Your weekly coffee briefing from TFG. Here are some of the last week’s updates from the trade sector. The pound dropped after the announcement of the parliament suspension. Boris Johnson has asked Donald Trump were discussing new trade deal agreements. R3 partnered with FinTech, Wethaq, to digitise Islamic Capital Markets. The UK Government is in negotiations with the high street banks to maintain credit supply to small businesses after no-deal Brexit.

What happened last week?

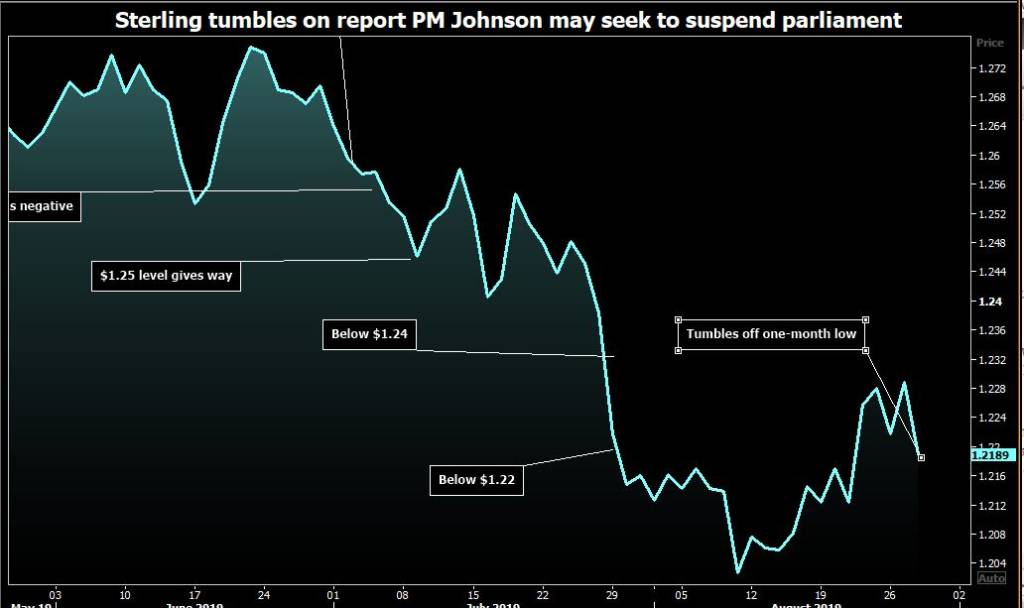

Pound drops over parliament suspension and no-deal Brexit

The pound dropped and shares in British-focused companies were marked lower as the City interpreted the five-week suspension of parliament as shortening the odds on a disorderly no-deal Brexit. Traders and economists saw the announcement as making it harder for parliament to block any exit from the EU without a deal and more likely that the confidence-sapping uncertainty would go right up to October 31 and possibly push Britain into recession. Read more →

PM urges Trump to open up the US to British firms

Boris Johnson has asked Donald Trump to remove red tape preventing UK firms from exporting to the US as he outlined terms for a trade deal. In a phone call on Friday, Mr Johnson said he wanted the agreement to remove the “very considerable barriers” that currently hamper the ability of British firms to operate in the US. He cited obstacles to selling Melton Mowbray pork pies, British-made shower trays, bell peppers and wine. He also said that there is a tax on British micro-breweries in the US that doesn’t apply to US micro-breweries in the UK. Read more →

Ailing high streets to get £1bn boost to revitalise town centres

Boris Johnson has revealed that another 50 towns across England – including Dover, Dudley and Stockport – will benefit from the government’s Future High Streets Fund, which now stands at £1bn. The fund was launched in 2018 as part of the Government’s plan to reshape town centres to drive economic growth and improve living standards. Read more →

Swiss regulator grants banking licenses to two blockchain firms

The Swiss Financial Market Supervisory Authority (FINMA) has issued banking licenses to two blockchain service providers – SEBA Crypto AG and Sygnum AG. FINMA has also published guidance as to the application of regulatory requirements for payments on the blockchain for financial services providers. Read more →

R3 partners with FinTech, Wethaq, to digitise Islamic Capital Markets, commencing with Sukuk

Fintech, Wethaq, has signed a strategic partnership with enterprise blockchain software firm R3 to build the next generation of financial market infrastructure to enable issuers, investors, central banks and regulators to seamlessly transact in Islamic capital markets. Read more →

No-deal may force Bank to loosen policy, says Carney

The Bank of England may have to loosen monetary policy to help the economy in the event of a no-deal Brexit, the governor told fellow central bankers yesterday. Mark Carney, speaking in Wyoming, added that there were limits as to how much the economy could tolerate a rise in inflation caused by a falling pound. Read more →

UK government to urge banks to keep lending after no-deal Brexit

Andrea Leadsom, Michael Gove, and City minister John Glen are expected to meet senior bankers and industry group UK Finance next Thursday to co-ordinate plans to maintain credit supply to small businesses. Read more →