TFG heard from CoFace Economist Bruno De Moura Fernandes on the bumpy road ahead for markets in 2021.

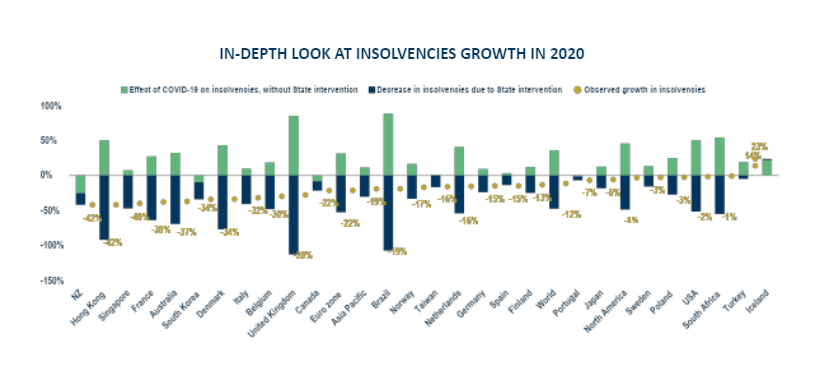

The first half of 2021 should be similar to the year 2020, marked by the strongest global recession since the end of the Second World War. In the end, despite this deep recession, the number of business insolvencies fell in most countries in 2020 and in all regions: -22% in the euro zone, -19% in Asia Pacific and -3% in North America.

Government support to the rescue

The number of insolvencies worldwide was last year 12% lower than in 2019. Companies were therefore saved by taking on debt on favourable terms on the bond markets and/or via traditional bank loans and those guaranteed by governments, taking advantage of the windfall effect, whereas they would have gone insolvent without this crisis. Without these government support measures, we estimate that insolvencies would have increased by 36% worldwide in 2020.

For instance, according to the Coface insolvency forecasting model, taking into account both the main business support measures (furlough scheme, state-backed loans, grants for SMEs) and the fall in turnover, 22,500 additional business insolvencies would have had to be recorded in France in 2020.

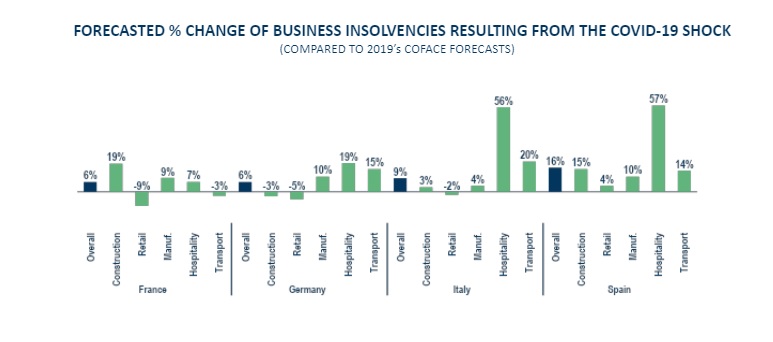

While it is difficult to predict precisely when these “hidden” business insolvencies will occur, they should gradually materialise by 2022, with the progressive return to normal activity and the phased withdrawal of support measures. Paradoxically, this rise in insolvencies around the world will occur at a time when the global economy will be rebounding sharply, assuming that the major advanced economies manage to vaccinate a sufficient proportion of their population to keep the pandemic under control.

Strong GDP growth expected in Asia and Africa

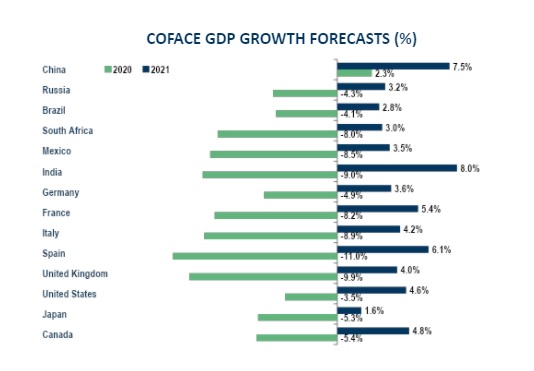

However, beyond this global trend, this crisis, its consequences and the recovery that will follow, is characterised by massive inequalities. First of all between regions: over the period 2020-2021 taken as a whole, the 15 economies with the strongest GDP growth compared to 2019, according to our forecasts, are all in Asia or Africa.

Latam loses

On the other side, half of the 15 worst performers are in Latin America. While this relative ranking by region was the same before the crisis, growth gaps have widened since then: the standard deviation of expected annual growth rates in 176 economies around the world last year was twice as high as in 2019 and 2018.

Furthermore, trajectories also differ within each region, partly due to sectoral specialization. This is the case in Europe: those that depend even more than others on service activities (such as Spain or the United Kingdom) or that are lagging behind in the vaccination process will take longer to restart.

These large differences in growth trajectories are also visible in Asia: China, Taiwan, Vietnam and South Korea are clearly leading the way. First, because local authorities there have managed the health crisis well, but also because they enjoy comparative advantages in sectors that were resilient in 2020 and will remain buoyant this year, such as electronics. At the other end of the ladder are India, Indonesia, and the Philippines, which have suffered a deep recession in 2020.

Between these two extremes are Malaysia and Thailand. In Latin America, the major economies (such as Argentina, Brazil, Colombia and Mexico) will rebound only slightly, due to sluggish investment because of political uncertainties and low fiscal margins. Conversely, Chile and Peru, despite the political uncertainties, should benefit from the excellent dynamic of metal prices, especially copper, while monetary and fiscal policies will support consumption and investment.

Acceleration of digitalisation and automation in trade

Finally, the pandemic is likely to lead to further sustained increase in income inequality within countries, as it is expected to accelerate structural trends such as digitalisation and automation of production and trade, leaving the least educated and low-income individuals behind. More represented in services, qualified as essential or not, and then forced to close down (catering, tourism, etc.), they are more likely to lose their income and employment.

For instance, in the euro zone, while 7.4% of the least qualified workers lost their jobs between the fourth quarter of 2019 and the third quarter of 2020, the employment of individuals with higher education grew by 1.2%. Job losses among young people rose twice as fast as for other age groups in the first half of 2020. While the expansionary monetary and fiscal policies initiated in response to the crisis have initially limited the increase in inequality by strengthening social protection systems and protecting jobs, these remedies will not be sustainable over time.

Inequality and social unrest

In fact, many countries, particularly emerging and developing countries, will not have the fiscal leeway to sustain this already lower social spending than in advanced economies. The impacts on employment and inequality are likely to be all the greater as the capacity for working remotely is lower, many jobs depend on the informal sector and the institutional framework and social protection systems are fragile. This is particularly the case in many countries in South and South-East Asia (India, Malaysia, Indonesia, Philippines) and in Latin American countries where taxes are not that progressive. This increase in inequality is expected to last, based on the experience of previous pandemics.

However, inequality is one of the main vectors of social unrest, which on average occurs about a year after a pandemic. This rise in inequality, combined with public dissatisfaction with the authorities’ handling of the pandemic in many countries, is likely to lead to more frequent protests and violence this year, and ultimately hamper economic recovery in the countries concerned.