Estimated reading time: 0 minutes

- Kazakhstan’s fintech sector has been quietly ascending to Central Asian domination.

- Government policies have allowed developments to accelerate.

- Cybersecurity threats pose challenging, but by no means insurmountable.

The world’s largest landlocked country also accounts for over 50% of Central Asia’s GDP, and has the region’s highest internet usage proportionate to its population. Some might be surprised by Kazakhstan’s emergence as a frontrunner in financial technology within Central Asia, but its preconditions made it a prime testing ground for these digital solutions.

The result of a deliberate focus on digital inclusion, infrastructure investment, and forward-thinking policies, Kazakhstan has become a prime example of how developing economies can turn to fintech to address long-standing challenges and create new opportunities.

Laying the groundwork for fintech success

Kazakhstan’s rise as a fintech hub began with investments in robust digital infrastructure and the population’s digital literacy. By 2023, internet penetration in the country reached an impressive 92.88%, roughly equivalent to Germany (92.48%) or Finland (93.51%), according to data from the World Population Review. Mobile technology adoption is also high, with over 91% of Kazakhstani aged 15 and older having a mobile phone with internet access as of 2021.

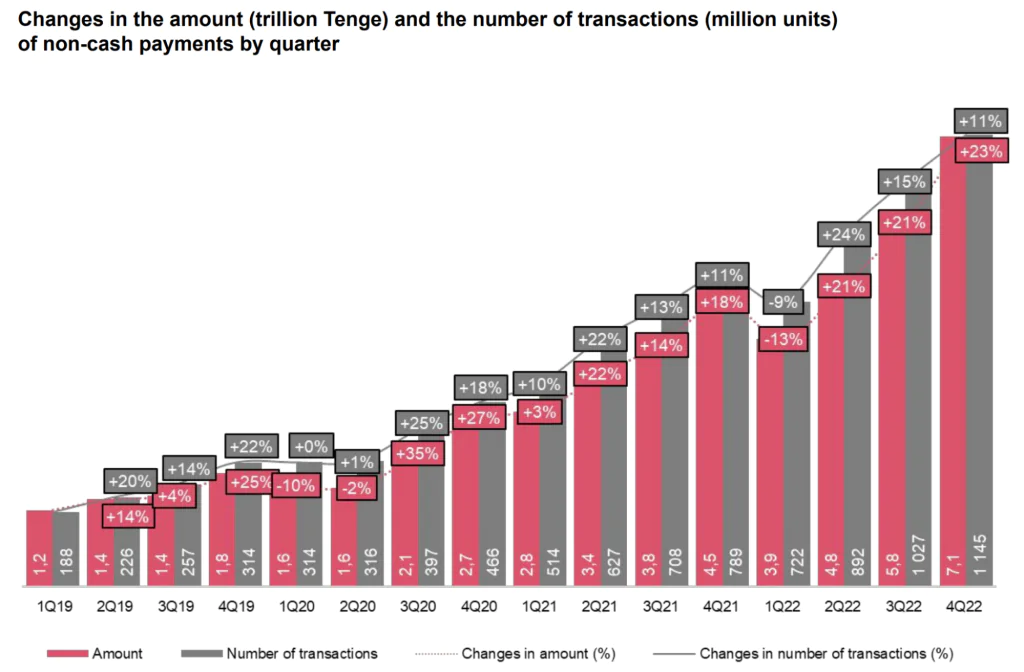

This digital acuity also reached Kazakhstan’s financial sector. Active online banking users surged nearly five-fold between 2019 and 2023, rising from 5 million to 23.1 million. The number of cashless transactions also expanded dramatically, rising from $5 billion in 2017 to $158 billion in 2022, achieving a 98% CAGR.

While necessary, consumer behaviour is not the only factor driving the nation’s financial digitalisation. Legislative initiatives, including the 2023 Digital Assets Law, have created a supportive regulatory environment, which has allowed the banking sector to actively embrace fintech advancements.

By 2024, 31% of financial institutions had implemented artificial intelligence (AI) technologies for fraud prevention, cybersecurity, and service personalisation. Major banks began acquiring promising startups to enhance their digital capabilities. For instance, virtual cards now comprise 37% of total card issuance at leading banks, and 90% of transactions are now cashless.

Reaching the unreachable: Innovating for financial inclusion

Kazakhstan faced a familiar challenge shared by many developing economies: financial services were out of reach for large portions of its rural population. However, the country’s fintech sector turned this challenge into an opportunity to innovate.

In 2023, Kazakhstan launched the world’s first digital tenge payment card through a partnership with Visa, the National Payment Corporation, and leading banks (Halyk, BCC, Altyn Bank). This technology allowed individuals in remote areas to access financial services without requiring a physical bank branch. Programmable digital tenge has been directed towards railway investment as of July 2024, as part of the second stage of the country’s CBDC implementation. Firms developing biometric identification systems and mobile payment solutions are further promoting financial inclusion by bridging the gap for those in geographically isolated regions, providing them with secure and convenient access to digital financial services.

Other developing economies can draw a powerful lesson from Kazakhstan’s approach: when technology addresses specific local challenges, it becomes an engine for social and economic empowerment.

Policies paving the way

Government policy decisions play a major role in shaping the business landscape of the jurisdiction being governed. Thankfully for the nation’s fintech sector, Kazakhstan’s government has been following a strategic vision rooted in policy innovation.

In 2017, recognising the importance of digital literacy as a foundation for further fintech developments, the “Digital Kazakhstan” program was introduced. This enabled paperless documentation, introduced a “single window” for export-import operations, blockchain-powered VAT accounting, and digital tools to support SMEs with automated monitoring and transparent state assistance.

“Digital Kazakhstan” laid the foundation for the “Digital Transformation Concept,” introduced by the government in 2023. This was a comprehensive roadmap to foster digital and financial advancements. The National Bank of Kazakhstan launched a regulatory sandbox for testing innovative financial products.

This government approach had the dual benefit of promoting the fintech sector domestically and attracting international investors. The Astana International Financial Centre (AIFC) – a financial hub based in Astana, Kazakhstan and launched in 2018 – offers a special legal regime tailored for fintech companies.

This move has signalled that Kazakhstan is open for business. The fintech sector has attracted $32 million in venture capital investment, a staggering 40% of all venture capital flows into the country, and a significant increase over the $10 million attracted in 2022.

The dual challenge of growth and security

As Kazakhstan’s fintech sector has expanded, the risks associated with cybersecurity have grown in tandem. Financial organisations were targeted by cyber attacks in 12% of cases during 2023. The consequences ranged from operational disruptions to significant financial losses.

Recognising the urgency of these threats, Kazakhstan launched “Cybershield Kazakhstan,” a national programme designed to bolster digital defences and train security specialists. Beyond managing internal risks, Kazakhstan also strengthened its position as a regional leader in fintech through deliberate collaboration with neighbouring countries. Partnerships with Russia, China, and other Central Asian nations have focused on developing shared digital payment systems and advancing the potential of cross-border financial technologies. Cooperation with international financial centres in Dubai and Singapore continues to expand.

By addressing security concerns while building regional alliances, Kazakhstan has created a case study for how a country can grow its digital economy sustainably while remaining abreast of the challenges of a digital economy.

–

Developing economies are in a somewhat advantageous position in terms of digital adoption. Their financial institutions are unencumbered by centuries-old infrastructures; innovation is not regarded as revolutionary, with all the rhetorical baggage that comes with discarding the old. That is to say, developing economies have little to dismantle when paving the road for digitalisation.

Kazakhstan’s journey from a resource-dependent economy to a fintech leader offers valuable lessons for developing nations worldwide. By prioritising digital infrastructure, addressing rural financial inclusion, implementing supportive policies, and tackling cybersecurity challenges, the country has positioned itself as a model of what targeted innovation can achieve.