Currency-pegged stablecoins have the potential to maximise the efficiency of international trade transactions and generate revenue via high-interest rate yielding options unavailable anywhere else in the traditional market.

Stablecoins can improve the international trade infrastructure

Stablecoins are a class of cryptocurrency that seeks to provide stability for its users by maintaining its value by pegging it to that of a reserve asset, usually one of the current significant fiat currencies such as the dollar.

The transfer of payments across the world is mainly conducted by banks or third-party intermediaries who usually take a large chunk of these payments in fees or commissions.

To avoid this, businesses can use corporate accounts available at most cryptocurrency exchanges today to transfer payments to each other in a stablecoin whose value is pegged to that of the euro, pound or dollar.

With today’s technology, this could cut the costs of transferring the desired assets to as much as zero in some cases.

Currently, there is little to no regulation surrounding these types of payments, and they are much less bureaucratic than traditional forms of payments.

This also means it takes less time than a standard international transfer and, in most cases, it can be received almost instantly from anywhere in the world.

Firms can also make use of an escrow feature using smart contracts and programing the release of funds for when certain conditions are met.

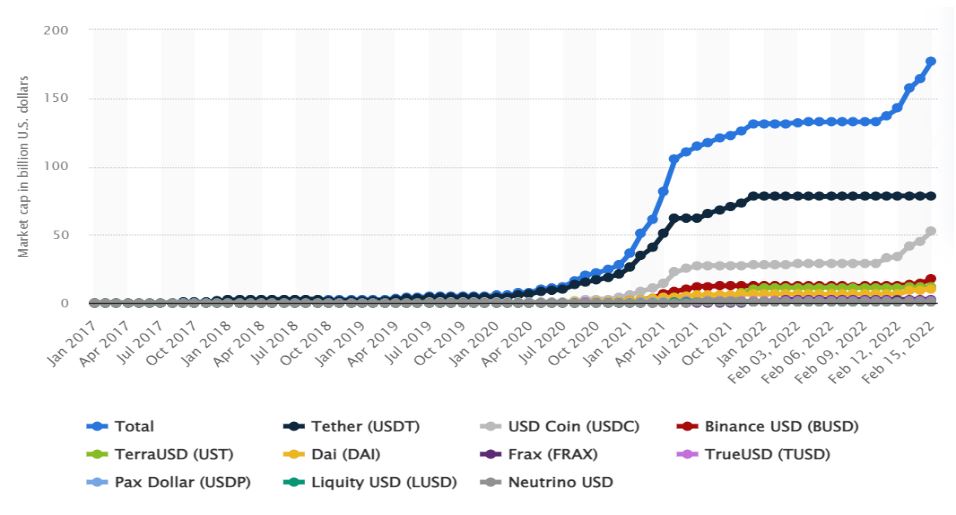

The adoption of stable coins has increased exponentially, with the most prominent being Tether (USDT), a cryptocurrency whose value is pegged to the dollar.

Receiving payment in Tether would be similar to a regular dollar payment, but it is much faster, cheaper and easier to access than traditional finance.

The yield benefit of stablecoins

In addition to the higher convenience and efficiency of using a non-volatile currency-pegged stablecoin to transact value internationally, these coins also attract some of the highest interest yields in the market, far exceeding those of traditional bank savings rates.

Some firms offer as much as 22% interest for stablecoin deposits.

Businesses can choose to invest their stablecoin funds when not in active utilisation and receive inflation-beating yields.

This can also be seen as a cash flow and optimising opportunity by clever business managers who are not afraid to adopt the latest technologies to obtain the best results.

Stablecoins still face long-term challenges

As a new technology that is only now truly facing mass adoption, stablecoins haven’t undergone the level of regulatory scrutiny that their other competitive alternatives have.

The issue of securitisation, as well as consumer protection and money laws and their application to stablecoins, is still a grey area and one in which governments are now beginning to take renewed interest.

Regulation could have a severe impact on the future of stablecoins, and the lack of rules currently might be one of the reasons why businesses might opt not to adjust to this new payment system until the risks of anything going wrong have been minimised.

Importantly, adoption on a more global scale is necessary to utilise stablecoins as a regular payment method.

Once buyers and sellers realise they have more to gain by using an efficient, permissionless payment method, this process can truly take off.

Granted that without the aforementioned regulatory framework, security is likely to take longer than usual and consumers are not protected, should anything go awry.

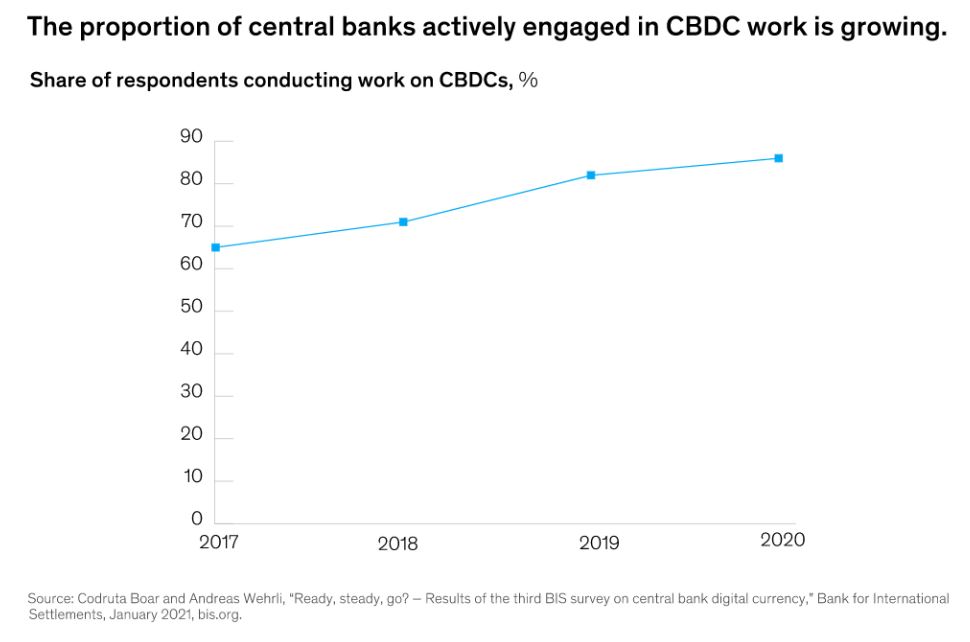

Central banks worldwide are working on developing Central Bank Digital Currencies (CBDCs) to digitise their currencies and make them more efficient in the interconnected digital landscape.

They will operate similarly to stablecoins today, being backed up in value by an existing fiat currency; however, how central banks will react to stablecoins is still largely unknown.

They might see them as primary competitors or largely ignore them, leaving the door open for businesses and individuals to have more free-market options choices.

The future of stablecoins for international payments?

It is clear that major players are noticing the significant impact stablecoins are having now in the early stages of their deployment.

This presents an opportunity to create systemic change that is sorely needed as the current international payments infrastructure is based on outdated technology and has been slow to adapt to current global needs.

Not only are stablecoins a cheaper method to transact, but they are also faster and can return very high yields for their holders.

It is now up to the regulators to analyse the situation and apply the appropriate measures to protect consumers and businesses worldwide, and for these very consumers to capitalise on a window of opportunity that can maximise their global reach and earnings potential.

Let’s share the capabilities of stablecoins so that more businesses can take advantage of this incredible technology while it is still available to all.