In the trade finance sector, as in almost every industry, recent tariff announcements and the seemingly impending trade war have spread uncertainty at every level: stocks tumbled, currencies became more volatile, and markets around the world are scrambling to adapt.

In the trade finance industry, what many are wondering is: will these changes hurt trade finance, supply chain finance, factoring, and every other kind of financial vehicle connected to international trade?

Fortunately, there are ways to predict the tariffs’ effects – for example, using the data from the last trade war, which happened between 2017 and 2019, as a frame of reference. During that time, the devastating Covid-19 pandemic was also compounding the disruption impacting trade and therefore trade finance.

Global trade did decelerate in 2019 when President Trump imposed tariffs during his first term in office. However, as a report by Allianz Global Investors points out, “a closer examination of broader data suggests Mr Trump’s tariffs may have disrupted global trade only marginally.”

Despite the tariffs, international trade as a share of global GDP exceeded 60% for the first time in a decade only 3 years later, in 2022. As many expected, trade did contract between China and the US, but growth from other regions offset the reductions.

During the first trade war, supply chain finance grew at a compound annual growth rate of 26% from 2017 to 2023 despite an increase in global protectionism and tariffs.

Factoring finance ⏤ mainly used by small businesses and mid-market companies to raise finance against their invoices payable ⏤ still grew at a rate of 5%, despite the same headwinds and uncertainty.

If everything plays out along similar lines, then we can expect similar outcomes during this trade war.

The potential of trade finance distribution

Trade finance distribution is a way of unlocking liquidity from trade finance products. Once an originator (like a bank or fintech) provides financing, they can sell or distribute individual or groups of trade finance products to other investors in the market.

This is usually done on an “originate-to-distribute” (OTD) model to ensure a bank is holding on to large volumes of trade finance exposure on their balance sheets. It unlocks opportunities and growth revenue for every party in the transaction.

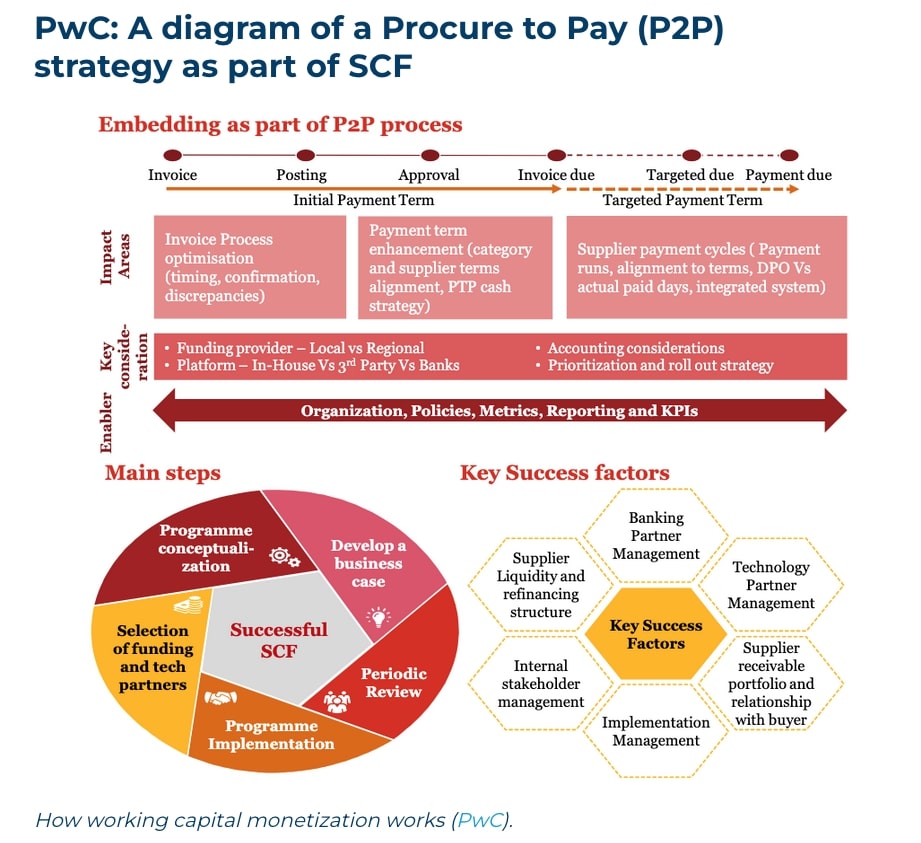

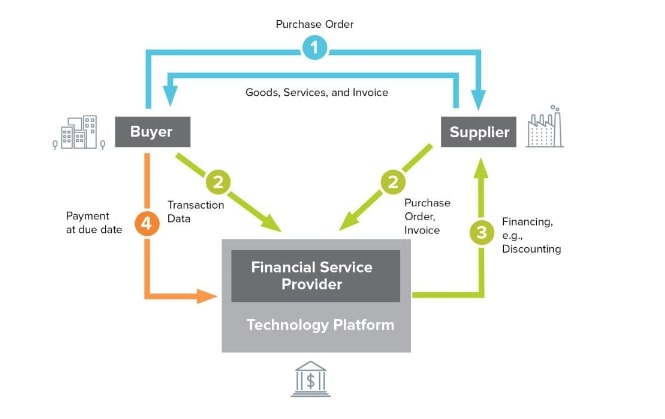

How funds and documents flow in supply chain finance (SCF)

For banks, asset managers, institutional investors, non-bank lenders, and alternative credit funds, the attraction of trade finance and distribution is hard to ignore:

- Trade finance is a high-growth sector, currently worth $9.7 trillion and a projected growth of 3.1% in the next 10 years.

- 80 to 90% of global trade relies, in some way, on trade finance.

- There is currently a massive trade finance gap, estimated to reach $2.5 trillion this year. This trade finance gap is especially high in Africa, Asia, and the United Arab Emirates.

- Supply chain finance continues to grow at a yearly rate of 7% and is currently worth $2.34 trillion

- Asia and Africa are seeing the fastest growth in volume of supply chain finance, up 29% and 17% year-on-year, respectively

- Trade finance instruments are always short-term, self-financing, self-collateralized, and can be insured. This makes them very attractive from an investor perspective.

- Unlike other asset classes, such as debt financing or even real estate, the default rates of trade finance and asset distribution have always been very low (in most cases, under 0.25%).

With all of that in mind, trade finance distribution seems like an opportunity that can’t be missed.

It’s one of the reasons Trade Finance Global launched the TFG Distribution Finance initiative in July 2023, which aims to identify and address unmet demands in the trade finance market, working towards closing the trade finance gap

At the same time, with the impending gradual phase-in of Basel III Endgame rules, (which starts on 1 July 2025) banks are keen to de-leverage balance sheets.

Fortunately, the IMF already thought about the impact of Basel III on trade finance. Despite the rules around Tier-1 banks (especially the global 37 with over $100 billion on their balance sheets), trade finance is “clearly not the target of the re-regulation exercise” because they are “low-risk, highly collateralized . . . with a very small loss record”, as the IMF noted in a policy paper about Basel III in 2014.

All of this makes now the perfect time for banks, asset managers, institutional investors, non-bank lenders, and alternative credit funds to get into trade finance distribution or scale-up current operations.

The question is, can this be done without over-leveraging risk, or increasing headcount?

Accessing distribution sustainably

Trade finance distribution should unlock new revenue opportunities for banks, asset managers, or corporates.

If organisations understand the market, they can leverage against any risk factors and avoid increasing their headcounts unnecessarily.

For financial players getting into or scaling-up distribution, LiquidX’s white-label platform enables seamless integration of distribution into the organisation’s existing offerings while maintaining brand identity.

Thanks to LiquidX’s award-winning capabilities and a deep partnership with Broadridge ⏤ a trusted global fintech leader ⏤ financial institutions wanting to enter trade finance distribution can outsource this function completely without needing to recruit more staff. LiquidX’s software takes care of everything, from digitization at one end to distribution at the other; its solutions cater to a network of over 90 banks and asset managers worldwide.

Digital solutions for trade finance distribution

Organizations looking to get into trade finance distribution or wanting to scale up existing operations should be cautious and do quality research first. The steps and precautions to take will vary according to whether companies are starting from scratch and want to syndicate, buy, sell, or use an originate-to-distribute model, or if they are looking to grow their existing offerings.

One of the biggest challenges faced by companies is often managing the inflows and outflows of money and documents from different sources. Having a tool for managing multiple sources of data that’s platform-agnostic makes getting into distribution much easier.

Now more than ever, distribution is a high-growth opportunity for banks, asset managers, institutional investors, non-bank lenders, and alternative credit funds. Using solutions like LiquidX can help companies take advantage of this opportunity and leverage the enormous potential trade finance distribution has to offer.