Late invoice payments are costing businesses some £11.7bn a year according to the Federation of Small Businesses (FSB). Deemed as one of the most common problems faced by small business owners, late payments or unpaid invoices are responsible for around 75% of legal disputes.

“Disputes are inevitable in business, but many small firms don’t have the time or resources to deal with them effectively,” said Mike Cherry, Chairman of the FSB.

“We want to see a beefed up system to bring about fewer disputes and faster resolutions for small firms.”

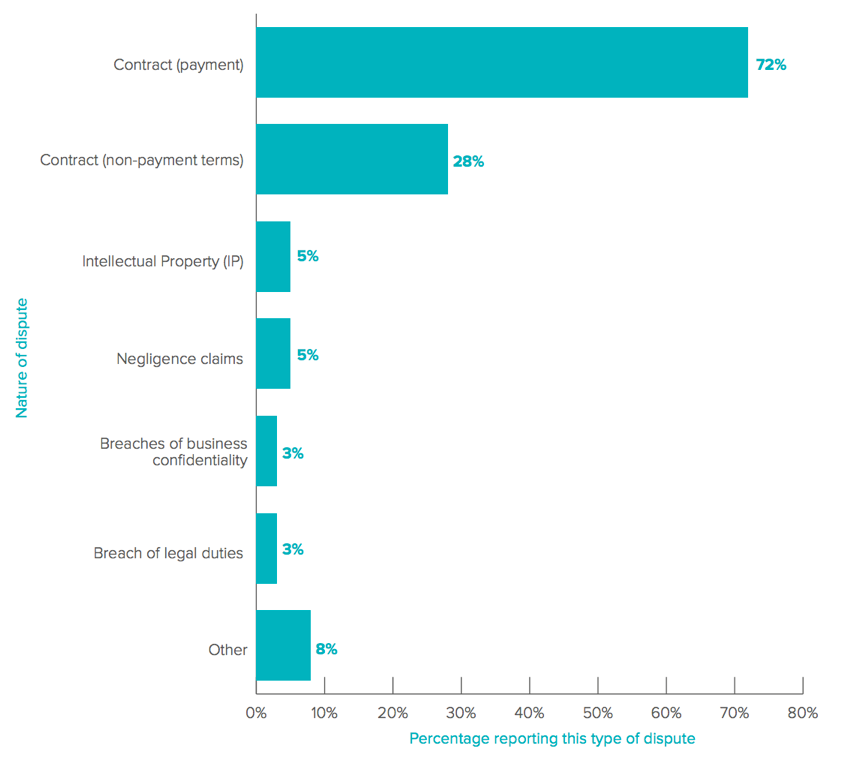

Figure 1: Types of commercial dispute in which SMEs have been involved. Respondents were asked to list the types of dispute they had experienced over the years 2010 to 2015. Respondents could choose more than one option. Source: FSB commercial dispute resolution survey 2015.

UK Small business minister Margot James however, is leading by example. In a measure to tackle this problem, James is introducing payment reporting rules of which larger corporates and Limited Liability Partnerships (LLPs) will be required to report on a bi-annual basis.

The draft regulation was put forward by James’ office at the Department for Business, Energy and Industrial Strategy on the 2nd December. The new reporting requirement will “increase transparency and make payment behaviour a reputational boardroom issue,” according to James.

“Poor payment practices and performance will be exposed, alerting organisations to issues and encouraging them to improve.”

In addition to this, organisations would be required to disclose the percentage of invoices which are paid on 30, 60 or 90+ day terms, and whether companies offer supply chain finance or e-invoicing.

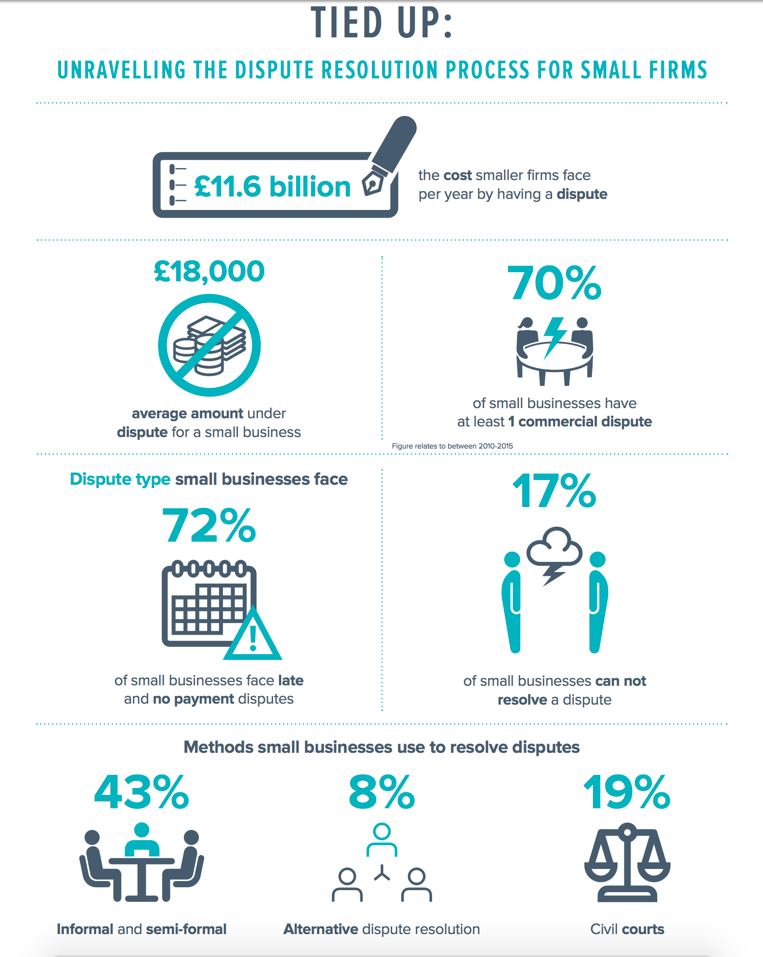

Tied Up: Unravelling the dispute resolution process for small firms

Figure 2: Infographic outlining the scale and disputes around late payments according to a recent Federation of Small Businesses Survey. Source: FSB commercial dispute resolution survey 2015.

What is currently being done about late invoice payments?

It is well known that larger corporates delay payments to ensure sufficient cashflow in their business, and this is a growing issue, particularly for cash strapped small businesses, the lifeblood of the UK economy.

Currently there is no requirement for larger corporates to pay invoices early, it’s primarily based on lengthy payment terms, sometimes for as much as 180 days.

It is estimated that as larger corporates strive on being customer friendly, ethical and sustainable, bringing a reporting cadence on late invoice payments to the boardroom could cause a behavioural shift towards paying invoices on better terms.

The FSB has welcomed James’ statement: “We estimate that 50,000 business deaths could be avoided every year, if only payments were made promptly,” Cherry said in a statement.

How can small businesses advance invoice payments and avoid payment disputes?

Currently, SMEs can use invoice finance to help free up working capital and cash flow tied up in Accounts Receivable and in invoices. However, it’s estimated that 1 in 5 businesses are still unaware of this type of finance.

Invoice finance is the umbrella term for both factoring and discounting. Invoice discounting is where a funder will give the business a loan whereby the security is the underlying invoice or book of invoices, and they will charge interest as a fee. The business is left responsible for collecting payments off customers still. Invoice factoring on the other hand is a more fully managed service, which allows a funder to manage your credit department and collects / chases invoices on behalf of your business.