Your weekly coffee briefing from TFG. Here are some of the last week’s updates from the trade sector. Central Bank of Ireland deputy governor Ed Sibley has revealed that more than 100 financial services firms that applied to set up or extend operations in Ireland. Boris Jhonson committed to debt reduction. China’s exports unexpectedly fell in August as shipments to the United States slowed sharply.

What happened last week?

The Irish central bank approves over 100 firms

Central Bank of Ireland deputy governor Ed Sibley has revealed that more than 100 financial services firms that applied to set up or extend operations in Ireland because of Brexit have been authorised to do so.

He said: “We’re well over 100 authorisations or authorisations in principle where we’ve said you’re authorised subject to certain conditions, for instance putting capital in,” adding “We still have a number of applications that are in train.” Read more →

The Chancellor declares the end of austerity

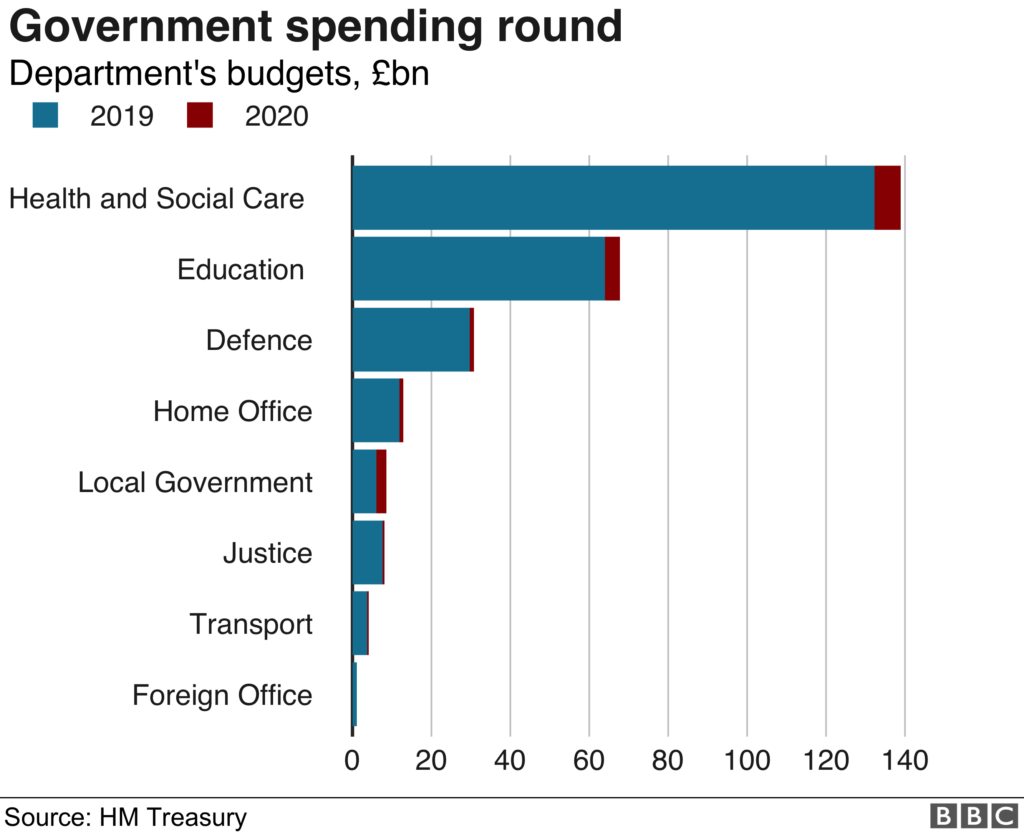

Sajid Javid yesterday declared the end of austerity and revealed £13.8bn of investment in areas including health, education and policing, saying every government department has had its budget for day to day spending increased “at least in line with inflation.” Public spending will rise to 38.6% of GDP in 2020/21, up from 38.1% last year and 38.3% this year.

Paul Johnson, director of the Institute for Fiscal Studies (IFS), said Mr Javid’s plan marked a “real change in direction on spending,” although the IFS said spending would still be 3% below its level a decade ago, and more than 9% lower in per-person terms. Read more →

PM commits to debt reduction

After announcing a £14bn funding boost to primary and secondary education over the next three years, Boris Johnson told Sky News that he would “continue to keep debt coming down every year” despite his proposed spending increases and tax cuts. Elsewhere, the Resolution Foundation has said the Chancellor’s spending statement on Wednesday will likely break his fiscal rules on public borrowing. Read more →

FastPay partners with AIG for receivables securitization program

This program will offer significant capital to the media and technology sector and allow FastPay to open the door for larger, global media and tech clients to access working capital backed by their trade accounts receivable. Read more →

Mastercard joins the Marco Polo Network

Mastercard Track™, a B2B global trade enablement platform, and the Marco Polo Network are collaborating to provide more businesses with trusted access to Marco Polo’s trade and working capital finance solutions. Companies of all sizes will benefit from better visibility into trading relationships and easier access to financing options, beyond the point to point relationships, to a global network of trading parties. Read more →

Late payments costing SMEs £51.5bn

A survey of 1,000 SME owners found that almost a third of SMEs (31%) have experienced late payments costing their business at least £10,000 in the last 12 months. The study found that 27% of SMEs have experienced a profit squeeze because of late payments, and 12% have had to defer staff pay, equating to an estimated 1.95m UK employees that have been left empty-handed on payday. Read more →

China’s exports to the US are falling sharply

China’s exports unexpectedly fell in August as shipments to the United States slowed sharply. Beijing is expected to announce more support measures in coming weeks to avert the risk of a sharper economic slowdown. On Friday, the central bank cut banks’ reserve requirements for a seventh time since early 2018 to free up more funds for lending. Read more →