Estimated reading time: 5 minutes

The notoriously volatile cryptocurrency market suffered another serious blow earlier this month as FTX, once one of the largest cryptocurrency exchanges in the world, met its rapid end.

On 5 November, the platform held over $8.4 billion of total balances. A mere five days later, this figure had dropped to $1.1 billion as depositors rushed to pull their capital out of the exchange.

FTX has since filed for bankruptcy, leaving many investors, including several institutional investors like Softbank and the Ontario Teachers Pension Plan in the lurch.

As the fallout from the collapse continues and more information about how it all unravelled continues to come to light, the entire decentralised world is finding itself under renewed scrutiny.

The subsequent question marks left in the wake of the event have extended to international trade, begging the question: how will this impact trade digitalisation efforts?

Trade digitalisation progress ebbs and flows

International trade and trade finance are notoriously antiquated industries that still predominately rely on paper-based documents to function.

Over the past few years, however, industry advocates and innovators have made tremendous progress towards bringing the industry into the digital age.

In October, the UK introduced a bill to parliament that would provide unambiguous legal backing for digital trade documents under English law, something that they currently do not have and which has been a major inhibitor in the space.

While there are several different technologies, ranging from artificial intelligence (AI) to the internet of things (IoT), that are poised to have positive impacts on trade, the most widely touted to revolutionise the industry has been blockchain—the same technology that underpins many cryptocurrencies.

While there are profound differences between the applications of blockchain in a commercial trade finance context and in a cryptocurrency context, the technical nuances of these differences may not resonate with the unfamiliar.

To many, the term blockchain is simply synonymous with cryptocurrency and foments fear of volatility and risk.

It does not help that prospective investors have other major trade finance-specific blockchain setbacks to point to from this year.

Back in May 2022, the European blockchain-based trade finance consortium we.trade filed for bankruptcy after it had run out of funds to continue operations.

In 2021, we.trade was one of the fastest growing projects for digitalising trade finance, having raised €5.5 million in capital during an investment round that year. Despite this, the company was never able to become profitable and therefore shut its doors for good.

2022 spells trouble for tech

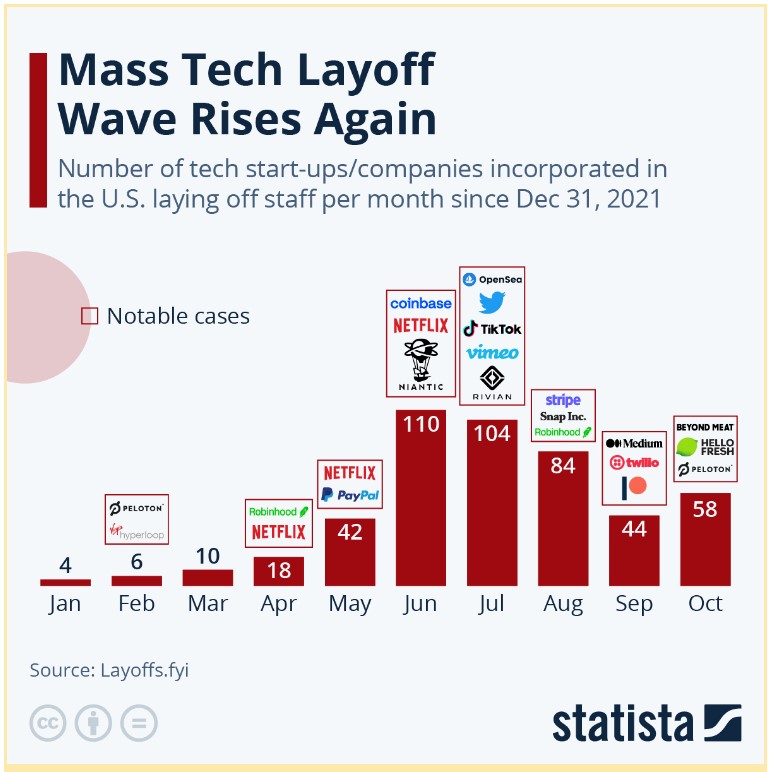

2022 has been a difficult year for technology firms in general, with several major companies announcing significant staff reductions to contend with lower-than-anticipated revenues.

In November 2022, Meta—Facebook’s parent company—announced that it was cutting around 10% of its workforce, removing around 11,000 workers. Twitter—following an acquisition by Elon Musk—has also slashed its employee base in half, eliminating 3,700 jobs in the process.

These announcements join a long list of firms, including the likes of Stripe, Microsoft, Coinbase, and Shopify, that have each eliminated more than 1,000 jobs this year.

This trend has extended across the tech space, affecting many companies. Unfortunately, this pattern of staff cuts will likely persist beyond 2022.

Many of these companies have cited similar issues, namely that they made sizable investments into their operations during the pandemic but were not able to experience the level of return required to sustain these levels.

The future of digital trade

But what does all this mean for digital trade?

André Casterman, the founder of Casterman Advisory, said, “FTX is an unfortunate event and demonstrates the role of regulators to protect end-users. Regulation is also the only way to scale new markets such as web3.

“In the meantime, crypto is not going away and digital assets are set to transform financial services by removing the many frictions that we still witness today in payments, trade and receivables financing, and capital markets.”

In these relatively early stages of trade digitalisation, much of the required investment is going to be inherently long-term in nature as the industry builds up the necessary technological infrastructure required to realise long-term benefits.

These can be expensive projects that may take years to see any financial return.

Innovative firms need capital to be able to build the connections and network effects needed to drive real value.

During times of uncertainty, it becomes ever more difficult to find investors that are comfortable placing long-term bets in a new and untested space.

The international trade industry, however, has proven itself time and again to be the incredibly resilient engine that keeps the global economy in motion.

These latest developments may place another hurdle on the track, but the past few years have instilled digital trade revolutionaries with the mindset and grit needed to overcome any obstacle in the way.

The flywheel of digital progress is already in motion.

This is no time to ease up.