The Department for International Trade (DIT) has recently published its Global Trade Outlook report. TFG summarised the key points from the report, outlining what could be in store for global trade between now and 2050.

Global GDP growth is slowing down

GDP plays a pivotal role in international trade. As more funds are available to the global economy, more trade can occur.

The previous 20 years have seen drastic events change the economic landscape, with the most prominent events being the 2008/2009 financial crisis and the global COVID-19 pandemic. Growth decreased from a 3.5% average per year in the early 2000s (2000-2007) to an average of 2.9% per year in the years 2011-2019. This has been due to the world population growing at a slower rate, markets not adapting to technological advances and a slower rate of globalisation. However, global GDP is expected to recover after the global pandemic caused it to decrease.

Global growth has been predicted to slow down in the upcoming decades, averaging 2.3% per year in the 2030s and 2.0% in the 2040s.

The global economy has been predicted to be worth approximately $380tn by 2050, reflecting a more than 300% increase from 2019, despite global growth decreasing through the decades. This growth in the global economy can be explained by real economic growth as well as significant changes in market exchange rates and prices.

A shift in trade patterns and power is taking place

Trade patterns

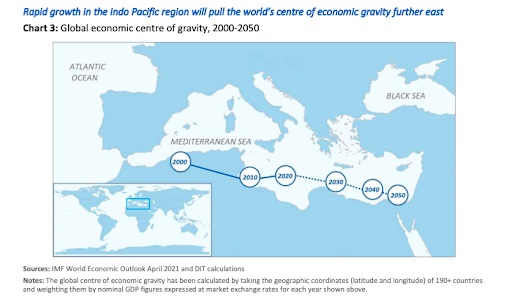

Growth in the Indo-Pacific region explains why trade patterns have been shifting East gradually over the past two decades. From 2000-2019, the EU accounted for 10% of global economic growth, whereas the Indo-Pacific region accounted for 50%. This shift towards the East is predicted to continue until 2050 and 56% of global growth is projected to come from the Indo Pacific region between 2019-2050. North America and the EU combined are projected to contribute 25% of global economic growth within the same timeframe.

Economic power distribution

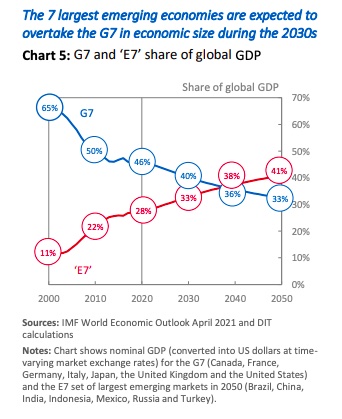

In the past decades, there has been a slow shift of economic power away from the G7 to the most significant emerging economies. This is shown in the plummet of G7’s share of global GDP from 65% in 2000 to 46% in 2020, while the “E7”, the group of the 7 largest emerging economies – China, India, Brazil, Russia, Indonesia, Mexico and Turkey, share surged from 11% to 28%.

Over the next thirty years, the labour productivity of the E7 is expected to grow at approximately twice the rate of the G7. This shift in economic power is projected to result in emerging economies playing a significantly more central role in the global trading system.

China, in particular, is taking centre stage as it is expected that the country will become the world’s largest economy by 2030, overtaking the economic powerhouses, such as the United States in both importing and exporting capabilities. Thus far, China has already surpassed the US in Purchasing Power Parity (PPP) terms in the mid-2010s.

The growth in emerging economies is due to their “catch-up” potential, being able to quickly and effectively increase productivity by implementing techniques from other countries.

Nevertheless, these economies also face significant challenges:

- the need to shift from imitation to innovation

- tackle indebtedness

- rebound from the pandemic

These challenges and the way in which they are handled can be detrimental to the long-term performance of these economies, the DIT report highlights.

Smaller population growth: impact on trade

Though the world’s population is expected to increase from 7.8bn in 2020 to 8.5bn by 2030, this is the smallest decade-long increase since the 1960s, and it could have serious implications for the global economy.

The DIT report highlights that this might not be the case, however, as the population growth in advanced economies might have plateaued, this is not the case in emerging economies. The latter is projected to account for over 75% of global population growth in the 2020s.

Though this might be a great opportunity for emerging countries, gaps in education, infrastructure and employment opportunities need to be considered. Despite the global population continuing to grow and supporting global GDP, it is likely to provide a smaller boost than when populations in the G7 were growing quickly.

Ageing workforces

DIT projects that by 2030, there will be 1 billion people over the age of 65. This billion will have different consumption preferences which could lead to new opportunities, such as for the healthcare and leisure sectors, as well as risks for trade. As countries’ populations’ age and their populations decline, a dwindling workforce will be responsible for the welfare costs of more people. Furthermore, as dependency ratios rise less disposable income will be available for consumption.

Increase in income levels

Income levels are equally as important as GDP when it comes to global trade. According to the DIT report, the number of high-income countries is projected to increase to approximately 70 by 2030 with these countries potentially accounting for over four-fifths of global import demand.

New high-income countries are likely to include:

- China

- Malaysia

- Russia

- Turkey

The middle class could be the key to global demand

With a surge in living standards and with households having more disposable income, their consumption patterns are likely to move away from necessities towards luxury goods and services. Therefore, as the world becomes richer, demand for services and higher-value goods is likely to rise.

By 2030, the size of the global middle class could reach 2.3 billion and by 2050 it could reach 3.5 billion people with over half of these middle-class consumers being likely to live in China and the Indo Pacific.

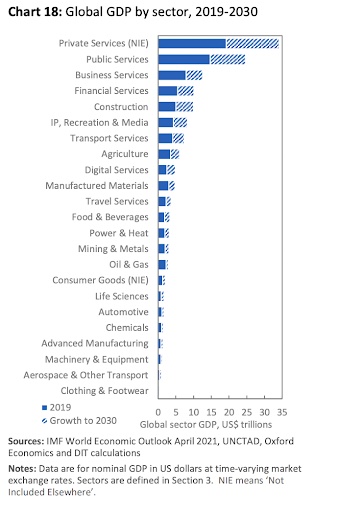

All sectors are expected to grow over the coming decade, However, rising incomes, as previously mentioned, are likely to change consumer preferences. Furthermore, rising incomes are set to positively impact the demand for services and increase their share of global GDP from 75% to 77% between 2019 and 2030.

The oil and gas sector is projected to grow slowly over the next decade as the green transition takes place. Meanwhile, high productivity growth and technological progress are projected to drive down prices in certain manufacturing sectors – reducing their share of nominal GDP despite continuing to grow. This trend can already be seen in the clothing and footwear, machinery and equipment, and automotive sectors.

The UK remains one of the top global economies

It is not all doom and gloom for the UK, as, despite its projected decrease in global GDP, the country is able to maintain its position until 2050.

It is important to note that the UK’s share of global GDP has been consistently decreasing for decades, in fact, the DIT report projects that the country’s contribution to global GDP will shrink from 3.3% in 2019 to around 2.7% by 2050.

The future of global trade

Global trade

We cannot discuss the future of global trade without also mentioning the unexpected event that was the pandemic. The impact of the global outbreak of Covid-19 led to a drop in world trade volume of 8.5%, according to the IMF.

Nevertheless, global trade is expected to rebound as its performance is closely linked to GDP growth. The DIT highlights that there are numerous factors that could impact the speed and direction of GDP growth, such as:

- stability of the global trading system

- political appetite for cross-border integration

- business attitudes towards global value chains

- technological advancements

Should the DIT’s projections be accurate, the value of global trade by 2050, will be worth roughly $100tn, an increase from $24tn in 2019.

Major trading regions

Trade will continue to be dominated by the same four regions – Europe, North America, China and the Asia Pacific – with Europe and the Asia Pacific being the main trade hubs. This is due to cross-border supply chains, as a region’s importance for trade depends not only on GDP but also on how frequently goods and services cross their borders. Both Europe and the Asia Pacific are particularly well-positioned to develop regional supply chains.

To summarise

Global Growth

Global GDP will continue to expand over the coming decades, but at a slowing rate due to slower population growth and ageing workforces which will place a strain on growth.

Global trade is expected to grow in line with global GDP over the next decades reaching $100 trillion by 2050.

Regional Shifts

The G7 is expected to be overtaken by the 7 largest emerging economies in economic size in the coming decades.

Additionally, the 7 largest emerging economies are projected to match the G7’s import market size by 2050.

Industry Shifts

The industrial structure of the global economy is expected to slowly become more services-oriented, this is due to rising income levels in emerging markets.

UK Prospects

The UK is projected to remain as one of the world’s largest economies until 2050, nevertheless, the UK’s share of global GDP is projected to fall from 3.3% in 2019 to 2.7% by 2050.