The EU Federation (EUF) for Factoring and Commercial Finance has released its latest round of statistics, which indicates a strong recovery of factoring following the pandemic-induced decline from the previous year.

After the global pandemic, it was difficult to project when and how the market would recover the lost volumes following the dramatic decline in GDP.

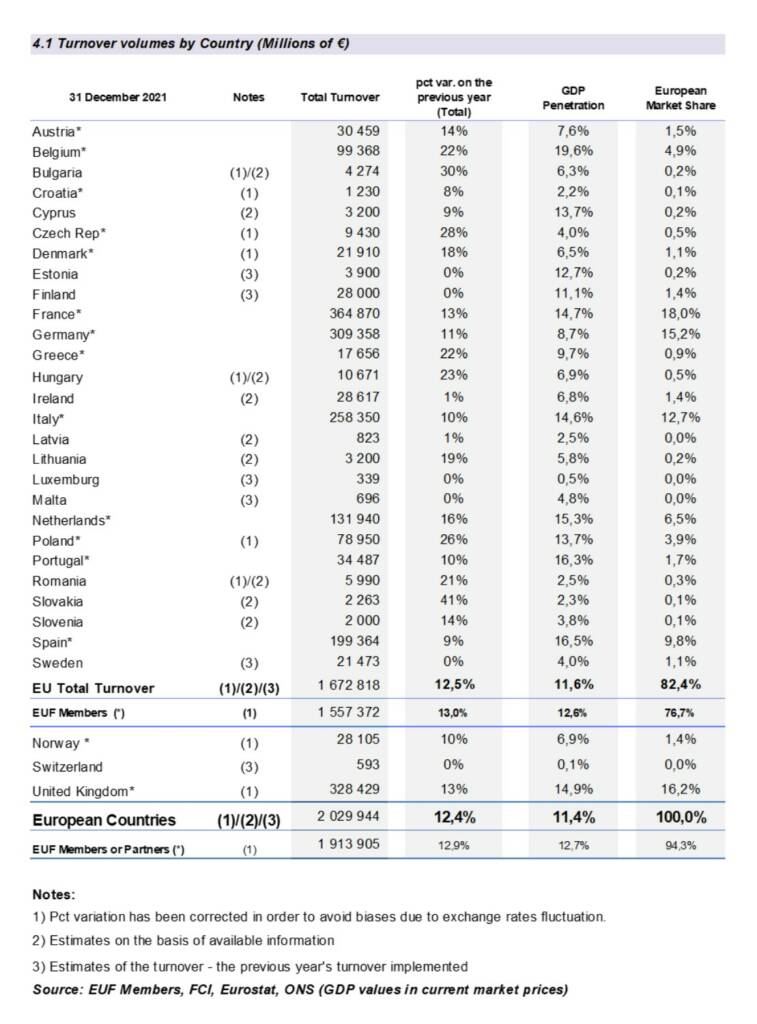

The data collated by the EUF Economic and Statistic Committee for 2021 indicates a strong performance of the factoring market with a turnover growth of +12% compared to the previous year.

The overall volume reached €2.0 trillion, up from €1.8 trillion in 2020, with international factoring comprising 23% of the total value.

The European factoring market accounts for two-thirds of the worldwide turnover and these figures show how factoring is appreciated by the businesses as important financial support also in times of crisis.

Such volumes, even higher than the level reached in 2019, indicate a recovery after the dramatic decrease in 2020 caused by the pandemic.

Despite the last year’s drop, the compound average growth rate of the European factoring turnover over the past 6 years is 6.2%.

According to the information received from the EUF members and partners, this return can be attributed to multiple factors.

These factors include the rebound of the European economy, inflation, rising prices of raw materials, shipping costs, energy, and the perception of factoring as a widely accepted working capital financing product.

EUF estimates that banks or financial intermediaries owned by banks account for over 95% of European turnover, with 94.3% being done by EUF members.

In 2021, the GDP penetration ratio was higher than the previous year (11.4% and 10.6%, respectively).

It is important to underline that the growth of factoring turnover was over 2x higher than the European GDP increase (in the EUF members and partners countries, this growth was about 5.4% in 2021).

Mr. Fausto Galmarini, chairman of the EUF, said: “The global pandemic shook the world in 2020 and continues to affect all countries.

“However, the data collated by the EUF shows the resilience of our industry that could recover the volumes lost in 2020 and in some areas even exceed the turnover reached in the pre-pandemic period.

“This news gives hope to our industry and once again shows how factoring can support the real economy effectively also in difficult times of crisis.

“We have more than 264,000 active clients and at the end of 2021 the estimated amount of funds made available was over €274 billion (12% higher than in 2020), secured by receivables valued at €354 billion (increase by 12% year-over-year) and 6% higher than in pre-pandemic 2019.”

In conclusion, data collected by the EUF for 2021 confirm that the trend of factoring turnover is only partially correlated to the European macro-economic situation.

In 2021 the volume growth was much higher than the increase of GDP and inflation together.

This indicates that factoring is more often perceived by the entrepreneurs as a reliable source of funding that provides additional values such as debtor rating and debtor risk coverage, especially in times of uncertainty.