Corporate treasurers face the challenge of balancing an uncertain economic outlook with increasing demands for environmental, social, and governance (ESG) responsibility. However, financial prudence and a sustainable future can go hand in hand. By integrating sustainability into strategic decision-making, treasurers can harness the tangible business benefits and position their organisations for future success.

Although there is widespread support for ESG initiatives and a large proportion willing to prioritise positive environmental and social impacts over financial returns, Standard Chartered’s research reveals that many companies still haven’t made concrete sustainability commitments or set targets.

The Sustainability Commitment Paradox report highlights the disconnect between interest and action. Corporates understand the value of sustainability, with the majority saying they would prioritise positive environmental and social impacts over financial returns and profit.

However, several factors hinder the transition from intent to action, including uncertainties about the financial implications, to complexities of implementing better practices.

Michael Spiegel, Global Head of Transaction Banking at Standard Chartered, explains, “The discourse within organisations has fundamentally shifted. The question isn’t whether they should engage in ESG initiatives, but rather how they can weave these into the fabric of their business strategy.”

As consumer and regulator demands for sustainability increase, corporate treasurers have an opportunity to bridge the gap between intention and action, turning the ambition of a greener and more equitable future into today’s business practices.

Barriers to sustainability commitments

While more companies are acting on sustainability, Standard Chartered’s report reveals a hesitancy to formalise these efforts with commitments.

Over half of the respondents are already reducing resource use and emissions, and nearly 80% are capitalising on sustainability opportunities in logistics and distribution efficiency. However, less than 20% have set waste reduction targets, and almost two-thirds have no plans to do so.

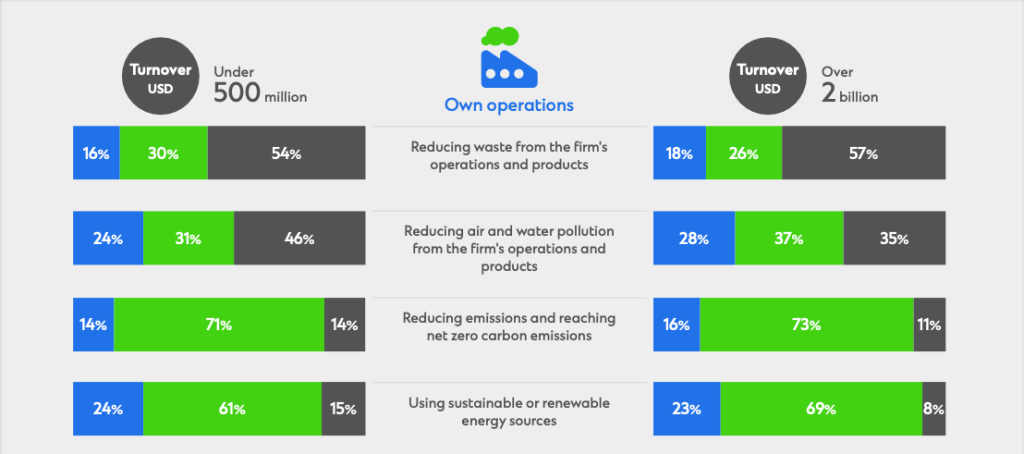

Graph 1: In which of the following areas has your company made commitments or set targets?

Looking outside of their own operations, most companies either plan to, or are already encouraging and mandating their suppliers to operate more sustainably – be that by including ESG standards in supplier contracts or supporting suppliers with access to finance and know-how.

But less than a quarter have set any targets in this regard, and over a third have no plans to do so.

Pradeep Nair, Global Head of Structured Solutions and Development, Trade at Standard Chartered said, “It’s clear that while action is underway, the step to formalise these efforts through concrete targets remains a significant hurdle for corporates,”

Standard Chartered’s research, which surveyed 300 senior finance, procurement, and supply chain decision-makers from around the world, looks at the main barriers preventing companies from setting public targets—and three key themes emerge.

1. Data challenges

Difficulties range from identifying a consistent source of data to the accuracy and structure of the data itself. Almost 60% of respondents indicated that accessing data and reporting on suppliers’ ESG and sustainability practices was problematic, while over half pointed to data definitions and measurement methodologies as a challenge.

Graph 2: How challenging are the following for your company when working towards ESG and sustainability commitments and targets? (Percentage ranking challenging and very challenging)

2. Resource Allocation

Most respondents said they found recruiting and retaining ESG and sustainability experts to be challenging. Around 50% added that they struggle to find the time and budget for ESG and sustainability data collection and analysis.

3. Business case and stakeholder buy-in

Sustainability efforts need adequate financing to succeed, and over 65% of companies said they face challenges in obtaining funding or finance for ESG and sustainability expenses and investments. Over 50% also shared that they face difficulties in building a business case for ESG and sustainability initiatives.

It’s only by addressing these constraints that companies will have the confidence to set real targets and formalise commitments. This is where the treasury function plays a vital role.

How treasurers can bridge the gap

“Overcoming internal and supplier challenges, securing financing, and improving sustainability data and reporting will give companies the comfort they need to consign the sustainability commitment paradox to the history books,” says Nair.

“But to achieve this, Treasurers must be proactive champions of their organisations’ ESG objectives and lead by example with data clarity, internal alignment, and strategic partnerships form the roadmap to success.”

The first stop on this roadmap is solid data infrastructure.

Confidence in setting targets and commitments is fundamentally linked to the ability to measure progress, making reliable ESG data collection a necessity. Importantly, treasurers should leverage valuable data and insights from their banking partners, enabling them to assess both their financial and ESG risk landscape more clearly.

A range of solutions is available to help digitise, streamline and automate treasury operations, enhancing data accuracy to provide a clearer picture of both internal and external sustainability performance.

“Our Climate Advisory Specialists work with clients to provide a comprehensive understanding of the potential financial impacts that ESG risks could have on a business, enabling treasurers to pinpoint priorities,” adds Nair.

Next, it’s about alignment.

Sustainability commitments can’t exist in a silo, divorced from the business’s overall strategy. Treasurers are ideally placed to ensure that ESG KPIs and the company’s broader strategic goals go hand in hand and can also forge stronger ties with banking partners who offer assessments of environmental and sustainability risks.

“Because ESG encompasses so many aspects, it’s often hard for companies to identify which levers to pull to make the biggest impact,” says Spiegel. “In collaboration with clients, we work to set targets on ESG aspects that align closely with their goals. This targeted approach leads to meaningful change and lays a solid foundation for broader sustainability efforts in the future.”

The final waypoint is cementing the financial foundation for sustainability efforts.

The traditional view of sustainability as a barrier to corporate profitability has been dispelled by a growing body of evidence that indicates just the opposite. By identifying those areas of focus that are most meaningful to financial stakeholders, treasurers can dispel the trade-off myth and direct focus towards strategic objectives.

Most corporates surveyed by Standard Chartered agreed that sustainability creates both revenue growth and cost reduction opportunities.

The majority of respondents surveyed believe that sustainability creates financing and funding benefits for their business, with 84% of large corporates highlighting ESG alignment to position themselves as a longer-term investment option.

By leveraging financing tools such as sustainability-linked supply chain finance, blended finance and green bonds, treasurers can develop long-term solutions to foster responsible, sustainable growth.

“Through our sustainable trade finance proposition, Standard Chartered enables clients to meet ESG objectives as well as encourage improved disclosure and reporting,” says Spiegel.

More pay-off than trade-off

Along with the climate crisis, there is an increasingly challenging economic situation with rising inflation and interest rates – which could mean treasurers have a complexity of forces and issues to navigate.

However, sustainability-related initiatives are especially crucial during turbulent times, as the same pressures that amplify economic uncertainties can also intensify ESG issues.

Standard Chartered’s research demonstrates that what benefits the planet can also benefit business. By leveraging the expertise and technology of partner banks and fostering internal alignment, treasurers can overcome the sustainability commitment paradox.

This approach not only paves the way for a more sustainable future, but also enhances business performance—an outcome that benefits all stakeholders.