Ninety seven per cent of exporters questioned in a survey said they were optimistic about growing their businesses through international trade.

“This is great news for the country and also for the Institute as we are increasingly convinced that to succeed in this new business environment, knowledge of how international trade operates is vital. It includes the legal aspects of contracts; insurance and IP; the financial issues around getting the price right and getting paid; how to comply with regulations and understand how trade works in terms of tariffs and rules of origin. This knowledge is going to be crucial to all businesses that trade across the world – even with our closest neighbours, with whom, traditionally, we have not had these issues.

“In these changing times, it is crucial that businesses find out how to do this properly, efficiently and in a timely manner so they will not delay their goods and damage their ongoing relationships. Late deliveries will not make it easy to do business in the new world we will be moving towards. To quote Einstein, first learn the rules of the game and then go out and play it better than everyone else!”

Spearheaded by the Institute of Export & International Trade – the UK’s only professional body offering recognised, formal qualifications in International Trade – the research involved responses from over 200 Institute members and the wider export community.

Respondents were positive about future trade prospects despite fears of a growing US protectionist agenda, national elections across Europe potentially upsetting the status quo – and Britain’s possibly fractious divorce from the EU.

While 93 per cent of those taking part were upbeat about exports to the EU, participants were moderately optimistic about opportunities with the US and cautious about trading with India, China and Russia.

How did these results fare after both Brexit, and the US Elections?

“The survey was conducted to gauge opinion post Brexit and following the US election. The world is constantly changing and the referendum and US poll have made a tremendous impact on international trade but it is all business and where businesses find a problem, they work around it and come up with another solution that allows them to continue. This is expected.

“There is no real evidence that exporting has increased as a result of the depreciating pound. The ONS suggested growth may have been due to EU purchases brought forward to take advantage of weak sterling, but this can only be established once the first half of the year figures are collated.”

Exporters surveyed remain concerned about Brexit – 87 per cent forecast it would result in a loss of trade and 40 per cent expressed uncertainty over negotiations and their outcome.

The greatest optimism was for global trade and trade with the EU – with 93% of respondents saying they are still optimistic for export opportunities in the EU why do you think this is so?

“It is clear that UK businesses would sooner continue to trade as they have been with their closest and, by merit of proximity, easier markets to deal with. Obviously, this may not be the case if the hard Brexit route is followed; it all hinges on the terms of the negotiations which no-one has knowledge of. We will have to wait and see.”

Nevertheless, over half of the respondents regarded extending their overseas markets as the single biggest opportunity for their company this year – with a 3:1 ratio looking to grow markets overseas and almost one third seeking to achieve this expansion in 2017.

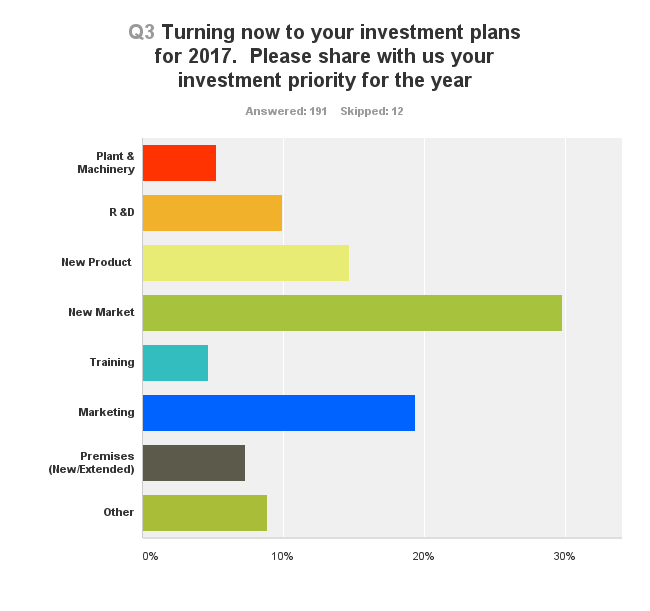

This confidence extended to investment – with nearly a fifth of businesses working in international trade planning to invest in their marketing spend and 15 per cent looking to develop new products. While 12% plan to invest in plant and/or machinery or extend their premises, just 5 per cent will invest in training.

When examining further opportunities for 2017, 12% recognised the value of extending their offer with additional services to increase revenue.

In your opinion, what are the biggest challenges companies will face when it comes to new market expansion and growth?

“Almost two thirds (61 per cent) have contingency plans in place for foreign exchange risk and just over half (52 per cent) have a plan for credit risk. Whilst half have prepared for cyber attacks, less than a third of participants have a strategy to avoid the risks involved with customs compliance.”

Read our article about trade finance and cybersecurity here.

Institute Director General, Lesley Batchelor OBE, said: “The importance of businesses managing currency risk is a fundamental part of ensuring profitability when trading in international markets.

“The survey results indicate that 60% have plans in place for this, which is a significant level, however all businesses should do so. In practice, use of forward foreign exchange contracts and matching of currency payables and receivables are the most frequently used methods of managing this risk.”

The full report is available here.

Do you trade overseas in different currencies?