be held by industry experts, hopefully leading to new and innovative answers.

To try to find some of these answers, TFG’s Brian Canup asked industry leaders about emerging trade technologies, important strategic focuses, and corporate approaches in an increasingly tight market.

Iain MacLennan (IM), VP of product management and trade at Finastra, and Patrik Zekkar (PZ), CEO of Enigio, Patrick DeVilbiss (PD), head of product at CGI and Alisa DiCaprio (AD), chief economist at R3, provided us with their predictions for the trade technology landscape in 2023.

Using tradetech to grow trade finance

BC: What technologies are emerging that will help grow trade finance?

IM: Digital trade ecosystems will accelerate in 2023.

Paper documentation and signatures have long burdened the industry, stunting the growth of digital and inclusive trade. Overcoming these barriers is no easy feat, but progress is happening.

The Model Law for Electronic Transferable Records (MLETR) laid the foundation to make eDocs legally valid. This has since been adopted by several jurisdictions, including Bahrain, UAE, Singapore, and recently, the UK.

We expect more markets to adopt MLETR in 2023 and beyond, which will have a significant impact on international trade. It will become easier and cheaper for firms to buy and sell internationally, while promising real progress in reducing the trade finance gap for MSMEs.

To support this infrastructural growth, banks will need to prioritise digitisation through ecosystem play.

By integrating channels, third-party services, and connecting digital islands, they can provide corporates with the services they expect, while supporting the journey towards a sustainable and inclusive trade finance industry.

PZ: Moving trade initiatives from analog to digital has developed in two different directions in recent years.

First, centralised platforms with data management and transactions have moved within the “closed garden” concept.

Secondly, the decentralised digital document concept has replicated the physical document’s contained data management, but with independent, open and free transferability.

History gives us a good direction to predict the (near) future. All surviving communication and data transfers have to, sooner or later, become globally accessible.

So, the two trade initiative directions will inevitably converge.

The key prerequisites for interoperability, i.e., legal, regulatory, and technology, will become available in time for the industry to sort out how to do it.

2023 will be the year of the how.

Focus on adoption and client needs

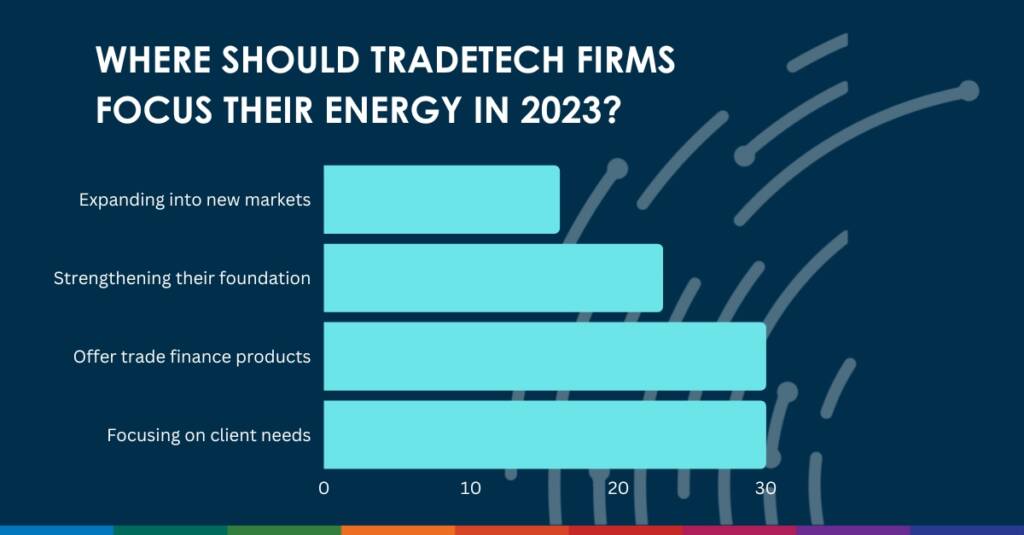

BC: Where should tradetech firms focus their strategy?

PZ: Adoption, adoption and adoption.

A well-known particular in trade finance is that the product is the process. It is the various process steps (create, issue, amend, sign, transfer, check etc.) of the documents that originate and complete the transaction.

Be humble to the complexity and history. Trust and acknowledgement in the trade processes and structures, as they have taken many, many years to be adopted and cemented.

Change does not come in a leap, it comes in a transition. It is unlikely to go from physical paper processes and structures in trade, to solely data matching in one major global leap.

There needs to be a transition, where recognised trade processes, policies, and customs are adhered. This has to happen digitally, and without large investments in IT.

This transition needs to occur in both developed, and developing markets.

Additionally, the solutions not only need to solve the “here-and-now” digital transition, but also the longer-term digital requirements. The next step is solving how automatic data matching is achieved within the larger trade community.

Tradetech strategy for 2023. Blockchain, AI or APIs?

BC: What technologies are emerging that will help grow trade finance?

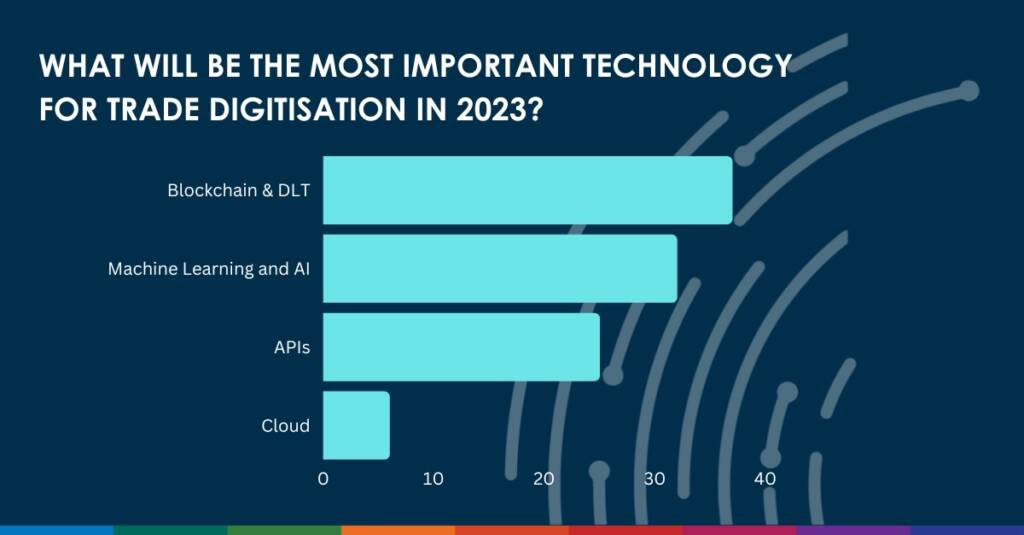

PD: A few standout technologies appear poised to continue to make waves in 2023.

First, operational efficiency through full end-to-end incorporation of Intelligent Process Automation Solutions.

Second, the ESG space offers a real opportunity for banks to blend novel technology components with new product offerings that align with bank and government agendas.

Finally, APIs and the increasing interconnectivity of industry utilities, bank systems, corporates, and digital platforms will continue to be a major factor.

Customer and product expectations will drive all the entities involved to adopt fast integration built on the common framework of REST APIs.

BC: Where should tradetech firms focus their strategy?

PD: Easy money in the market is gone, so the key focus for tradetech firms is delivering immediate value to banks and their customers. It isn’t acceptable anymore to have a 3–5 year horizon for delivery of scale.

This has been borne out by several closures and mergers, which no doubt will continue into the new year. Our recent BAFT/CGI survey showed that banks continue to have a middling view of engagement with technology partners, but an increased reliance on their capabilities.

Solutions need to be commercialised with an immediate ROI for the participants utilising the service.

AD: There are two areas that trade technology firms should be focused on in 2023.

The first is influencing regulators. 2022 saw some important corrections from the UK Law Commission and the U.S. Uniform Commercial Code. These corrections were needed to allow for basic electronic negotiable instruments and digital assets.

The next step is getting U.S. states to adopt these rules and working towards uptake. This momentum will continue, but regulators need both pressure and expertise from the private sector to guide them.

This raises the question of how trade finance has innovated over the past few years. One thing we have not seen is an expansion of instruments being offered.

Technology has largely been used to improve existing trade finance instruments. This has been absolutely critical to streamlining the sector, but it doesn’t solve persistent problems like the trade finance gap for SMEs.

PD: Digitisation of physical documents, automation of manual processes, new access to data for double financing, and a plethora of digital channels for corporate customers all offer opportunities for banks.

There is a real opportunity for financial institutions to provide new products at a broader and deeper level, whether by themselves or paired with strategic technology partners.

Make sure to join TFG on our journey in 2023 to see if these predictions come true! Follow our newsletter and LinkedIn to stay on top of breaking news and expert analysis.