Recent market events related to the very public implosion of a high-flying boutique finance firm have the potential to do irreversible damage to a set of financing techniques that play a critical role in enabling global trade flows, and supporting the success of international and domestic supply chains. The economic value of these commercial activities is in the trillions annually.

Some will argue that the consequences, already rippling wider, will destroy Supply Chain Finance (SCF), and that it is too late to reverse this outcome.

Not so.

Industry sectors, capital markets, national and global economies have experienced major failures, unprecedented incompetence or fraud and huge losses, and have bounced back. SCF has too much potential, and, properly used and structured, generates and sustains too much value, to be allowed to disappear.

Payables Finance (also referred to as Reverse Factoring), one of several techniques or structures under the umbrella term SCF, is at the core of the current controversy. It is also one of the fast-growing structures with clear potential to strengthen supply chains and to help drive financing to SMEs involved in domestic or international supply chains. This includes SMEs based in emerging markets, where the need is critical.

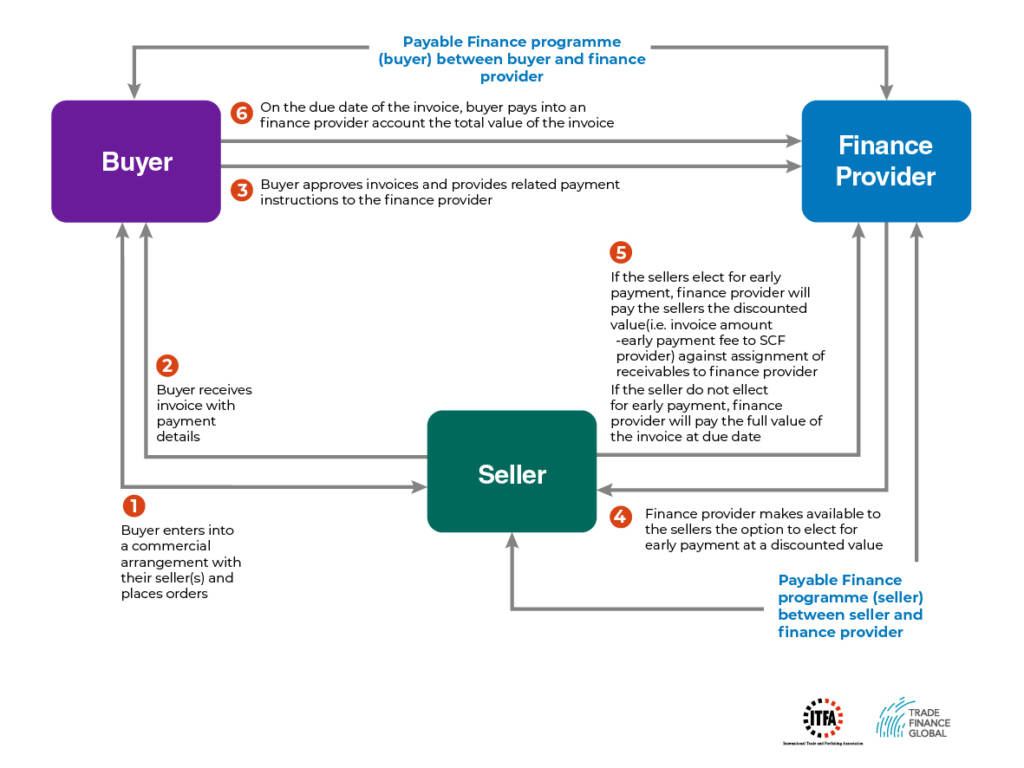

Briefly, a Payables Finance Program involves:

- Large buyer and bank/financing entity create SCF program, extending or delaying payment terms to a subset of suppliers (for example, from 30 to 90 days). The extension should be in line with industry sector practices

- The program should be designed with the health of the supply chain in mind, not as a predatory approach to squeezing suppliers. One US-based buyer refers to theirs as a “Supplier Wellness Program”

- Suppliers can choose to wait, or to have approved invoices “discounted” by the bank for immediate payment. The discount rate (effectively, a financing rate) is most commonly set based on the credit standing of the buyer and is thus usually less expensive for the supplier

- The buyer pays the bank when invoices are due, settling the outstanding loan

While such programs, can be abused or used to perpetrate fraud (like any other type of financing), SCF solutions aim to support trade, strengthen supply chains, engage SMEs and advance development. They are not inherently designed to facilitate fraud, nor are they meant to misrepresent the financial health of any participating company. SCF, including Payables Finance Programs should absolutely require appropriate disclosure, proper financial reporting in line with how material the program is for a particular buyer and supply chain. Prudent risk assessment and credit practice must be part of these programs, no matter how innovatively they are applied.

When the extension of terms is reasonable and aligns with an industry sector’s working capital cycle, and the dynamic between buyer and seller is collaborative, these programs can play a critical role in ensuring the health and viability of supply chain ecosystems (buyers, suppliers and service providers that can number in the multiple thousands). They improve the cash flow and financial health of buyers as well as suppliers. The role of the financier in setting the tone for prudent structuring and appropriate commercial behaviour is important.

The existence of such programs should be appropriately reported and recorded, especially if they are material. Adequate disclosure and proper accounting treatment have been part of industry dialogue on Payables Finance for several years, and it is the abuse of these elements of certain programs that is at the root of all of the sensational financial failures and fraud now associated to Payables Finance, and by extension to SCF.

Payables Finance programs are not inherently predatory, as some have suggested in obvious pursuit of political “points” or attention-grabbing headlines.

But they can be.

Payables Finance programs are not inherently predatory, as some have suggested in obvious pursuit of political “points” or attention-grabbing headlines.

These programs are not designed to understate the debt owed by a company or to misrepresent its financial health.

But they can and have been used precisely for that purpose in a small but visible number of known cases.

SCF as it exists today is still evolving. It does not yet have the benefit of mature industry practice and guidance, like Documentary Letters of Credit which are commonly subject to a global set of rules first published in 1933 by the International Chamber of Commerce. There have been efforts to distinguish SCF and Payables Finance from other forms of lending, and to “ring fence” what is considered prudent and proper practice in the structuring of these solutions. It is clear that those efforts need to be redoubled.

The firm currently in crisis has actively sought to build its brand and market visibility around SCF, with significant press coverage over several years, encouraging and facilitating that linkage. It will be found however, that perhaps 10% of this entity’s structures look anything like Payables Finance or even SCF, and that fundamental questions will arise about governance, credit, risk and financing practices.

This latest failure does come on the heels of several very visible bankruptcies, frauds and financial misrepresentations, including oft-cited instances in Spain, the UK and the UAE among others. In hindsight, more should have been done, more decisively, to differentiate these cases from the thousands of successful, prudent and appropriately structured trade finance, SCF and Payables Finance transactions that take place daily all over the world.

The more important issue now, is to ensure that stakeholders focus on the value and potential of Payables Finance Programs and SCF, and not allow an aberration – no matter how large and visible – to destroy a set of techniques that enable trillions in commercial and trade flows annually, all over the globe. This is particularly important given the role that trade must play in the post-COVID recovery and in making up the massive lost ground in poverty reduction that has resulted from the pandemic.

There is a big picture and a larger question to consider, and trade-related financing, including SCF, has a very important role to play. The larger question touches more than banking and finance. It is a matter of robust global trade, public policy, economic recovery, international development and inclusion, as well as the engagement of SMEs in trade and global supply chains.

This is a moment for leadership and vision, a moment to champion and advance prudent practice while continuing to support constructive and thoughtful innovation. Financiers, clients, positive disruptors, regulators and standards bodies face a stark choice: retreat or over-react, or come together to chart a constructive, balanced way forward in the financing of commercial and trade activity. The way forward must be informed, the overall response to current circumstances, measured, strategic and devoid of sensationalism. All of this with a collective awareness of the larger context in which Payables Finance and SCF create value and have their impact.

SCF can end up irreparably tarnished and damaged beyond redemption, or it can be, as it should be, decoupled from a series of negative, even reprehensible events, to be more properly structured, managed and reported on, so that it can make the necessary and critical contribution to global economic recovery and inclusion.

The nascent state of SCF and Payables Finance programs in particular is illustrated by several facts: that the “Big Four” accountancy firms co-signed a letter seeking guidance from the Financial Accounting Standards Board on appropriate treatment of these structures; that industry practice and rule sets around SCF do not yet exist as they have done for eighty years or more, in traditional trade finance; and that basic definitions related to SCF were only published as recently as 2016.

SCF, including Payables Finance, properly structured, appropriately reported upon and disclosed, and managed with the right stewardship mindset, remains a valuable, promising and viable component of the global trade financing toolkit.

Written by: Craig Weeks, Managing Partner, Lisa Robins, Partner – Prism Global Partners

TFG, together with ITFA recently produced a Guide to Trade Finance, defining Supply Chain Finance, including Payables Finance, and how corporates and large businesses can use these techniques in a structured way to enable global trade. Read it here.