The falls in Sterling following the Brexit vote have been punishing for those importers who did not hedge against declines; but could the weakness finally be ending?

The British pound has been hammered by the vote to exit the European Union on the 23rd of June.

The declines were brutal with Sterling recorded its largest one day fall against the US dollar in history.

The slump only extended on the delivery of a fresh, and aggressive, stimulus package at the Bank of England on August 4th, in response to the vote.

In all, unhedged UK importers have been left with a currency that is today well over 10% weaker against the US Dollar and Euro.

Against the Rand it is over 17% weaker.

The lesson here is that hedging certainly pays off when it comes to protecting against such hefty declines.

For instance, one UK SME with a sizeable import order book has told PoundSterlingLive.com that they are still looking to expand despite the Brexit vote because of their foreign exchange hedges.

For unhedged exporters though, the decline in Sterling will have come as a godsend – we are starting to see some encouraging surveys which suggest order books from across the world are picking up.

A Bottom May Have Been Reached

For those importers that are unhedged, there are signs that the pain may be easing.

We have noted Sterling stabilise since the early July lows were reached.

It has adopted a sideways trend of late and while it is too early to say further declines are not possible, the hefty declines of June and early July have almost certainly passed.

One of the reasons why we suspect Sterling may have passed its low-point is the better-than-forecast UK data releases we have seen of late.

Official statistics for the post-referendum period show UK inflation continues to nudge higher while employment continues to grow alongside wages.

A big positive was dished out to economists, who certainly appear to have a pessimistic view of the economy, when UK retail sales beat expectations by reading at 1.4% in July.

Recent CBI Distributive and Manufacturing Trades surveys have also surprised to the upside.

In fact, the CBI Manufacturing Trades survey reported UK export books were at their best in over two years.

No doubt, a weakened Pound is doing some of the heavy lifting here and should continue to do so at current levels.

The data appears to have vindicated those foreign exchange analysts who had taken a more constructive approach on Sterling’s outlook.

An example of one such institution who sees a higher Sterling by 2017 are Barclays.

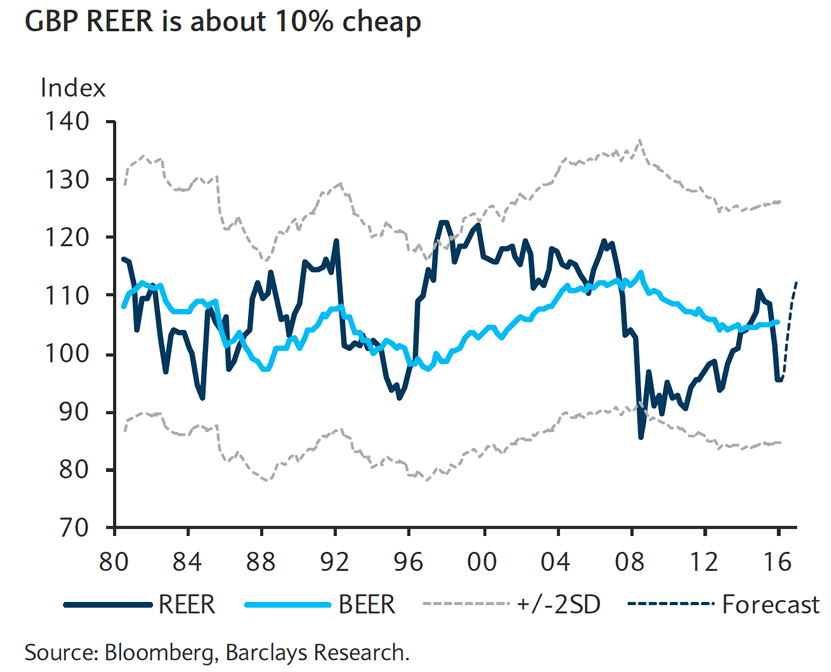

Their studies show that, on a fair-value study, GBP is oversold:

The above shows that GBP is one standard deviation (10%) below the estimated fair-value.

Fellow UK-focussed bank, Lloyds, are in agreement and see a similar level of undervaluation.

So while those who need a stronger Sterling have certainly had an awful year, there is a smidgen of hope in that the worst may very well have come to pass.