Trade Finance Global sat down with several top experts in the trade, supply chain, and receivables industry to discuss their predictions for the upcoming year.

In this interview, we speak with Iain MacLennan, Head of Trade & Supply Chain Finance, Finastra; Ana Boata, Head of Macroeconomic Research and Virginie Fauvel, Board Member, Euler Hermes; Michael Bickers, Editorial Director, BCR Publishing; and Steven Beck, Head of Trade and Supply Chain Finance, Asian Development Bank.

What are your top Macroeconomic and Geopolitical predictions for trade, supply chain, and receivables in 2020?

Iain MacLennan: It is a challenging environment, and at the World Trade Symposium there was much discussion in regard to whether we are moving away from a rule to a power-based system. Even if we see progress on the one hand, based on the last eighteen months we know that can be reversed almost overnight. Therefore, we will likely see a continued period of uncertainty over the next twelve months.

Ana Boata: I agree. In 2019, global trade of goods and services could grow at its slowest pace in a decade (+1.5%). Globally, exporters are likely to lose USD420bn. China (-USD67bn), Germany (-USD62bn) and Hong Kong (-USD50bn), as well as the Electronics (-USD212bn), Metals (-USD186bn), and Energy (-USD183bn) sectors, are the main victims of the trade recession.

And then there’s the question of whether the U.S. and China empires will strike back in 2020? The worst could be behind us but despite a slight acceleration we expect global trade to remain in this low-growth regime in 2020 (+1.7%). The sectors software and IT services (USD62bn), agrifood (USD41bn) and chemicals (USD37bn), as well as China (USD90bn) and the U.S. (USD87bn) will see the largest trade gains in 2020 (USD87bn and USD90bn, respectively). However, trade tensions have taken a toll: export gains would be roughly half of what they were in 2018 for both. In addition, Germany and the UK could be targeted by U.S. tariffs on cars.

Trade diversion shows that a few winners are capturing export market share to the U.S. (Vietnam, France, the Netherlands and Taiwan) and China (Malaysia, Singapore, Russia and Saudi Arabia). However, these winners (like Vietnam) could be next on the hit-list. Meanwhile, Phantom Trade, whereby companies ship their merchandise to a third market (such as Taiwan, Japan) before exporting it to their trade partner, is unveiling tariff circumvention mechanisms and artificially inflating trade figures.

Source: Euler Hermes Data

Steven Beck: Yes, something that we are seeing is that ongoing trade tensions and the decoupling of value chains will add to intra-Asian trade growth, already fueled by high growth rates compared to the rest of the world.

Michael Bickers: To add on to this, I think that supply chain finance will grow more rapidly than traditional factoring and there will be more open account trading. We should also see slightly more stability in Europe post Brexit but bearing in mind so much to do in terms of trade relationships.

What are your top predictions for 2020 related to the regulatory environment and compliance issues?

Michael Bickers: In the receivables finance sector people are nervous about the introduction of regulation and the cost of compliance, but in markets where it has been introduced it has had an overall benefit in my opinion. But it’s important to work with the regulators and the supervisory bodies during any introduction.

Iain MacLennan: Yeah, I am hopeful that we will start to see more policies that support digital trade, not simply the focus on due-diligence that we have seen to date. There is evidence of this but we need to see this across the globe. After all, trade is global in nature.

What are the biggest challenges in trade, receivables, and supply chain finance you predict for 2020?

Ana Boata: Pervasive protectionism (~1,290 new trade barriers in 2019, number of new regional trade agreements divided by three and average U.S. tariffs more than doubled since 2017) has pushed countries to sharpen their trade arsenals. We identify that challenges could come from countries that could become irritable (i.e. could be tempted) and capable to wage trade wars (the U.S., India, Russia, China, France); those that are irritable but not equipped (Japan, Mexico, South Africa) and those that are neither equipped nor irritable (Australia, South Korea).

In addition, we expect new rules of the game, as part of the shift towards more sustainable trade (regulation of trade transportation and carbon emissions of traded products). Simplifying and considering the EU Border Carbon Adjustment tax (BCA) to be an outright tariff on EU imports, we estimate that a 1% tariff could result in a loss of USD7bn of exports to the EU, affecting Russian, U.S. and Chinese exports.

Source: Euler Hermes Data

Finally, trade Tech is reshuffling trade cards in the backdrop: e-commerce platforms and blockchain technology are expected to reduce trade-related costs, while 3D printing could alter the cross-border production process by shortening global value chains, reducing operational risks but decreasing trade flows.

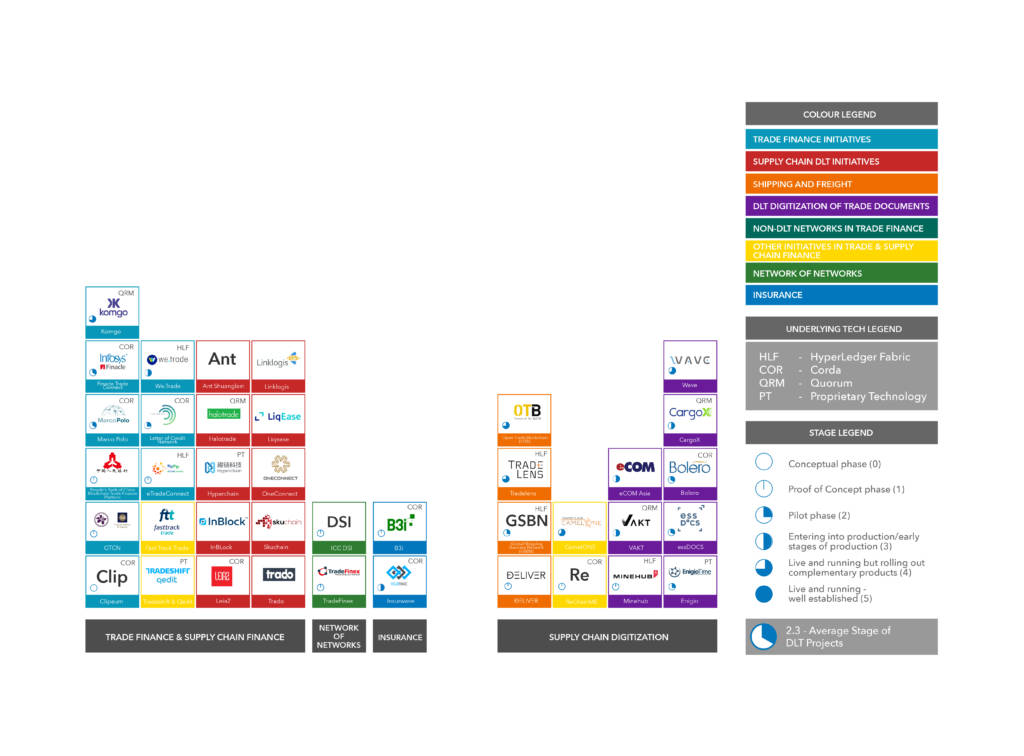

Michael Bickers: Speaking of technology, specifically the use of blockchain and DLT in trade and receivables finance, the biggest challenges are interoperability and standardisation. The cost and efficiency of such structures are also being called into question. Finding new markets for supply chain finance will be a challenge as the market for blue chip buyers becomes saturated. For banks in this sector, the on-boarding and financing of SME suppliers will become more of an issue as non-bank competition increases. Trade wars and Brexit may make international trade increasingly challenging and even an increase in government expenditure generally may put in an increased burden on business and consumers through taxation. There is increasing pressure to use new technology and we may begin to see adoption providing more competitive advantage.

Steven Beck: I think there are many challenges that the industry must tackle. The conscious or unintended consequence of deterring economic activity, including value chains and the free flow of goods and technology on a global basis will have adverse consequences for the world. Decoupling is a threat to global trade, prosperity, and possibly even peace.

It’s incumbent on all of us to ensure that this scenario does not happen. Creating global digital standards and protocols to drive interoperability, the interconnectedness of systems and platforms on which trade will move in the future is important to ensure global trade continues to deliver peace and prosperity.

Trade-based money laundering will become an area of increasing focus. The industry will need to work closely with regulators to address concerns and improve our ability to detect and prevent crime in our transactions. Decoupling inhibits international cooperation and creates more space for bad actors to use the financial system. ADB, an active member of the Financial Action Task Force’s (FATF) Trade Based Money Laundering (TBML) Working Group, is well positioned to play a convening role and will continue to do so.

Making choices about what IT initiatives to undertake and purchase will become even more difficult. Technology becomes obsolete quickly. It requires tremendous resources and operational upheaval to implement. Interoperability always an issue.

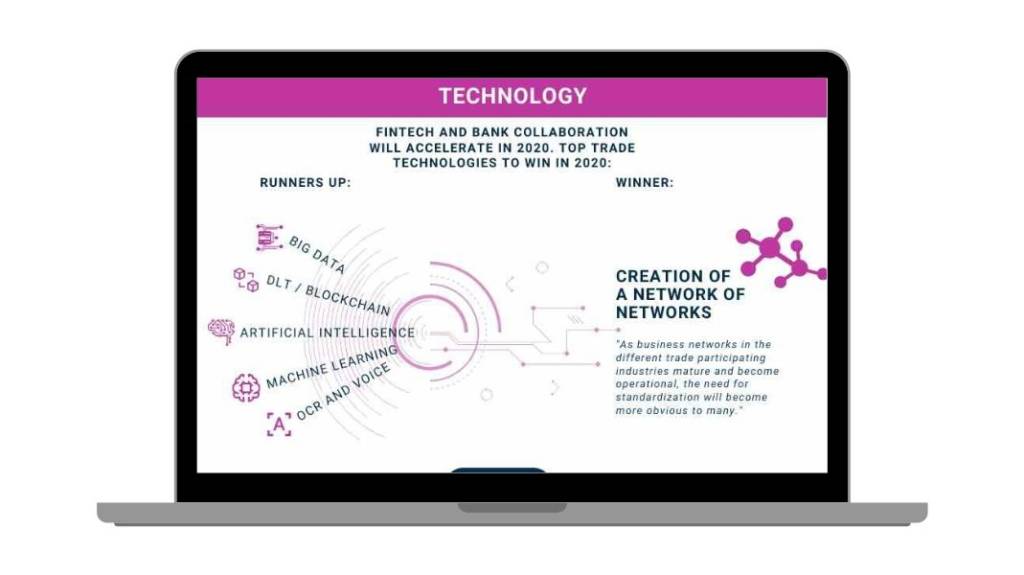

Speaking of technology, what’s your top prediction for a technology that you think will truly kick off or have the most success in 2020?

Virginie Fauvel: In 2020, the B2B insurance trend will continue to seek the enhancement of our predictive capabilities. For this, the internalization and scale-up of Machine Learning and Artificial Intelligence skills and assets is key. Euler Hermes has already increased its predictive power in the risk area, and we will continue to use it across our value chain: sales, claims, collections, pricing & underwriting.

Why do you think Machine Learning will have such success?

Virginie Fauvel: Artificial Intelligence and Machine Learning have enabled us to target new business that we could have previously refused with traditional mathematics. That is to say, ML is generating higher revenues and fewer losses. In addition to addressing the risk of traditional products in a more accurate manner, ML is also allowing us to develop new digital products for untapped markets (such as SMEs) by pinpointing and controlling the risk inherent to this new underwriting.

Michael Bickers: For me, I would say that Optical Character Recognition (OCR) technology and Application Programming Interfaces (API) have the most potential to really kick off in 2020. While many of the other technologies are great, I think they will still need more time to get real traction.

Steven Beck: Our top prediction for a technology that will have the most success in 2020. Artificial Intelligence. Why? Because human intelligence needs all the help it can get!