Your Monday morning coffee briefing from TFG. The transmission of COVID-19 has returned to “alarming rates” across Europe, says the World Health Organization. The UK government imposed more restrictions on areas of the North East and the Midlands to combat a rise in the number of cases. Around one-in-five of the UK population are now facing some form of local restrictions.

BAFT announces new Payables Finance Principles

BAFT announced the publication of their Global Trade Industry Council Payables Finance Principles to inform the industry on the payables finance supply chain finance product. Geoffrey Brady, MD, Chair of the BAFT GTIC said, “The BAFT GTIC spent considerable time developing these principles to help those in the industry build strong, sustainable payables finance supply chain programs.” Read more →

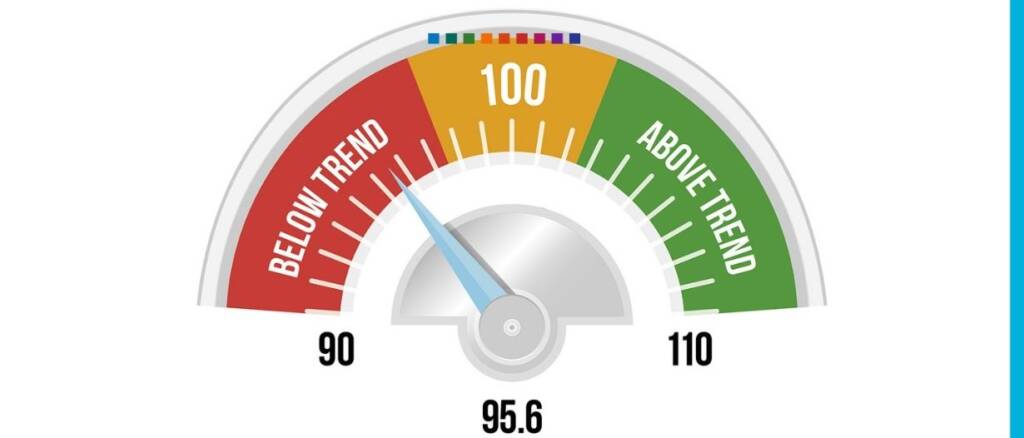

Services trade barometer signals resilience in key sectors amid overall decline

World services trade likely remained far below trend through the second quarter of 2020 amid the economic fallout from COVID-19, but the latest reading from the World Trade Organization Services Trade Barometer also shows modest gains in some key sectors, suggesting a degree of resilience in the face of the pandemic. Read more →

Lloyd’s of London Interview: The £5bn Covid-19 payout

TFG heard from Chairman of Lloyd’s of London, Bruce Carnegie-Brown, on the critical Covid-19 related challenges faced by the 300-year-old institution, as well as what could be in stock for the longer-term future of Lloyd’s market. Read more →

Pandemic risks eclipse treasury priorities as businesses diversify investments to mitigate impact

The Covid-19 pandemic has shunted aside existing challenges to sit atop treasurers’ priority lists, according to a survey run by the Economist Intelligence Unit and sponsored by Deutsche Bank. The results show that as many as 55% plan to increase investments in long-term instruments, with 48% increasing investments in bank deposits, another 48% in local investment products, and 47% in money-market funds. Read more →

AFREXIMBANK and ITFC Partner with ARSO to Facilitate Intra-African Trade

Afreximbank and ITFC Partner with ARSO to Facilitate Intra-African Trade in Pharmaceuticals and Medical Devices under the Umbrella of the AATB Program. The new initiative aims to harmonise African standards for pharmaceuticals and medical devices thereby enhancing intra-African trade, reducing substandard counterfeit products, and building resilient regional health systems. Read more →

SWIFT announces a new strategy for instant, frictionless payments and securities processing

SWIFT announces that over the next two years and beyond it will fundamentally transform payments and securities processing, retooling cross-border infrastructure as part of a new strategy approved by its Board to enable the world’s financial institutions to deliver instant and frictionless end-to-end transactions. Read more →

B20: Protectionism Could Cost the Worldwide Economy $10 Trillion in 2025

The report, titled The $10 Trillion Case for Open Trade, was produced by experts at Boston Consulting Group and HSBC. Drawing on work prepared for the Business 20 (B20)—the forum of global business leaders providing policy recommendations to the G20—it quantifies the relative benefits and costs of open trade versus #protectionism. Read more →

Mastercard and ADB build multi-stakeholder alliance to digitalize supply chains

Mastercard and its partners N-Frnds, SGeBIZ and Finastra have formed an alliance with the support of the Asian Development Bank (ADB) to create technology solutions to drive greater digital efficiency across the retail supply chain in Asia and increase wholesalers’ access to credit. Read more →